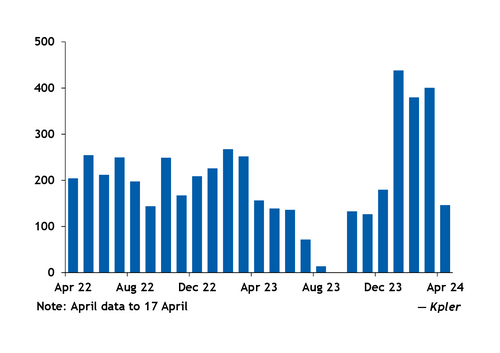

Venezuelan petroleum coke exports look to have remained high in March even as loadings slowed in anticipation of the US' decision today to reinstate sanctions on Venezuelan crude and oil products.

Venezuela exported about 400,000t of coke in March, up by 59pc on the year and up by 5pc from February, according to preliminary data from global trade analytics platform Kpler. February's total initially appeared to be higher than 500,000t, but was revised lower in later weeks.

The elevated exports reported for March were likely a result of significant delays in loadings, with many of the cargoes purchased in January and February, before many companies began backing away from business with Venezuela. Venezuela coke cargo loadings appeared to be slowing last month ahead of the US' possible reinstatement of sanctions.

The US administration today reimposed sanctions targeting Venezuela's oil exports and energy sector investments — including petroleum coke — and set a deadline of 31 May for most foreign companies to wind down business with state-owned PdV. The US decision rescinds a sanctions waiver issued last October that was due to expire on 18 April and was tied to Caracas' agreement to hold a competitive presidential election and to allow opposition politicians to contest it.

As of 17 April, a total of 451,000t of Venezuelan coke was in transit, including 146,100t with no listed destination, although some of this tonnage may have a final buyer that is obscured because the cargo has traded through a long chain of third parties. The coke volume without a listed destination is about one-third of the 461,700t without a clear destination in late February, meaning most of that floating coke was ultimately sold.

Some distressed Venezuelan mid-sulphur coke cargoes were recently heard being offered to buyers in Asia at about $100/t cfr, a significant discount to US high-sulphur coke, which was last assessed at $113.50/t cfr India and $120/t cfr China.

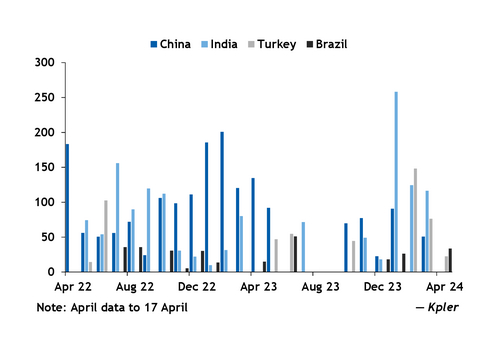

India remained one of the largest destinations for Venezuelan coke in March, although shipments slipped from a month earlier. Venezuelan coke exports to India were at 116,400t in March against 124,300t in February and 80,200t a year earlier. While some larger Indian cement companies will pull back from Venezuelan business because of the renewed sanctions, some smaller buyers were purchasing from the country prior to the six-month sanctions waiver last October and are likely to continue.

But China, which hadbeen the largest destination for Venezuelan coke since upgrades in 2022 to the Jose port allowed for much higher exports, has taken little recently. Venezuela shipped 50,700t of coke to China in March, down from 120,300t a year earlier. But this was up from none in February.

Turkey was the second-largest destination for Venezuelan exports in March at 76,200t, down from 148,300t in the prior month but up from none a year earlier. Cement plants in Turkey boosted purchases of Venezuelan coke at the end of 2023, but most stopped making new trades since February because of the risk of renewed sanctions.

Venezuela in March also exported 45,500t of coke to Trinidad and Tobago and and 33,700t to Jordan.

Exports may drop in April following the lower demand in February and March. From 1-17 April, Venezuela exported 146,200t of coke, according to Kpler. In addition, about 85,500t was loading at the Jose port and 281,800t was scheduled for loading later this month.