Dangote can theoretically cover 50pc of Nigeria's demand, but over-reliance on the refinery could be a source of volatility, writes Adebiyi Olusolape

Nigeria's LPG imports plummeted in the first half of this year, largely as a result of additional supply emerging from the 650,000 b/d Dangote refinery near Lagos, according to market participants.

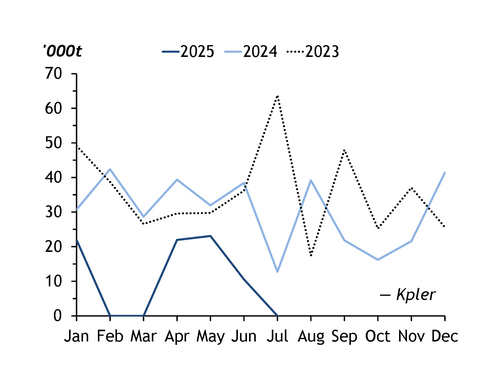

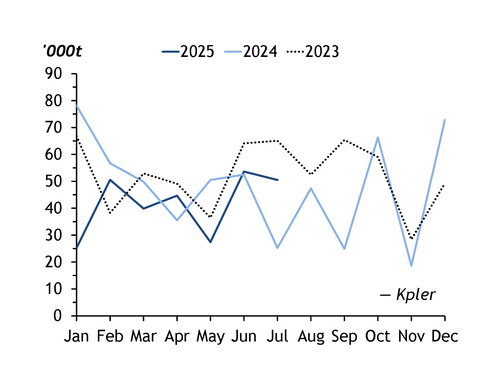

Imports dropped to 77,000t in January-June this year, down by 64pc from 211,600t a year earlier, Kpler data show. Around 46pc of imports came from the US, 24pc from Equatorial Guinea and 21pc from Argentina. Seaborne arrivals from Nigeria's offshore Bonny Island LNG facility — which provide the majority of domestic supplies — also fell, by 12pc to 230,000t. This comes after seaborne deliveries fell last year owing to domestic market headwinds and rising domestic output.

The Dangote refinery started up in early 2024 and began selling LPG domestically from August, with output available for sale from the plant initially estimated to be in the region of 300,000 t/yr. The first sales coincide with imports also declining to about 149,000t over the second half of last year, Kpler data show. Dangote supplies are displacing the country's LPG imports, as is rising production from domestic gas processing plants, although the impact of these sales is marginal compared with those from the refinery, note Emeka Iheme, chief executive of Nigerian trading firm Gasavant, and Funso Amoo, head of private-sector oil company Funtay.

Dangote is currently distributing around 1,000 t/d in the domestic market, according to LPG pricing and marketing consultant Godwin Okoduwa. This figure is slightly short of the 1,300-1,500 t/d estimate provided by Nigerian Liquefied and Compressed Gases Association president Felix Ekundayo. "Dangote production is somewhat opaque to the market," Ekundayo says. Dangote Group places total LPG production from the refinery at 2,500 t/d, or 912,500 t/yr, according to chairman Aliko Dangote. But two-thirds of this will be redirected to integrated petrochemical units. The refinery's crude intake averaged 61pc of nameplate capacity at 395,000 b/d over the first half of this year, Argus estimates. LPG output from the plant averaged 943 t/d in April, according to a source at downstream regulator NMDPRA.

Dangote can theoretically produce up to 584,000-730,000 t/yr and cover more than 50pc of domestic demand, Ekundayo says. Calculating domestic consumption is difficult given the opacity of domestic production data, but ArgusConsulting puts non-petrochemical sector demand — which is entirely residential use as a cooking fuel — at about 1.36mn t in 2024, up from 1.22mn t a year earlier. Petrochemical use was about 519,000t last year.

On-off switch

The country becoming so reliant on a single production source "is never a good thing from a security of supply point of view", Ekundayo says, adding that it "creates too much volatility in the market every time they switch on and switch off". Dangote supplied little to no LPG in September 2024 after starting sales in the preceding month, market sources say, and a local trader says their company had to refund several last-mile distributors during the same month.

LPG output from Dangote also dipped in April-June, Okoduwa says, which corresponds with a shutdown of the plant's residual fluid catalytic cracker, its key LPG production unit, in April–May. LPG yields from the refinery are also due to drop this quarter when an integrated 820,000 t/yr polypropylene unit is brought on line.

The refinery is also disrupting Nigeria's domestic market by selling at lower prices than its competitors, Okoduwa says, noting that in late July, it offered 20t of LPG at a 7pc discount to the same volume from a local import terminal controlled by trading firm Vitol on 23 July, he says. And the refinery plans to force domestic LPG prices even lower, Amoo says. The plant is trying to encourage more homes to use LPG to transition from harmful cooking fuels, Aliko Dangote says, but market participants argue the refiner is undercutting them to capture market share.