As India's steel production capacity increases, demand for coking coal is expected to remain strong, reinforcing the country's position as the world's fastest-growing importer of seaborne coking coal.

India is the world's second largest crude steel producer with output over January-November 2025 totalling 150.1mn t, the latest data from Worldsteel Association show. Major Indian steel producers have registered steady or even record output in the third quarter of the April 2025- March 2026 fiscal year, driven by firm domestic steel demand.

India aims to double its steel production to 300mn t/yr by 2030, and reach 500 mn t/yr by 2047, reinforcing its position as a major seaborne coking coal buyer.

Alongside its ambitious expansion initiatives, India has extended safeguard duties on specific flat-steel products for three years to protect the domestic industry from lower-priced imports. These protective measures are designed to preserve India's steelmaking capacity, reducing dependence on imported semi-finished products for further processing.

Met coal prices, imports up

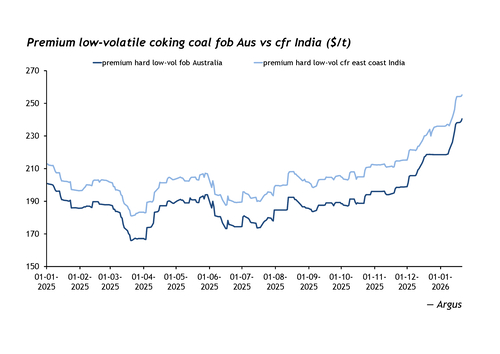

As steel production increases in India, both the demand for and prices of steel feedstocks such as metallurgical coal have also steadily climbed.

On pricing, recent outages and force majeure declarations in Australia because of heavy rain pushed the Australian premium low-volatile (PLV) hard coking coal price to a 17-month high of $240.55/t fob on 21 January.

Reflecting firm demand, metallurgical coal imports into India rose sharply in 2025 with volumes rising by 32pc on the year to 73.53mn t, data from shipbroker Interocean show. For December, imports climbed by 97pc on the year to 7.32mn t. This trend is continuing in 2026, with Indian steelmakers seeking a total of around 75,000–100,000t of metallurgical coal via tenders as of 21 January.

Australia remained India's top supplier, with December shipments rising by nearly 40pc on the year to 3.29mn t. Inflows from the US, Mozambique and Russia have also gone up. Higher steel margins and restocking needs encouraged mills to secure volumes despite the elevated prices, market participants said.

India's coking coal imports are projected to stay strong, with inflows of about 81.6mn t in 2026 and 86.5mn t in 2027, according to a report by Argus consulting services. The anti-dumping policy on low-ash metallurgical coke from major suppliers is expected to have a slightly positive effect on imports for six months, it added.

Coal demand rides on policy tailwind

Steel prices in India have been on an uptrend as the market rebounds on the back of improving macroeconomic conditions and robust demand. Traders and mills are also citing the recent introduction of safeguard measures as a key driver, as these protections are expected to boost domestic steel consumption.

The combined effect of firmer demand expectations and policy support has helped lift sentiment, with Indian buyers showing greater willingness to restock at higher levels, a trader said.

Steelmakers could also be nudged towards higher domestic coke production as coke imports could be curtailed with the implementation of anti-dumping duties, spurring demand for premium hard coking coal imports for blending, particularly Australian material, Argus consulting services said.

India to stay a key buyer

Looking ahead, India is expected to remain a key driver of coking coal demand, as ongoing steel production growth supports import needs.

"India has the biggest role to play given the fact that it is going to be the largest sea borne customer in all the years to come unless China starts buying [more meaningfully]," an India-based trader said. Import requirements are likely to rise substantially — potentially by 100% — as capacity expansions in the steel sector are rolled out, he added.

India is set to add more blast furnaces over the coming years as steelmakers push ahead with capacity expansion and each new blast furnace will raise metallurgical coal demand, another trader said.

| India metallurgical coal imports | ('000 t) | |||||

| Origin | Dec'25 | Dec'24 | ± % | Jan-Dec'25 | Jan-Dec'24 | ± % |

| Coking coal | ||||||

| Australia | 3,292 | 2,355 | 40 | 35,403 | 30,825 | 15 |

| US | 1,218 | 433 | 181 | 9,675 | 9,118 | 6 |

| Mozambique | 712 | 172 | 314 | 5,524 | 3,856 | 43 |

| Indonesia | 333 | 55 | 506 | 3,459 | 2,109 | 64 |

| Russia | 1,159 | 453 | 155 | 12,411 | 6,725 | 85 |

| Others | 573 | 82 | 598 | 5,438 | 869 | 526 |

| Total | 7,323 | 3,714 | 97 | 73,533 | 55,917 | 32 |

| Met coke | ||||||

| Indonesia | 94 | 452 | -79 | 961 | 2,521 | -62 |

| China | 0 | 13 | -100 | 308 | 825 | -63 |

| Poland | 0 | 0 | n/a | 486 | 613 | -21 |

| Colombia | 33 | 17 | 93 | 353 | 241 | 46 |

| Total | 171 | 586 | -71 | 2,762 | 5,052 | -45 |

| PCI | ||||||

| Australia | 284 | 668 | -57 | 2,392 | 5,780 | -59 |

| Russia | 640 | 1,255 | -49 | 7,206 | 11,651 | -38 |

| Total | 924 | 2,042 | -55 | 10,814 | 17,558 | -38 |

| Source: Interocean | ||||||

| *Note: Total includes additional small values excluded from individual breakdown, so component numbers may not sum to total | ||||||