Lower power demand and coal's narrowing cost advantage for power generation against LNG in northeast Asia cut US July coal exports to a four-year low for the time of year.

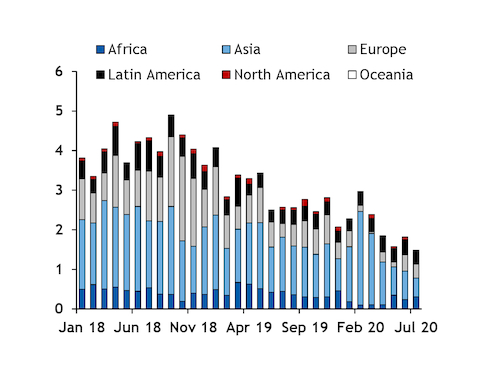

Overall US thermal coal exports decreased by 1.1mn t on the year to 1.5mn t in July, according to customs data.

Lower shipments to Asia drove the downward trend, with deliveries to Japan and South Korea decreasing by 428,000t and 335,000t on the year, respectively, to 70,000t and 300,600t in July.

Power demand in Japan and South Korea remained weak in July owing to the impact of Covid-19 and the arrival of the wet season in this region. And intensifying coal-gas competition in northeast Asia owing to declining oil-linked LNG import costs following the oil price dip earlier this year may have influenced importers' decision to stock up ahead for the winter.

India was another weak market for US exporters in July with shipments decreasing by 132,000t on the year to 100,000t. Overall Indian coal demand remained lower during the month but showed signs of recovery with receipts exceeding 10mn t for the first time since April.

European demand edged higher in July and partly offset the weak imports from Asia. Overall exports to Europe increased by 11,200t on the year to 355,100t, with deliveries to Germany and the Netherlands increasing by 59,000t and 35,000t on the year, respectively, to 59,000t and 35,000t.

Coal-fired power generation in Germany has remained lower year on year but has recovered somewhat since June, according to Fraunhofer power data. Total coal output increased by 223GWh on the month to 1.6TWh in July, while in August it posted a bigger monthly rise of 337GWh to 1.9TWh.

Margins for coal generators have improved in northwest Europe, increasing the potential for a reversal in recent coal-gas fuel switching in the coming months. The API 2 fourth-quarter delivery swap was only €0.78/MWh higher than the fuel switching threshold at which a 46pc efficient coal-fired unit can compete with a 55pc-efficient gas unit on 8 September, compared with €2.87/MWh on 21 July.

This may support US coal exports to the region as Atlantic basin supply fundamentals have tightened owing to production uncertainty in Colombia.

Elsewhere, US deliveries to the Dominican Republic posted the strongest increase in July, with shipments rising by 132,000t on the year to 180,000t.