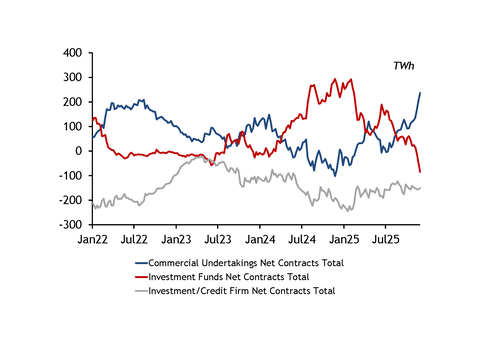

Investment funds have further increased their net short TTF gas position on the Ice exchange, according to the latest Commitment of Traders (CoT) data published on Wednesday.

Hedge funds held a net short position of 85TWh in the week to 5 December, out from 50TWh a week earlier, after increasing their short positions to an all-time high of 528TWh.

The volume of short contracts owned by investment firms has increased each week since 8 August, more than doubling from 233TWh at that point. This led this category of traders to eventually switch to a net short position in the week ending 21 November for the first time since March 2024.

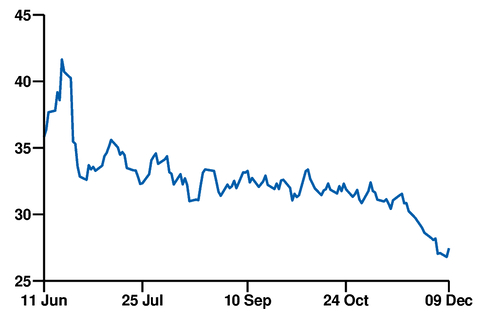

The TTF front-month price continued to slide last week on increasingly firm forecasts of a spell of abnormally mild weather in northwest Europe this week. The TTF front-month price closed at €27.10/MWh on 5 December after starting the week at €28.24/MWh and holding in a €30-33/MWh range since August (see graph).

Companies with retail portfolios — or commercial undertakings, as defined by Ice — have in recent weeks ramped up their purchases of long risk reduction contracts. This brought their net long position to an all-time high of 237TWh on 5 December, increasing sharply from 136TWh four weeks earlier on 7 November.

Long risk reduction contracts can be used to hedge a short position from any potential upside risk. This might be needed, for instance, if a cold second half of the winter boosts European demand and lifts near-term prices. Beyond the short term, low end-of-winter underground gas stocks would create upside price risk for the summer because of increased restocking needs.

The CoT report does not provide data on how positions vary across contract types, making it difficult to draw conclusions.