Rising freight rates and domestic gas prices helped to bolster the South Korean coal market this week, although coal-fired generation is expected to remain weak this month.

Argus assessed minimum NAR 5,700 kcal/kg coal at $86.83/t cfr South Korea and $70.43/t fob Newcastle this week, which was up by $2.12/t and $1.57/t on the week, respectively.

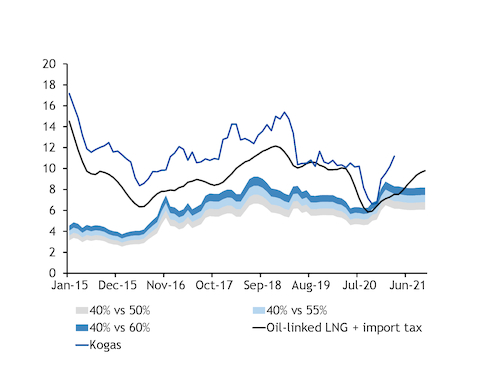

The short-term weather outlook in South Korea is mild and additional coal-fired power plant outages were added to the March schedule this week, which should continue to suppress coal consumption in the weeks ahead. But sustained increases in crude prices will make term LNG increasingly uncompetitive with coal for power, which is creating upside potential for coal demand and prices.

South Korean state-owned gas supplier Kogas set its March tariff for the power sector at a 17-month high of $11.18/mn Btu this week, which is likely to reflect increased spot purchases earlier in the winter when the LNG market briefly spiked to record highs. And recent gains in the oil market should keep contractual LNG, the majority of which is linked to crude prices, on an upward trajectory for at least the next six months, potentially making natural gas increasingly uncompetitive with coal for domestic utilities as the year wears on.

Based on recent prices, the 38pc coal-switching price for a 55pc efficient gas-fired plant is around $7.60/mn Btu, which is significantly lower than Kogas' latest tariff. This could help coal to displace gas in the mix from next month, when winter plant restrictions ease.

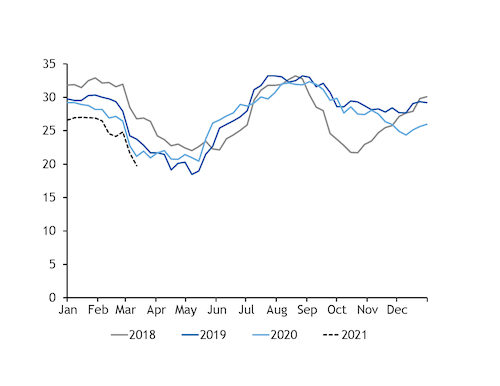

But until then, coal will remain constrained by the capacity limitations that aim to curb air pollution. An average of only 21.3GW of state-owned utility Kepco's 33.7GW installed coal-fired capacity is currently scheduled to be on line this month, of which only 80pc is permitted to be used according to the winter suspension policy.

On the supply side, railway operator Australian Rail Track (ARTC) said this week that it is planning 10 more Hunter Valley network maintenance closures this year that will impact thermal coal deliveries into the key New South Wales (NSW) port of Newcastle. This includes a minor event over 13-14 March and a major event — which entails an entire network closure — over 6-8 April.

Chinese demand for Russian and Indonesian coal has also strengthened considerably in recent months because of China's self-imposed embargo on Australian purchases, constricting the pool of Asia-Pacific coal that is available to other northeast Asian buyers.

Availability of South African coal — which typically comprises only a small part of the east Asian supply mix — has also been tight early in 2021, because of domestic railing issues.

There was no reported South Korean tender activity this week, but state-owned utility Korea Western Power (Kowepo) today launched a tender for high-calorific value term supplies that will close on 11 March. The company is inviting offers on a cfr basis for its Taean coal-fired plant.