Vietnam emerged as an increasingly significant buyer of Australian coal last year as imports built momentum and easily outpaced shipments from its traditional market of Indonesia for the second year running.

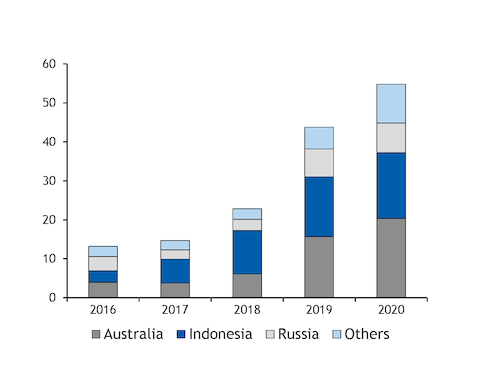

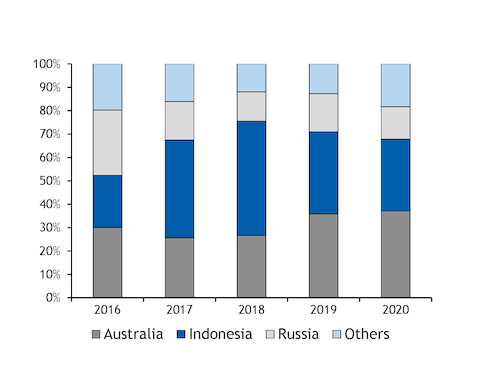

Vietnam absorbed some of the surplus arising from Beijing's informal ban on Australian coal, with imports from Australia reaching a record 20.34mn t in 2020, up from 15.7mn t a year earlier, customs data show. In contrast, Vietnam imported 16.85mn t from Indonesia last year, which was up from 15.3mn t in 2019. Imports from both countries totalled 37.19mn t last year, accounting for more than two-thirds of Vietnam's total imports of 54.81mn t. Vietnamese customs data do not differentiate between coking and thermal coal.

The trend may continue, given the country's increasing appetite for thermal coal to power its growing economy. It was also an opportunistic buyer of additional seaborne supplies at unusually competitive prices as it helped absorb some of the Covid-19 pandemic-driven oversupply in Asia, particularly from Australia and at one point from South Africa. The country was also one of the beneficiaries in December when China imported no Australian thermal coal for the first month since March 2008, and producers tried even harder to connect with buyers in southeast Asia.

Vietnam's emergence as a key demand centre in the region also helped support seaborne coal prices, which have recovered after hitting multi-year lows last year. Indonesian GAR 4,200 kcal/kg (NAR 3,800 kcal/kg) coal was assessed at $49.89/t fob Kalimantan on 22 January, the highest since early March 2018. Australian NAR 5,500 kcal/kg coal was assessed at $57.92/t fob Newcastle, also at its strongest since 18 December, when the price was at an 18-month high.

Overall shipments have cooled since the record run, falling to 1.66mn t in the first half of January, compared with 1.92mn t in the same period a year earlier, following similar declines in December and October 2020.

But fundamentals remain strong and Vietnam's economy has proved more resilient this year than other countries, as its efforts to contain the spread of Covid-19 ensured business continuity and supported electricity consumption.

Vietnam's economy is expected to grow by about 6.8pc this year, according to the World Bank, up from 2.91pc in 2020. The country's industrial activity looks steady after rising by 9.5pc in December and 3.36pc last year, supporting the outlook for power demand. "Central to this growth has been, and will be, coal," World Coal Association chief executive Michelle Manook told Argus.

There are firm prospects for steady coal imports by Vietnam, given a string of scheduled and under-construction projects. This is despite plans to expand renewable capacity in the next 10 years to ease the country's reliance on coal.

Vietnam is likely to continue to develop 15 planned coal-fired power projects with a combined capacity of 18GW between now and 2026, the sustainable energy think-tank the Institute for Energy Economics and Financial Analysis said last month. A consortium led by the Japan Bank for International Co-operation on 28 December agreed to finance the construction of a 1.2GW power plant in central Vietnam.

Other factors supporting coal consumption included Vietnamese cement and steel production. Cement output reached 100.1mn t last year, according to provisional data from the general statistics office (GSO), up from an estimated 96.5mn t in 2019. The country produced 30.67mn t of crude steel in 2020, up from 20.1mn t a year earlier, supporting more coking coal imports.

Russian supplies

Vietnam's coal imports from Russia rose further last year, up by 460,000t on the year to 7.61mn t, customs data show. And some market participants expect Russia to ship more than 8mn t to Vietnam in 2021.

Supplies from Russia accounted for almost 14pc of the country's total imports, compared with 16pc a year earlier. Russia exports thermal coal, coking coal and anthracite to Vietnam, according to Russian customs data.

Vietnam's other suppliers in 2020 include Japan and China, according to the country's customs data. Although data does not differentiate imports from South Africa, exports from the Richards Bay Coal Terminal rose sharply to Vietnam last year.

The growth in imports suggest Vietnam's reliance on coal is likely to continue despite its push to expand generation from renewable sources of energy in the next 10 years.

But the Vietnamese government is also taking "a pragmatic and realistic view" as it grows renewable power capacity, Manook said. The country's focus has been on balancing Vietnam's economic and environmental goals. At the same time, coal has been identified as "remaining critical to maintaining an affordable, dependable and robust energy supply to underpin this expansion and growth," she said.