Expectations of a reset in Chinese coal import quotas by the start of the 2020 calendar year have pushed both international and Chinese traders to restock aggressively throughout most of November in anticipation of an uptick in demand.

Some initial signs of a turnaround in domestic Indian steel demand have also spurred a handful of Indian traders to take positions, although most Indian mills are known to be sufficiently covered for requirements until the first quarter of 2020 from contract volumes and also currently have high stockpiles.

One major Indian steel producer is offering its December-loading stocks of Goonyella, Peak Downs and Lake Vermont in the spot market but has found little buying interest, underlining weak spot demand in India amid steel production cuts.

And yet Chinese and international traders have been targeting January-loading cargoes of Peak Downs, Saraji, Goonyella and even some Peak Downs North cargoes with the expectation that China will reset coal import quotas next month, prompting China mills to restock cheaper coking coal imports.

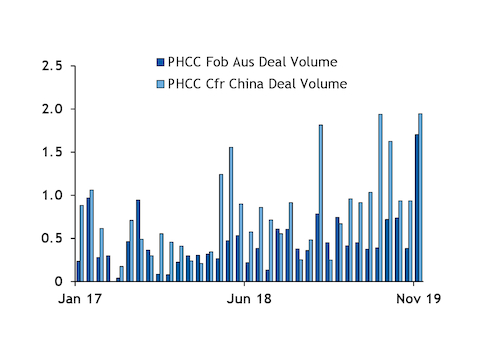

Fixed-price spot trades captured by Argus in November totalled about 1.7mn t on a fob Australia basis and 1.95mn t on a cfr China basis. The fob volume was the highest recorded in one month since at least 2017, while the cfr China monthly volume was only modestly above average.

The strong buying interest from traders has driven a steady and sustained increase in premium low-volatile coking coal prices on a fob Australia basis, which are up by 4.5pc since 1 November to the last assessment of $138/t on 5 December.

Seaborne coking coal prices on a cfr China basis have been comparatively more stable. The Argus premium low-volatile cfr China assessment dipped by around 2.6pc to the lowest level in November of $142.75/t, before rebounding to the most recent level of $150.30/t cfr. Further gains are expected if Chinese mills are allowed to re-enter the seaborne spot market next month.

As seaborne prices were easily $30-40/t lower than domestic prices throughout November, seaborne coking coal became an attractive option for Chinese mills, especially with domestic coal contract prices temporarily remaining unchanged.

Much of the buying on a cfr China basis in November was driven by large state-owned Chinese steel mills, which are more able to find alternative ports to get their imported coal cargoes cleared with customs or to discharge their vessels.

Independent Chinese mills have chosen to stay out of the spot market entirely amid continuing uncertainties over their ability to secure customs clearance for their cargoes, preferring to wait until there is more clarity on policies before resuming purchases.

By Rou Urn Lee and Gregory Holt