Aramco's biggest unconventional gas development has enabled the company's latest asset monetisation deal, writes Nader Itayim

State-controlled Saudi Aramco is just weeks away from starting production at its Jafurah natural gas project, the largest unconventional gas field in the Mideast Gulf region, and the cornerstone of the company's plan to expand Saudi gas production by 60pc by 2030.

Aramco's gas production has inevitably always been in the shadow of its world-leading crude output, although its Master Gas System (MGS), developed in the 1970s, has ensured that oil output enjoys ultra-low flaring intensity, and associated natural gas and natural gas liquid (NGL) production have become a bedrock of domestic economic development. Now, the $100bn Jafurah development, which is on track to start producing in the fourth quarter, looks set to become the latest pillar in Aramco's asset monetisation drive.

A consortium led by US investment firm BlackRock last month signed an $11bn lease-and-leaseback dealwith Aramco covering midstream assets at Jafurah. The transaction involved the sale of a 49pc stake in the Jafurah Midstream Gas Company (JMGC), a newly formed subsidiary that will lease development and usage rights for the Jafurah field gas plant and the Riyas NGL fractionation facility, and lease them back to Aramco for 20 years. The deal will see JMGC receive a tariff payment from Aramco in exchange for granting it exclusive rights to receive, process and treat the raw gas from Jafurah.

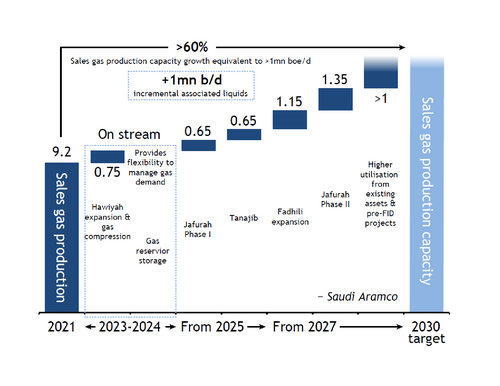

With in-place reserves of 229 trillion ft3 (6.87 trillion m3) of raw gas and 75bn bl of condensate, Jafurah is one of Saudi Arabia's largest non-associated gas developments. Aramco says sales gas production from the project's first phase will begin at a rate of 200mn ft3/d, rising to around 650mn ft3/d by the end of 2026. The second phase, which is due to come on stream in 2027, will then help lift production steadily to 2bn ft3/d by the end of the decade. Aramco is currently working on the third phase expansion of its MGS, which will raise its capacity by 3.15bn ft³/d to 12.5bn ft³/d by 2028 through the installation of 4,000km of pipelines and 17 new gas compression trains.

The Jafurah development is a major part of Aramco's plan to grow by more than 60pc its sales gas output capacity by the end of the decade. With Aramco basing this growth off a 2021 baseline of 9.2bn ft3/d, this implies output of around at least 14.72bn ft3/d by 2030, with Jafurah delivering just over one-third of the increase.

Although Saudi Arabia is already a top-10 gas producer — the eighth largest, according to the Energy Institute's most recent Statistical Review of World Energy— the sheer size of its domestic market has always ruled out any opportunity to export its gas. And this latest expansion, still, looks set to be focused on domestic economic development.

Captive market, low-cost energy

As the sole supplier in the kingdom, Aramco enjoys low risk, a captive market and commercial returns for its growing gas business. And it hopes the guarantee of lower energy costs should attract foreign investment in industry and mining, but also artificial intelligence (AI) data centre development, as part of the country's ambitious Vision 2030 economic diversification programme.

Saudi Arabia attracted 119bn riyals ($31.7bn) in foreign direct investment in 2024, according to official figures published this week, which while up by 23pc on the year, was in line with 2022 investment and just shy of the record SR122bn inflow recorded in 2021.

Electricity generation in Saudi Arabia currently comes predominantly through the burning of natural gas and liquids such as crude oil and fuel oil. Internal estimates put the mix at around 57pc gas and 43pc liquids. This makes the country the world's largest consumer of oil for power generation. According to the latest figures from the Joint Organisations Data Initiative (Jodi), liquid burn in the country averaged just under 1mn b/d last year, only marginally less than in the previous year. And in the first half of this year, Saudi Arabia burned 822,000 b/d of liquids, largely in line with the corresponding six months in 2024.

But with the country already working towards eliminating the burning of liquid fuels for power generation by the end of the decade, and replacing it with a combination of gas and renewable energy, the knock-on effect of the current gas expansion will be felt directly in international oil markets.

Saudi Aramco says its liquids displacement programme will free up the 1mn b/d or so of oil from direct burning, potentially for export. But beyond that, Aramco can also look forward to an additional 1mn barrels of oil equivalent/d of associated liquids from Jafurah and its other gas developments through to 2030, which can again be monetised and made available for export.

By 2030, Jafurah is due to produce around 420mn ft3/d of ethane, and around 630,000 b/d of NGLs and condensate as by-products of the gas. The ethane and NGLs from Jafurah will be sent to the Riyas fractionation plant, which is being built as part of the phase two development, while the condensate will be sent to the Juaymah terminal where Aramco is expanding its storage and export facilities. Aramco says it anticipates having additional cash flow of $9bn-10bn/yr by the end of the decade as a result of the development of Jafurah and other planned gas projects.

Aramco's gas growth ambitions should also help achieve both its and Saudi Arabia's net zero targets. Aramco aims to achieve net zero Scope 1 and Scope 2 greenhouse gas (GHG) emissions across its wholly owned operated assets by 2050, while the kingdom is targeting net zero GHG emissions by 2060.

Surplus gas

Saudi Arabia and Aramco have to date made clear that this gas expansion will be primarily directed inwards to meet domestic demand, and fuel its growing downstream and petrochemicals industries, with any potential surplus being directed towards the production of blue hydrogen and ammonia.

Aramco's burgeoning ambitions in the LNG space are taking clearer shape, as chief executive Amin Nasser said last month that it was ultimately aiming for 20mn t/yr of LNG in its trading portfolio. For now, investment towards that long-term goal has largely been limited to LNG offtake contracts abroad and building up its trading capabilities through acquisitions, rather than producing Saudi LNG.

But the company's decision earlier this year to slash its 2030 target for blue ammonia output by more than 75pc to 2.5mn t/yr from 11mn t/yr before, due to the absence of long-term offtake agreements, could open the door for it to pursue domestic LNG, if the government so chooses.

"The potential is there," one industry source says. On the one hand, Saudi Arabia's competitive gas prices and its strategically advantageous position with respect to the European market would hold it in good stead should the government choose to go down this path. On the other hand, for a company like Aramco, with its decades of experience building major oil and gas facilities, constructing liquefaction facilities "is no major undertaking", the source says.

But even if Aramco were to turn to domestic LNG production, construction times for greenfield liquefaction terminals are typically at least a few years, and that is without factoring in any time for marketing planned output ahead of a financial close. This would place any potential first Saudi Arabian LNG in the closing years of this decade, at the very earliest.