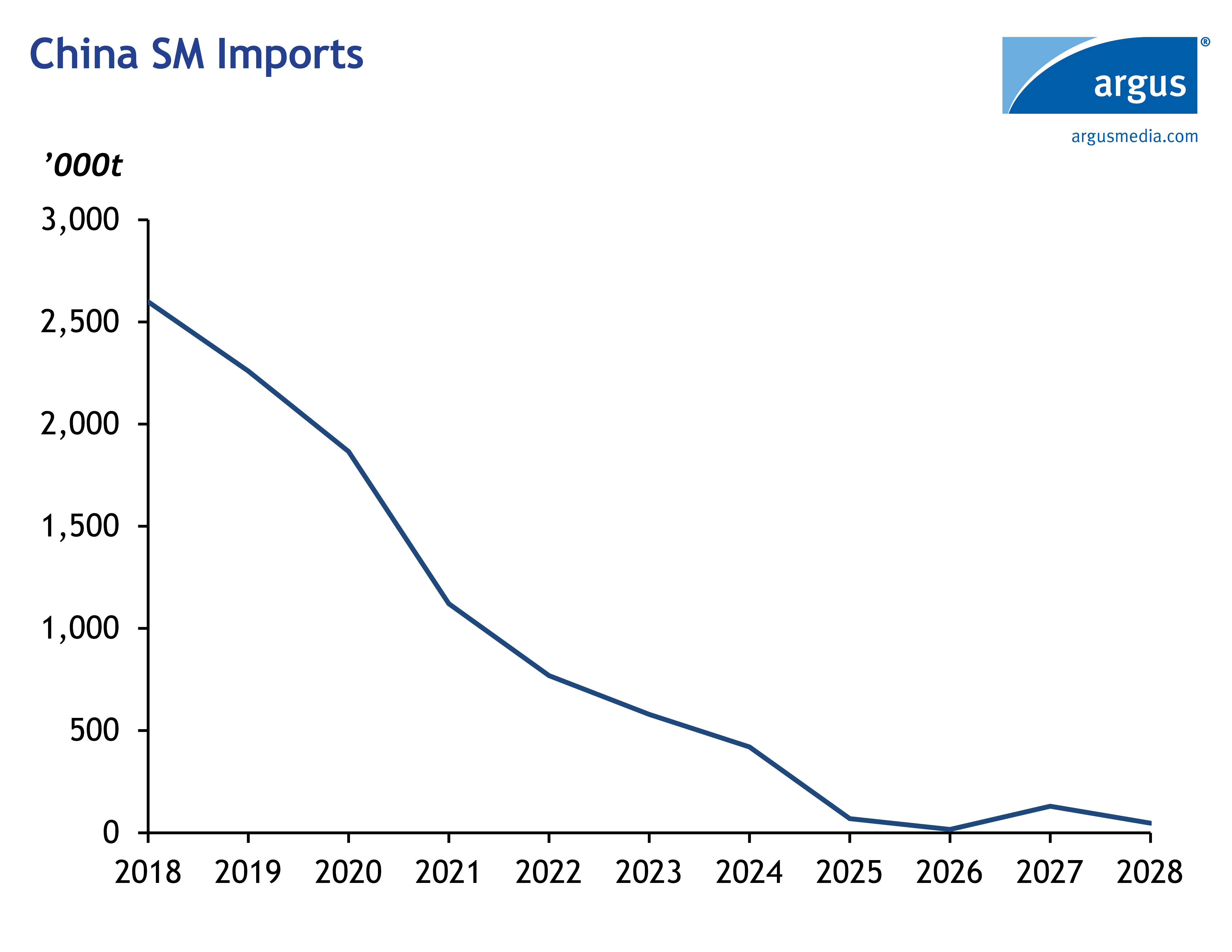

Last year, Chinese styrene monomer (SM) capacity surpassed its derivative capacity for the first time. As a result of this massive buildout, its SM imports have fallen off a cliff. How does this impact the global market?

