India's thermal coal imports have risen over the last few months to cater for the country's increase in power demand, but next year's outlook depends on factors including domestic supplies and the electricity generation pattern during the election year.

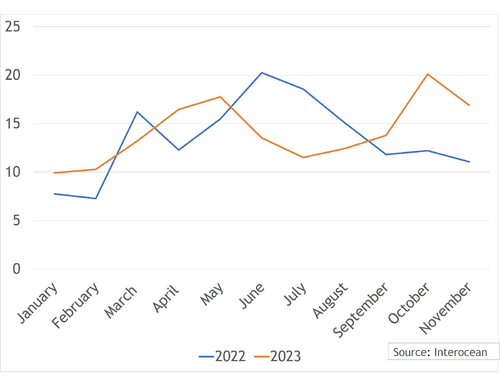

India, the world's second-largest thermal coal importer, received 16.9mn t in seaborne thermal coal in November, taking the year-to-date tally to 155.89mn t, up by about 5.4pc compared to the same period a year earlier, according to data from shipbroker Interocean. The import volumes last month were up from about 11.1mn t a year earlier, but down from October's 20.11mn t, which was the highest since June 2022. The uptick in imports over the last few months has partly helped utilities to boost generation and replenish stocks to cater for an increase in power demand. It has also helped to reverse the lukewarm trend observed in imports during the first nine months of the year.

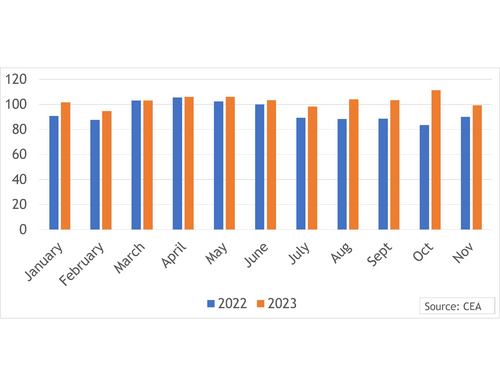

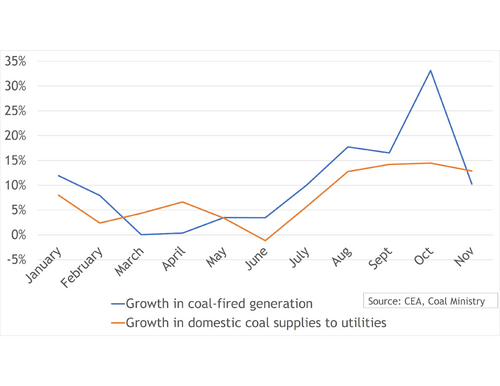

India's coal-fired generation, which meets the bulk of India's power requirements, rose to 1,130.91TWh between January-November, up by nearly 10pc from a year earlier, according to data from the Central Electricity Authority (CEA). Coal-fired generation rose in the second half of the year amid an increase in electricity consumption, to make up for weak hydro-power output following a lackluster monsoon.

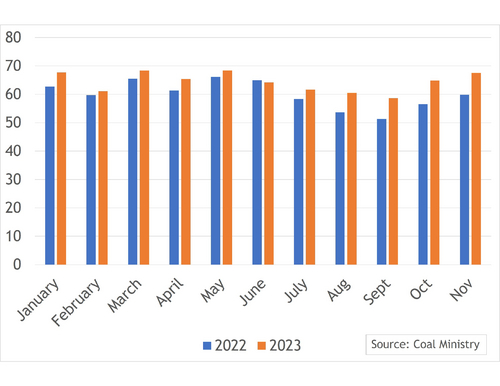

Domestic coal supplies to utilities rose this year, but this increase was outweighed by the growth in power demand. Domestic coal supplies to utilities during January-November rose by about 7pc from a year earlier to 708.44mn t, according to a compilation of monthly data from India's coal ministry. Coal-fired generation growth peaked in October, rising by 33pc compared to a year earlier to 111.35TWh. But domestic coal supplies to power plants during that month rose by only 14pc on the year to 64.8mn t, leading to sharp inventory drawdowns at utilities.

Combined coal inventories at Indian power plants reached 27.09mn t as of 30 November, equivalent to over nine days of use, CEA data show. The stocks were down from about 31mn t as of 30 November 2022. The federal power ministry has asked pithead power plants to maintain 12-17 days of coal stocks, while non-pithead utilities are mandated to have 20-26 days of inventories.

Imports have also picked up in recent months as the power ministry asked 15 coal-fired plants that run on imported coal, with a combined 17.5GW of capacity, to keep power generation levels high until 30 June 2024. It also ordered plants that run primarily on domestic coal to increase the percentage of imported coal in their blends to 6pc by weight, from 4pc earlier.

"The government directions mean that some utilities would continue to be in the market at least until the first half of next year," a market participant said. "But a lot will also depend on growth in domestic coal supplies to power plants."

Boosting domestic output and generation

India wants to boost domestic coal production and supplies to utilities as part of broader goal to boost generation and trim imports.

The country has outlined plans to raise coal production to 1.4bn t/yr by 2027, up from the projected output of 1bn t in the April 2023 to March 2024 fiscal year. Delhi has also set an ambitious target to raise coal output further to 1.58bn t/yr by 2030. India produced about 893mn t of coal in 2022-23 fiscal year.

The federal coal ministry has outlined several plans including higher output from underground as well as captive mines, and blocks auctioned recently for commercial mining.

Delhi will also continue to add coal-fired capacities over the next decade as part of its goal of providing round-the-clock electricity to all households, and to support its economic growth.

India's federal government plans to add about 80GW of thermal power generation capacity by 2031-32, and the coal ministry has estimated that the new capacities could need an additional coal supply of 400mn t/yr at 85pc capacity utilisation. The actual requirement could be lower owing to an expected increase in renewable power. Coal-based capacity accounts for nearly half of India's overall generation capacity at 207GW and over 75pc of actual generation.

The federal government may try to boost economic activity in the run-up to the national elections next year, especially with a potentially weak global economic climate in 2024. The pre-election efforts could lift industrial production, boosting commercial power demand on top of higher power supplies to households. An uptick in infrastructure activity could also buoy coal demand from non-power sectors such as steel and cement.

El Nino

The onset of the drier El Nino weather phenomenon might prolong heatwaves during the next Indian summer, exacerbating the country's reliance on coal-fired generation. The weather pattern could also potentially affect seasonal monsoon rains, curtailing hydro-power generation.

But at the same time, drier weather conditions could mean higher supplies from domestic mines, in addition to an increase in shipments from key origins such as Indonesia to meet any spurt in coal demand, a seaborne coal supplier said. A potential increase in coal availability could keep a lid on international prices next year, a trader added.

Argus last assessed Indonesian GAR 4,200 kcal/kg coal at $57.61/t fob Kalimantan on 15 December, down from $90.41/t fob Kalimantan at the start of the year.