Delhi has increased its subsidy on LPG cylinders in time for the country's festive season, write Rituparna Ghosh and Frances Goh

India's LPG consumption is expected to increase this winter after the government raised temporary LPG subsidies for its low-income users under the Pradhan Mantri Ujjwala Yojana (PMUY) scheme.

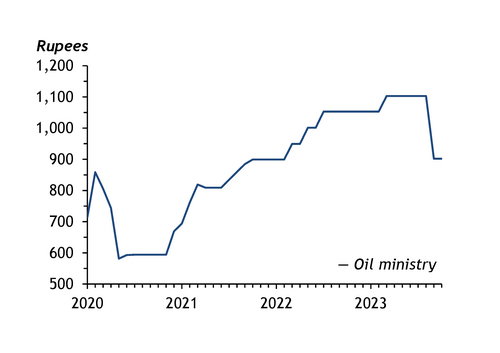

The subsidy on sales of 14.2kg cylinders for residential consumers has risen to 300 rupees ($3.60) from Rs200, just in time for the country's festive season that started this month, which typically boosts cooking fuel use in homes. This leaves 14.2kg cylinder prices for PMUY users at Rs603, the lowest in thee years, after India's state-controlled refiners lowered the outright prices to Rs903 in Delhi from the start of September. The subsidy runs until March 2024. It was due to expire in March this year but the government extended it for one year.

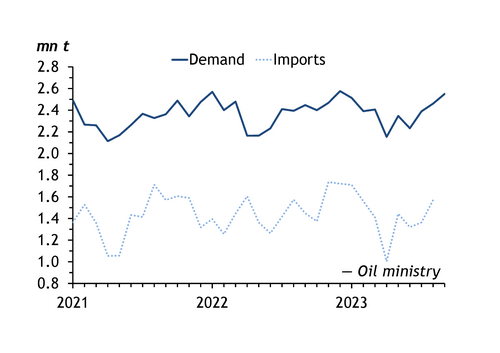

Domestic demand increased to 2.55mn t in September from 2.47mn t in August and 2.45mn t a year earlier, the latest oil ministry data show. Imports also rose by 5.6pc on the year to about 1.72mn t/month in July-September, data from oil analytics firm Vortexa show. Market participants expected a similar increase of about 5-7pc in imports during the fourth quarter, although this could prove to be higher after the subsidy announcement and other government measures introduced recently that should stimulate demand. This includes a cut in cylinder prices to just Rs450 in Madhya Pradesh state for up to 12 refills a year. India also recently cut the customs duty on LPG imports for the industrial sector to 5pc again from 15pc.

The number of PMUY households has also increased by about 1.5mn to 97.4mn as a result of the construction of new homes, the government said last month, adding that a further 7.5mn households will be connected by the 2025-26 fiscal year ending in March. This will cost the Indian government Rs16.5bn ($200mn). But the expansion of the scheme and near saturation of the domestic market has disguised the low refill rate among PMUY users, meaning there is still significant room for growth.

Government think-tank Niti Aayog is about to embark on a review of India's main subsidy schemes, including the PMUY, to rationalise expenditure and prevent subsidy "leakage" by ensuring the benefits are reaching eligible people. India's LPG consumption accounts for about 12pc of total petroleum products demand, according to Niti Aayog, and 13pc of 223mn t in 2022-23, according to the oil ministry. This is expected to grow as the PMUY scheme expands, meaning the subsidy allocation could swell significantly.

The introduction of further PMUY incentives comes as import prices increase, with state-controlled Saudi Aramco's contract prices (CP) rising to $600/t for propane and $615/t for butane in October, an increase of 50pc and 64pc from July, respectively. Argus Far East Index (AFEI) propane prices, based on deliveries to northeast Asia, meanwhile, rose by about 38pc in the third quarter. The CP gains followed a drop in Mideast Gulf exports in August and September owing to Opec+ production cuts and higher domestic consumption, which coincided with rising demand from India.

Valued customer

India is often considered the most valuable buyer by Mideast Gulf producers because of its geographical proximity and significant demand growth in recent years, particularly for butane. Importers pick up about 80pc of their supply on term contracts, and they had concluded contract renewals for 2024 by September. But they have increasingly sought to augment supply through spot tenders on expectations of increased consumption this winter. State-run refiners HPCL and IOC stepped in to buy evenly split propane-butane VLGC shipments for November and December, but were put off by high premiums to the loading-month CP.