The container shipping market is entering a period of oversupply which will keep spot rates under pressure in the next 1-2 years. But regular shippers are likely to stick with long term agreements to combat reduced reliability, even at higher costs, freight analytics platform Xeneta's chief analyst Peter Sand told Argus.

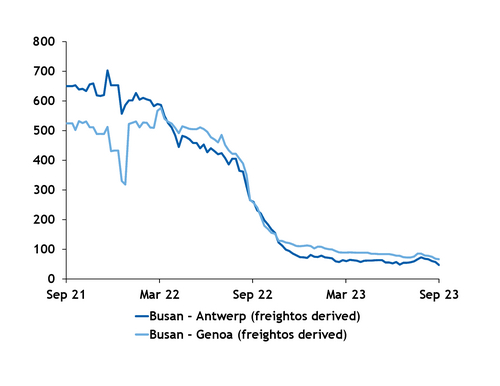

Spot freight rates on some major polymer transporting routes have fallen by more than 90pc since the middle of the pandemic, particularly on routes into Europe, moving back to approximately pre-Covid levels. And volume and tonne-mile demand for shipping containers is on track to decline for the second year in a row in 2023, Sand said, while a large number of ships ordered during Covid — when vessel supply was tight and rates historically high — are now reaching the market. Xeneta expects the global fleet to grow by 6-7pc this year and next on a net basis (balancing new deliveries against scrapping activity), with more tonnage still on order for 2025.

Growing length in the market is frustrating the efforts of carriers — the companies in charge of transporting shippers' goods — to pass on higher costs, particularly for bunker fuel, to their spot customers. The price of high sulphur bunker fuel at the important bunkering hub of Singapore reached $553.50/t earlier this month, having risen by $186.50/t since early January, according to Argus data.

For the polymers market, a sustained environment of cheaper freight rates would facilitate inter-regional trade, benefiting sellers in regions that are net exporters and buyers in regions with a trade deficit. In the simplest terms, Europe and Asia-Pacific are net importers of most commodity virgin polymers — buying particularly from the Middle East and US which are both net exporters.

For recycled polymers, areas with cheaper manufacturing costs, including India, and parts of the Asia-Pacific and Africa, often export regranulates to Europe and the US, with plastic waste travelling in the opposite direction. European and US recyclers may therefore expect to see more import pressure in their markets in a prolonged period of low container prices.

Reliability suffering

Sand expects carriers' unit cost for 2024 to be 1.5-2 times above pre-Covid levels, and in many cases higher than spot rates. As a result, the price of long-term shipping agreements is likely to remain above pre-Covid levels as carriers are reluctant to sign such deals below break-even levels.

Carriers' strong financial position after the pandemic makes them "more agile and more confident" to cover their costs, he said. Regular shippers should be willing to pay for peace of mind by partnering with trusted carriers, with schedule reliability "pretty shy" of pre-Covid levels, he said.

Sand noted that shippers have increasingly used "fleet management" techniques — such as cancelling sailings and reallocating containers to new ships, redirecting ships on longer routes, or slow-steaming — in recent months to manage vessel oversupply, harming schedule reliability.

"Eighty percent is a good day [for schedule reliability], but on a global scale we are at 64pc right now," he said. "So you really do not get your goods on time if you're a shipper running at just in time supply chain."

Therefore, while the freight rate environment appears likely to benefit sellers of polymers looking to exploit global arbitrages, lower reliability may make their potential customers think twice about depending too heavily to incremental volumes via long distance supply chains.

Reliability issues are not evenly spread across the world, Sand said. Minor routes will be worse affected, because fewer sailings mean more impact when one is cancelled or delayed, and reliability on the transpacific route from Asia to the US west coast is also currently well below the Asia to Europe route. Tonnage availability on backhaul routes from Europe, the US and the Middle East to Asia could also tighten if fewer ships are sailing out of Asia and therefore needing to travel back.

Meanwhile, shorter routes such as US to Europe on which a large volume of polyethylene is shipped are favoured by carriers when rates are low, meaning that the transatlantic market is currently very well supplied with ships.

Gradual rebalancing

Xeneta expects container volumes to increase again from 2024, and eventually to bring the shipping market back into balance.

"After a dramatic correction of demand in the second half of 2022, 2023 has been more about transition to the next normal level of demand," Sand said. "In my mind, this means that inventories of retailers and others have found the desired levels and goods will flow in more classic fashion."

But he said "the market needs time to finding the right way of absorbing the new/next level of overcapacity that will develop in 2023 and 2024 — perhaps also in 2025."