The European Chloralkali Industry Gains from the Red Sea Disruption

Somewhat surprisingly, the European Chloralkali industry stands to gain from the disruptions in the Red Sea as the derivative industries opt to re-shore production and avoid the uncertain logistics associated with long supply chains from Asia.

The Chloralkali market is never a story about one product, as both chlorine and caustic soda are consumed in a multitude of products. However, caustic soda is directly traded while elemental chlorine is not. This dichotomy leads to an interesting result that, on the surface, does not seem logical.

Before the hostilities in the Red Sea, the European Chloralkali industry was forecast to see operating rates in the first quarter fall when compared to the fourth quarter of 2024. This was a result of weak economic growth and a relatively high level of chloralkali derivative imports from Asia. But due to the disruption to supply chains originating in Asia, European producers of chlorine-consuming derivatives like titanium dioxide, isocyanates, and epoxy are forecast to benefit. Operating rates for these derivatives are expected to increase in order to supply a larger share the domestic market. Factors driving this behaviour include buyers seeking to replace inventories that have been delayed owing to the increased shipping time from Asia to Europe as well as buyers wanting to have a more stable supply chain. There are a number of other chlorine derivatives that are anticipated to experience this same dynamic, ultimately driving an increase in Chloralkali operating rates in Europe.

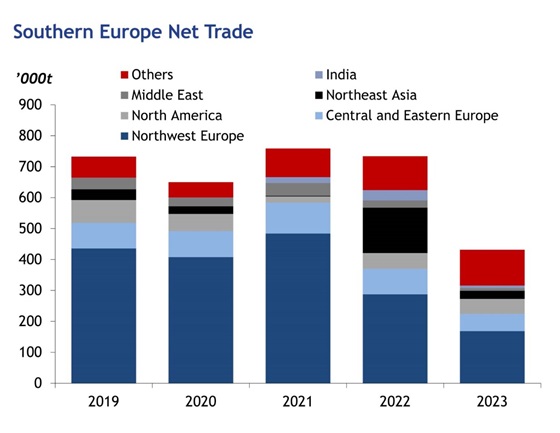

The Southern European Net Trade figure is from the Argus Chloralkali Outlook report and shows the imports of caustic soda to the region from other parts of the world. According to the figure, Northwest Europe is the leading provider of caustic soda to the region, even in 2022 when energy prices were extremely high. The slowing economy and relatively high energy prices reduced caustic soda demand in the region in 2023, leading to lower imports of caustic soda. Although imports of caustic soda from Asia, the Middle East and India fell from their high levels in 2022, they remain a significant portion of the supply mix.

The disruption to the logistics through the Red Sea have led to an overall increase in shipping costs, not only from Asia to the Mediterranean, but also from the US Gulf coast to the Mediterranean. This in theory would lead one to believe that caustic soda prices in the Mediterranean would increase. This may not necessarily be the case, as one also has to consider the impacts of the Red Sea shipping disruptions on caustic soda derivatives.

Caustic soda demand into derivatives like alumina and soaps and detergents are not expected to be significantly impacted by shipping issues on the Red Sea. However, the pulp and paper industry may be another story. Exports of wood pulp from Europe will be less competitive in international markets owing to the higher cost of freight and potentially lead to lower pulp production rates and a reduced demand for caustic soda. Between the increase in chlorine operating rates and lower caustic soda offtake into the pulp industry, Northwest European Chloralkali producers will be able to supply more caustic soda into the Mediterranean and replace the product that was being supplied by India, Asia, and the Middle East. The increase in caustic soda supply may also result in Northwestern European producers needing to export more volumes of caustic soda to other markets around the world. This could potentially force exports to be competitive into markets like Latin America.

The Red Sea logistics disruption is forecast to benefit the European Chloralkali industry by increasing chlorine offtake and increasing operating rates. This benefit may last for some time as chloralkali derivatives like titanium dioxide and isocyanates are re-shored to the European market to improve security of supply and reduce the uncertainty related to the logistics of moving products from Asia. After hostilities in the Red Sea subside and logistics costs are reduced, chlorine derivatives may be sourced from Asia again. However, by that time the European economy may start to improve and chlorine and caustic soda offtake into their respective derivatives may increase, offsetting any loss in demand related to the increased imports.

Author: George Eisenhauer