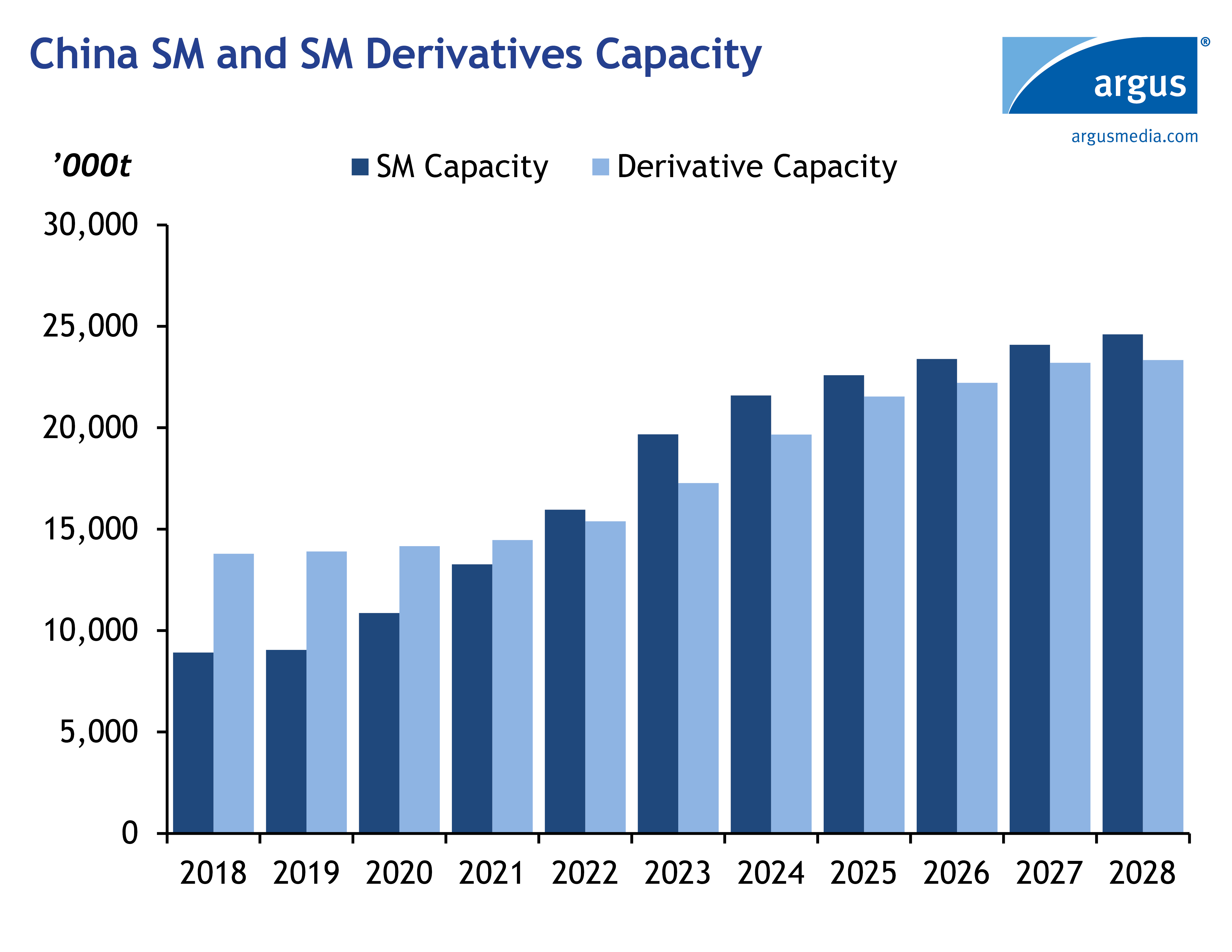

China is the largest market for styrene, accounting for almost one third of global SM demand. Until recently, the country was a net SM importer as its derivatives capacity exceeded its production capacity. But the country will add 9 mt of SM capacity from 2022 to 2027, with 3.5 mt in 2023 alone. Almost all global capacity additions in SM are in China.

Since China’s growth in styrene production capacity outweighs the rise in its derivative segment, the country’s own operating rates will decline, and some plants will close. Argus estimates that since 2021, China’s average run rate has dropped from 70pc to 64pc and will fall an additional 10pc in 2023. However, some new plants will act as a “replacement capacity” for older plants that are not cost competitive. Closures should revive operating rates in coming years. It remains to be seen that if these capacities can rationalize and China can become a structural SM exporter.

