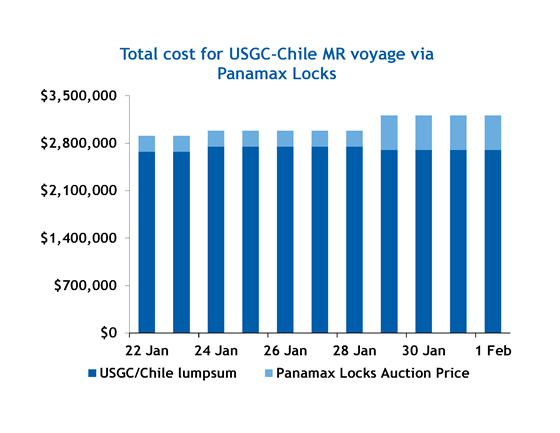

Auction prices for Panamax locks at the drought-restricted Panama Canal have more than doubled since mid-January on soaring demand from ship operators to secure transit slots.

Auction prices for Panamax locks at the drought-restricted Panama Canal have more than doubled since mid-January on soaring demand from ship operators to secure transit slots.

Demand for Panamax locks, which are responsible for over 70pc of canal transits, rose as auction prices declined compared with late last year, and as operators prefer to avoid the Suez Canal’s outlet into the increasingly risky Red Sea.

The average cost for an operator of vessels like medium range (MR) tankers and Supramax bulkers to win an auction there on 29 January was $507,739 lumpsum, up 84pc from $232,000 on 22 January, per Argus data.

The Panama Canal Authority (ACP) has restricted transits to 24 per day through the canal, with 17 per day via the Panamax locks and seven through the Neopanamax locks. Ship operators need to secure a booking slot well in advance or compete in an auction to win passage.

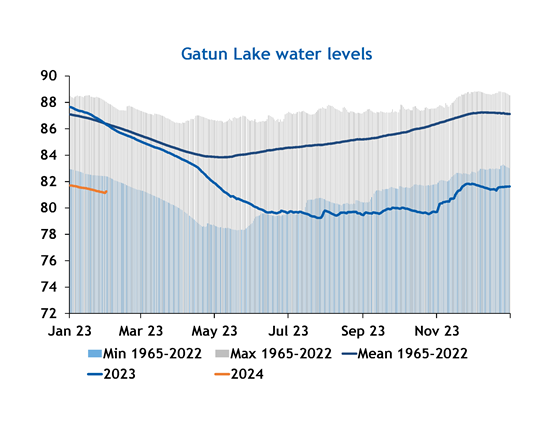

Competition over the limited number of Panamax locks booking slots for auction is likely to remain high ahead of the return of the region’s rainy season in June as shippers can still save on time and fuel costs by using the canal. The water level of the Gatun Lake that feeds the watershed has remained at its lowest-ever recorded levels for every day since mid-July 2023, and will likely necessitate more severe action by the ACP if this trend continues into the seasonal low point in May.

Source: Panama Canal Authority

MR tanker operators have increasingly relied on securing pre-booked slots ahead of transits, with shipowners using the quickly sold-out slots as leverage when negotiating charters for US Gulf coast-west coast South America voyages via the canal.

Shipowners without transit slots to reenter the US Gulf coast from the Pacific side after such a voyage have mostly been ballasting off into Asia-Pacific instead, but the upcoming Lunar New Year holiday beginning 10 February, and subsequent loss of most Asia-Pacific traders from the market for around two weeks, will likely increase the desire of these shipowners to quickly reenter the Atlantic basin.

Large dry bulkers, such as Panamaxes and Kamsarmaxes, on Asia-Pacific-bound voyages have already diverted away from the canal after the ACP introduced restrictions affecting their ability to fully load in November 2023, suggesting that the upcoming Lunar New Year across Asia-Pacific that typically silences the dry bulk market is unlikely to significantly drop demand for transits in the near-term.

There were zero Panamax or Kamsarmax bulkers transiting or waiting to transit at the Panama Canal on 1 February, according to vessel imaging data, reflecting the switch by many Asia-Pacific buyers of coal and grains to Suez Canal transits until the advent of Houthi attacks further rerouted most US-loading cargoes around the Cape of Good Hope.

The average payment to win a Neopanamax Locks transit auction hit $266,818 on 29 January, down by 29pc from the $374,000 averaged on 22 January, per Argus data. Recent auction prices are down sharply from the start of the year. A Neopanamax locks auction at the beginning of January crested $4mn, according to a shipping agency, demonstrating the massive drop in demand for Neopanamax transits caused by the exodus of larger dry bulkers and the collapse of the LPG arbitrage for US-loading very large gas carriers (VLGCs) over other regions.

Market segments shift dramatically at Panama Canal

The representation of market segments through the Panama Canal has shifted considerably from the end of fiscal year 2023 in September to December 2023, with chemical tankers overtaking dry bulkers as the plurality of Panamax locks transits, up by 1.9pc to 26.1pc overall, according to ACP data.

Meanwhile, dry bulker Panamax locks transits fell by 8.2pc to 17.3pc in the same period, the difference largely made up by containership transits rising by 4.4pc to 15.9pc, vehicle carriers rising by 4pc to 10.1pc, and LPG carriers rising by 0.8pc to 9.5pc.

The percent of crude and product tankers also ticked up, rising by 1.1pc from September levels to 5.5pc in December, as Cape Horn-transiting voyages remained a mostly unpalatable option for most MR ship operators for shipments loading in the US Gulf coast.

The drying up of dry bulker front-haul voyages through the Panama Canal and simultaneous increase in higher-paying voyages on a $/t basis for other commodities could contribute to higher auction costs in the near term as ship operators with stronger stomachs for higher lumpsum payouts increasingly vie for the slots.

Author Ross Griffith, Deputy Editor – Freight