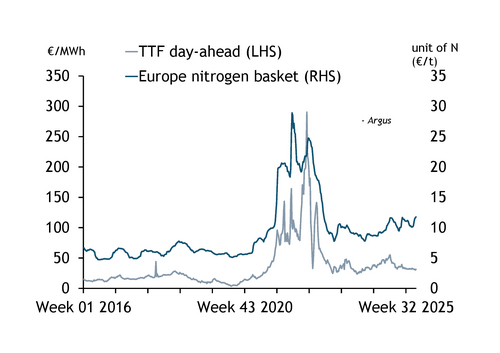

Front-month gas futures in Europe dropped by as much as 3pc today, which is supporting nitrogen fertilizer producer margins at a time of elevated urea and nitrate prices, continuing a trend which emerged earlier this year.

The December contract for natural gas at the Dutch TTF hub, listed on Ice, fell to as low as €29.2/MWh today, below the previous lowest close of €29.3/MWh on 23 February 2024. Gas prices in Europe have fallen further following the latest US-driven push for a deal between Russia and Ukraine, which is weighing on major energy markets. The US and Ukraine have made "significant progress" in talks about a peace deal that can be presented to Russia, the EU said today.

Gas costs for ammonia, the key feedstock for urea and nitrate fertilizers, dropped to as low as $355/t, accounting for gas consumption of 36mn Btu/t of ammonia at €29.2/MWh. That cost is $71/t below costs of $426/t three months ago, when the TTF contract was €35/MWh. The costs are calculated and do not account for processing or other ancillary costs.

The falling gas prices at the TTF this year have brought implied European nitrogen margins back up in line with typical levels before the conflict. European nitrogen producers had been buffeted by spiking natural gas prices in the years after the Russia-Ukraine conflict started in 2022, causing operating rates to drop as some producers idled loss-making facilities.

But the fall in gas prices and jump in nitrogen levels has lifted producer margins this year. A basket of European products — the average of granular urea fca French Atlantic, UAN 30 fca Rouen and CAN 27 cif inland Germany — hit €11.76/t of nitrogen last week on 20 November, the highest since early 2023.

Nitrogen fertilizer prices in Europe have jumped in the past month as importers scrambled to secure products for arrival and customs clearance ahead of the implementation of CBAM legislation and added carbon costs in January.

Urea prices out of Egypt, one of the key sources of duty-free product for European buyers, hit $507/t fob on 6 November, before the surging levels began to pull in more atypical origins to the European Union, with importers lining up product granular urea from Oman, Nigeria and China. European prices have also been supported by the bloc's imposition of a €40/t tariff on imports of Russian nitrogen products since 1 July.

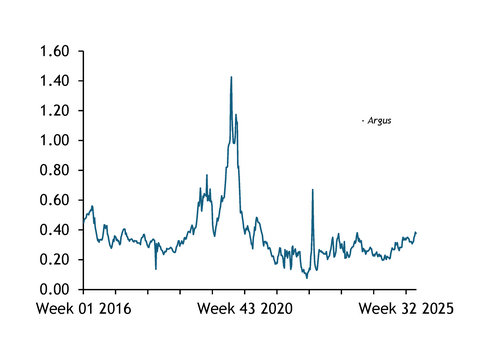

The ratio between the basket of European nitrogen prices against the TTF day-ahead price hit 0.38:1 on 20 November, marking the highest level this year. The ratio last consistently surpassed this level in the first half of 2021.

The ratio averaged 0.27:1 in 2024 and 0.26:1 in 2023.

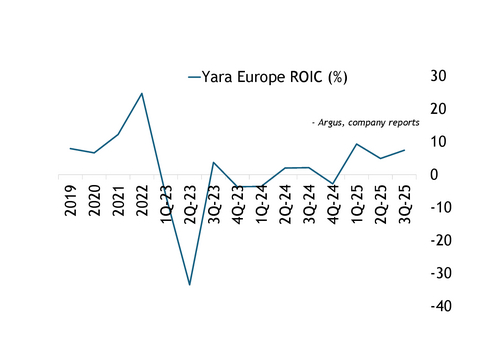

Improving margins for European producers has been a largely consistent trend through the year so far. Norwegian fertilizer major Yara posted a 7.4pc return on invested capital (ROIC) for its European segment in the third quarter of this year, up from 2.1pc a year earlier and -0.6pc for the whole of 2024. The ROIC for the firm's European unit dropped to as low as -33.5pc in the second quarter of 2023 (see chart).