Coal-fired generation in key coal-importing countries held its ground in the first quarter, except in China, despite the pressures on power demand stemming from the coronavirus. But stricter measures intended to contain the pandemic may pressure power demand and coal-fired generation in the second quarter.

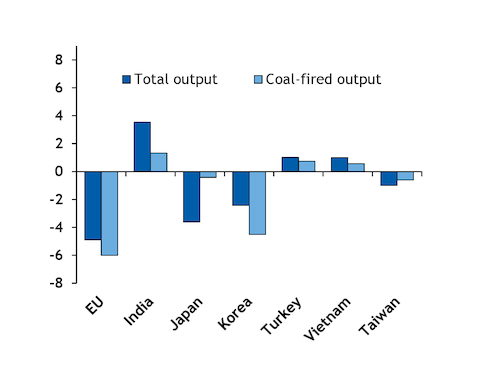

Total power generation in key coal-consuming countries Germany, France, India, Japan, Spain, Taiwan, Turkey, the UK and Vietnam fell by only around 8GW, or 1.5pc on the year, to around 580GW in January-March, Argus estimates.

Some of these countries are yet to publish their coal-fired generation data for the period, but Argus calculations based on historic coal-fired generation put output in those countries down by around 5GW on the year in January-March at 210GW.

Even if aggregate coal-fired generation registered a similar year-on-year fall to power demand during the period, this would only lead to a demand contraction of around 7.5mn t of NAR 6,000 kcal/kg coal from the seaborne market, which is insignificant given annual seaborne trade of 1bn t/yr.

Demand falls in Europe but coal burn little changed

Of the key demand hubs in the seaborne coal market, Europe recorded the biggest year-on-year drop in power output in January-March. Aggregate generation in Germany, France, Spain and the UK declined by 5GW on the year to 191GW.

Coal burn was also down sharply during the quarter, but most of the decline came in January and February before the strictest coronavirus control measures came into force, amid surging wind and hydroelectric output.

Coal-fired generation in Germany, France, Spain and the UK ran at 6.8GW in the first quarter, down from 12.4GW in January-March 2019. This 12.1TWh drop is equivalent to around 4.5mn t less NAR 5,800 kcal/kg coal burn in 40pc-efficient plants.

Output was 8.3GW lower on the year in January at 9.6GW and 7.2GW lower in February at 6.4GW, but less than 500MW lower in March at 5.8GW. Widespread coal-to-gas fuel switching began to emerge in March 2019 and displaced a significant proportion of flexible coal-fired generation, limiting the scope for additional downside in 2020.

India's power generation stood firm until March, rising by 1.6GW and 10.56GW in January and February, respectively, to 102GW and 145GW. But the impact of restrained economic activity started to surface in March, with overall output falling by 6.3GW on the year to 138GW in the first half of the month.

Indian coal-fired generation in January-March is likely to have been around the same level as a year earlier at close to 113GW. But power output and coal burn are set to fall sharply this month following the government's decision to instate a three-week lockdown from 25 March, which forced coal-consuming industries to halt operations.

Power demand was also little changed from a year earlier in most Asia-Pacific countries.

Overall power demand in Japan stood at around 105GW in the first quarter. Japanese coal burn may have benefited from a 2.4GW drop in nuclear output in the quarter, although import data suggest demand has been weak early in the year. The country's thermal coal imports in January-February touched a four-year low of 18.8mn t, according to customs data, down from 20.1mn t in the first two months of 2019.

Taiwan's overall power generation inched down by around 1GW on the year to 23GW in January-March, and the country's coal-fired output fell by 605MW to 8GW.

South Korean power demand data are not yet available, but overall demand is expected to be around 64GW, according to Argus estimates, compared with 66GW a year earlier. Coal burn at state-owned Kepco plants is likely to have dropped by up to 4mn t on the year to less than 18mn t, driven by government restrictions to improve air quality, rather than weaker demand or coronavirus.

Chinese economic activity starts to recover

China's coal demand was heavily impacted by the coronavirus outbreak, with total thermal output falling by 9pc on the year to 542GW in January-February.

China has not released its generation figures for March, but the year-on-year drop in thermal output is likely to be softer as economic activity started to recover last month. The country's purchasing managers' index rose to 52 in March, signalling economic expansion, after falling to a historic low of 35.7 a month earlier.

But coal consumption at coastal utilities was still 120,000 t/day lower on the year in March, at 545,000 t/d.