Brazil's wheat imports from Russia may hit a new high this season, as competitive prices are expected to help partially replace lost supply from Argentina, which is forecast to have a weak harvest in 2022-23.

Brazil has already started to seek alternatives, with its receipts from Argentina falling to a multi-year low of 122,500t in October from 475,000t the same time a year earlier. Meanwhile, imports from the US totalled 101,200t, up from just 16,500t in October last year.

And Russia made a return to the Brazilian market after a multi-year break, delivering 31,100t of wheat in October. At the same time, at least two vessels carrying 61,500t of Russian wheat are currently heading to Brazilian ports, while line-up data suggest that a further 38,300t of product is earmarked for the destination.

Including already delivered volumes in October, Brazil's receipts from Russia would total 130,900t so far in 2022-23, already nearing previous annual records from 2019-20, when Brazil imported 171,400t.

Receipts from Russia could reach a new high of 240,000t by the end of the marketing year, Brazilian wheat industry association Abitrigo superintendent Eduardo Assencio told Argus.

The rise in Russian shipments comes despite higher freight rates, as importing Russian wheat to Brazil costs less than buying from Argentina. On a cif Brazil basis, Russian wheat would be $22/t cheaper than its Argentinian equivalent, Assencio said.

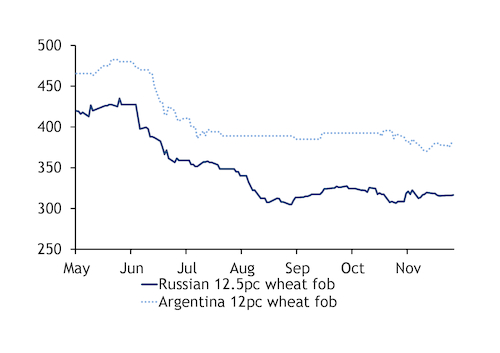

The spread between origins is even wider on a fob basis, with Argus last assessing Russia's spot 12.5pc protein content wheat at $316.50/t — $63.50/t below Argentina's spot 12pc crop (see chart).

But Brazilian millers are worried about shipment delays for Russian wheat — with reports of up to a 15-day delay for some ships this week. Freight logistics will test the feasibility of large-scale imports from Russia, Assencio said.

Brazil has sanitary restrictions, which ban the transport of Russian wheat to inland farms to avoid contamination from pests. But this should not pose a challenge, as most of the country's mills are close to ports and far from inland farms, Assencio said.

One obstacle could be Brazil's wheat import quotas under the Mercosur free trade agreement. Brazil can import a maximum of 750,000 t/yr of tariff-free wheat from countries outside Mercosur. Some of this quota is likely to be used for imports of high-protein wheat from Canada and the US, which is then blended with domestic lower-protein crops or those from other origins.

Argentina to lose key market share

Brazil's wheat imports oscillate in a range of 6mn-6.5mn t/yr, the bulk of which is supplied from Argentina. Argentinian origin is favoured by its geographical proximity, which reduces freight costs, and is further aided by both countries being members of the Mercosur bloc.

A bumper harvest in 2021-22 further boosted Argentina's market share in Brazil, which received 5.13mn t of wheat from the origin over the entire marketing season (October-September), accounting for 86pc of its overall wheat imports.

But adverse weather conditions in 2022 have weighed heavily on the prospects for Argentina's 2022-23 wheat production, which is forecast to be as low as 11.8mn t, down by around 10mn t from a year earlier. This could result in the country's exportable supply falling below 6mn t, with Abitrigo putting it at 5mn t, while a range of [participants surveyed by Argus](https://direct.argusmedia.com/newsandanalysis/article/2392764) put it at 3.8mn-4.8mn t, with Argentina's domestic consumption estimated slightly above 6mn t, according to the US Department of Agriculture.