Thermal coal prices for the South Korean market were mixed this week, as lower freight prices weighed on the delivered market while Australian fob prices firmed.

Argus assessed NAR 5,800 kcal/kg coal with maximum 1pc sulphur and 17pc ash $0.50/t higher on the week at $40.53/t fob Newcastle ($42.49/t on a NAR 6,080 kcal/kg price basis) and $0.49/t lower on the week at $50.36/t cfr South Korea.

Capesize freight from Australia to northeast Asia fell below $10/t for the first time since mid-June this week and was assessed by Argus at $9.90/t on 10 September, from $11.50/t at the start of the week. This applied pressure to delivered prices despite strength in Australian fob prices, which rose amid a series of fresh tender awards.

State-owned utility Korea Midland Power purchased Capesize cargoes of minimum NAR 5,750 kcal/kg and NAR 5,850 kcal/kg Australian coal at $42.50/t and $43.50/t fob Newcastle respectively on a NAR 6,080 kcal/kg price basis, sources said.

Fellow utility Korea Western Power (Kowepo) awarded Swiss producer Glencore supply in its five-year term tender for minimum NAR 5,200 kcal/kg coal at around $42/t fob Gladstone for the first shipments in the fourth quarter of 2020.

Kowepo is also seeking a further 1.04mn t of coal in another five-year term tender that closes on 15 September, while Korea East-West Power has tendered for 150,000t of NAR 4,400-4,999 kcal/kg coal in a spot tender closing 17 September.

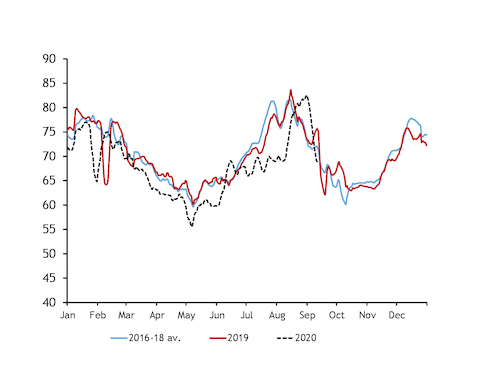

South Korean daily peak power demand has fallen sharply in September amid unseasonably cool weather, but disruption across the nuclear fleet in the wake of two typhoons built some risk premium into fob Newcastle prices.

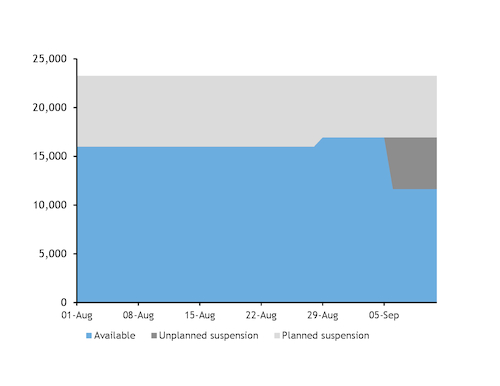

Typhoons Maysak and Haishen unexpectedly forced 5.3GW of South Korean nuclear capacity off line at the start of September.

As of 11 September, Wolsong 2 and 3 — both 700MW — Kori 3 and 4 — both 950MW — and Shin Kori 1 and 2 — both 1GW — were still shutdown, according to the Korea Hydro and Nuclear Power website. This is in addition to 6.3GW of planned suspensions, which means that only 11.7GW of South Korean nuclear capacity is currently available.

South Korean nuclear output was 14.3GW in September last year and was expected to climb towards 17.4GW this month, before the inclement weather struck.

The nuclear shortfall has likely drawn additional coal capacity into the generation stack this month, but one source at a South Korean utility said that gas demand would probably be more affected as there is less unused coal capacity to respond to the short-term disruption than gas.

The impact may also be dampened by weaker seasonal power demand. But daily mean temperatures in Seoul are forecast to be several degrees below the long-term average until at least 25 September.

Seven-day average daily peak power demand fell to less than 69GW this week, from nearly 79GW a week earlier.