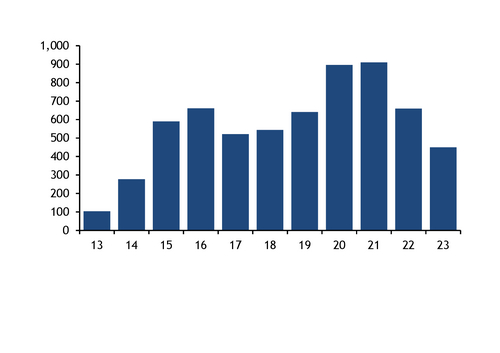

Wood pellet imports to the UK dropped by over 30pc on the year to 450,000t in April because of weaker power-sector demand, while receipts of premium wood pellets likely rose year-on-year.

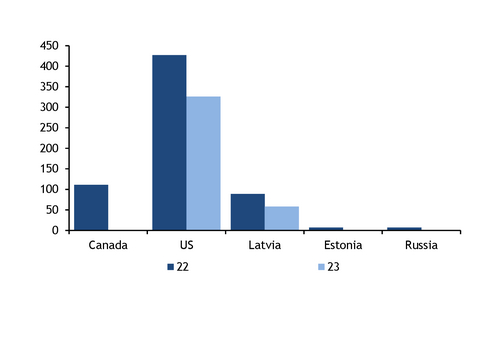

Canadian receipts fell to zero in April from 111,000t from a year earlier, the only month since at least 2016 the UK has not taken pellets from the country. And US and Baltic imports were also down significantly on the year (see chart).

Increased imports from Brazil — at almost 50,000t from zero a year earlier — partly offset the drops from other destinations. These may have been imported by residential pellet dealers in the UK, provided that Brazilian producers typically supply the Italian market with premium pellets in winter.

Premium pellet producers throughout Europe started trade discussions about two months earlier this year, compared with recent years This was for spot supplies to replenish inventories and for deliveries in the next heating season, in a bid to cover the supply deficit from sanctions on Russian material. Around half — or 1.2mn t — of Russian wood pellets delivered to Europe in 2021 are estimated to have been sent to the residential market.

The UK alone used to import 200,000t of ENplus-certified wood pellets from Russia — which counted for one third of its residential market, data from the UK Pellet Council show. Last year, the UK government granted the sector with a one-year suspension of the requirement for ENplus certification, which enabled companies to trade lower-quality pellets for heating. But the suspension is due to expire on 22 November 2023, and UK firms have already started exploring new sourcing regions and firms.

The UK has received a cargo of similar size from Brazil every second quarter over the past three years, which could be long-term contractual volumes. But despite the rise in Brazilian receipts, overall UK wood pellet imports in April fell to their lowest for the month since 2014 (see chart) because of a sharp drop in power-sector demand.

Over 1GW of wood pellet-fired capacity in the UK was off line for planned or unplanned outages in April, Remit data show. And between 1-2GW is scheduled to be off line each month until October.

Generation at CfD-supported units in the UK fell to 132MW on an average hourly basis in April, from 352MW a year earlier, and 1GW in 2021, as the scheme has been unprofitable since the start of winter 2022-23 season.

Argus estimates suggest that the negative margin for CfD output could remain throughout the summer, with a narrow positive margin expected in winter 2023-24.

Port throughput falls

Imports at all of the UK's major wood pellet terminals fell on the year in April, except for Liverpool where 160,000t of wood pellets were unloaded, from the 106,000t last year. Throughput at the ports of Immingham and Tyne fell by over 100,000t on the year to 246,000t and over 130,000t to 27,000t, respectively. The former is a terminal used by UK utility Drax for importing wood pellets and the latter by the delayed MGT Teesside wood pellet-fired plant, which is expected to come on line in the following one to two months following multiple delays to the project — most recently due to a fire in a wood pellet silo.