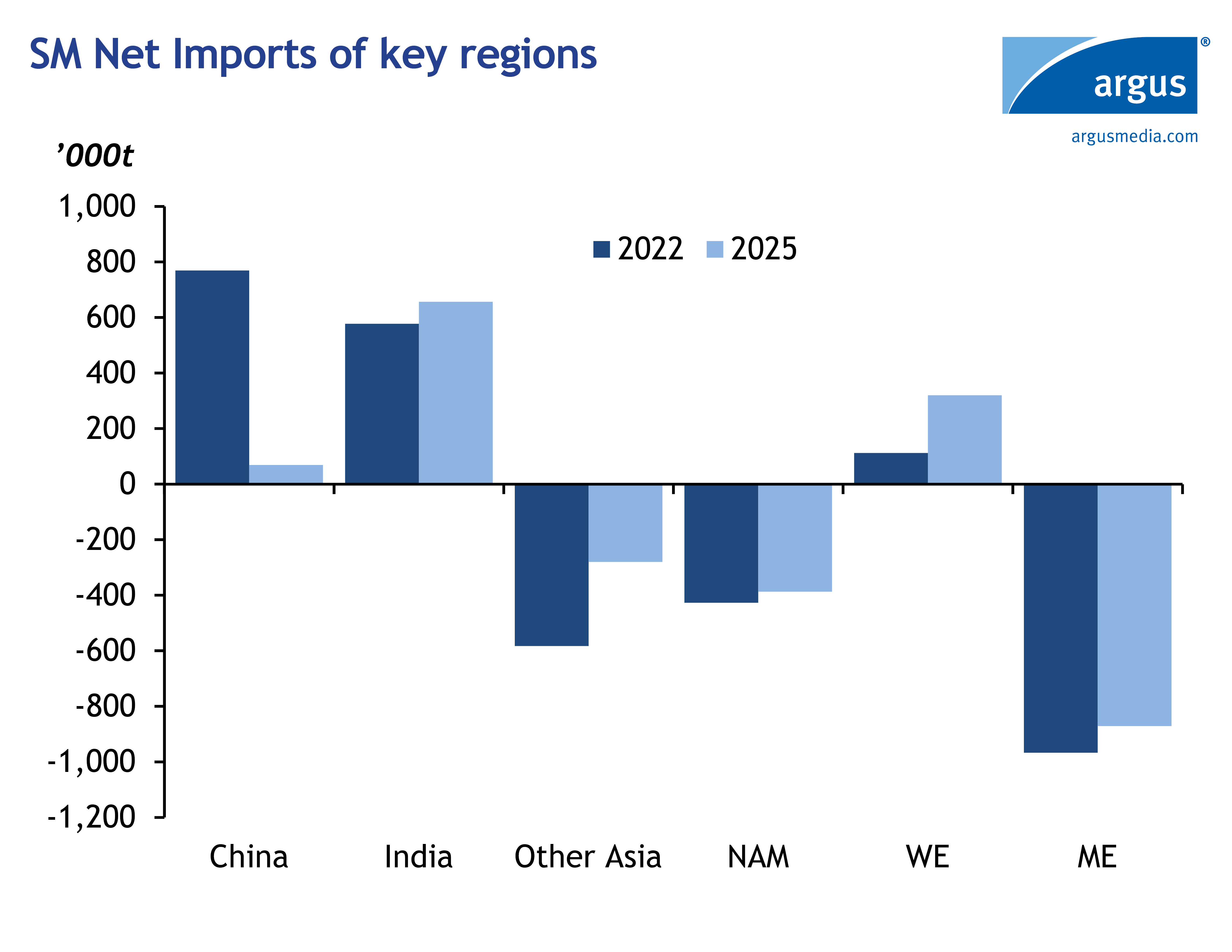

China’s legacy SM suppliers are being forced to sell elsewhere. China was the world’s largest SM importer with most supplies coming from Saudi Arabia, which accounted for half of all imports, Taiwan and Japan. The largest alternative market for these exporters is India. Saudi cargos are also flowing into Europe, which is putting pressure on domestic producers with higher costs.

Saudi cargos are competing with US shipments in Europe. In just three years, US exports to EU-15 members fell by more than half from 525,000t in 2019 to 220,000t in 2022. This was replaced by 215,000t from Saudi Arabia which saw an increase of around 70pc since 2019, even after Russian supplies were taken off the market in 2022 by EU sanctions. However, US is likely to remain a preferred exporter in European markets because of shorter voyage time. Unreliable and costly benzene production in US has also been one of the reasons for US’s lower SM exports.

Western Europe became a net SM importer since 2020. European growth is constrained by environmental regulations on polystyrene (PS) and expanded polystyrene (EPS). Producers cannot compete with large-scale Chinese plants, and some are shutting PS and EPS lines. INEOS has discontinued its PS production in Wingles and diverted its styrene supplies to Mass ABS production. Synthos has terminated its 100,000t EPS production in France, and Trinseo announced it would shut its Boehlen, Germany 280,000t SM facility. In addition to this many of the Europe’s producers are swinging between idle and operational depending on market conditions. However, China won’t displace all of Europe’s domestic production. Argus forecasts its SM production will cross 35 mt by 2028 with European production declining from 4.3mn t in 2022 to 3.7mn t in 2028.

Traditionally Europe has been a net exporter of Styrene derivatives, in recent years especially after the pandemic, Europe’s overall exports of styrene derivatives are also declining. Aggregate monthly exports have declined from 110,000t in April 2021 to around 20,000t by April 2023. This might be a key indicator of steady decline of Europe’s styrene industry.

Request a free trial or more information

Author Akash Chavanke, Business Analyst, Chemicals