South Korean coal prices fell this week, with limited spot tender activity and as state utilities re-introduced voluntary coal-fired caps amid the seasonal slump in power demand.

In the tender market, state-owned Korea Midland Power awarded NAR 5,700 kcal/kg January and February-loading Capesize cargoes at around $145/t fob Newcastle on a NAR 6,080 kcal/kg basis. And Korean South-East Power was heard to have awarded December and January-loading Capesize cargoes of Australian NAR 5,700 kcal/kg coal at around $145.50/t fob on a NAR 6,080 kcal/kg basis in a five-year contract.

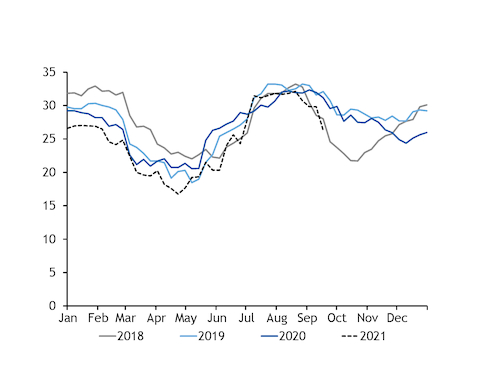

South Korean coal-fired generation rose on the year for the first time since April 2020 in July, Kepco data released today show. Coal burn climbed by 3.4GW to 28.6GW — split 24.9GW and 3.8GW, respectively between state-owned Kepco utilities and private-sector generators.

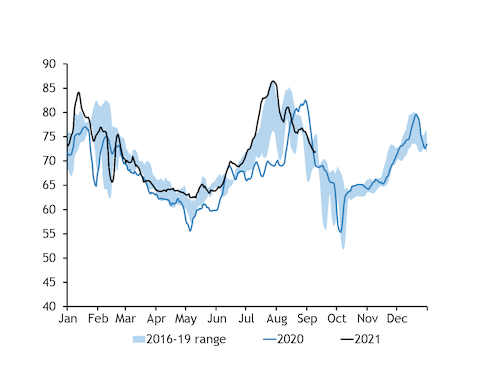

This came as overall power demand surged by 12.5GW on the year to a record 75.2GW, amid unseasonably hot weather. Coal burn is likely to have remained firm in August as well, although data will not be available for another month.

But as peak seasonal power demand for cooling winds down this month, state-owned Kepco utilities have reintroduced voluntary restrictions across coal-fired power plants, according to the Korea Power Exchange (KPX) outage schedule published today.

Six coal-fired units with a combined capacity of 3.5GW will be voluntarily suspended for 14-20 day periods this month. The overall September restriction as a result of the voluntary caps so far announced will be 2.2GW, according to Argus analysis, with a further 3.5GW of capacity restricted for maintenance or other reasons.

Implied Kepco availability of around 27GW would be down from 30.8GW in August and 31.1GW last September, with the potential for further restrictions to be added to the schedule in future weeks.

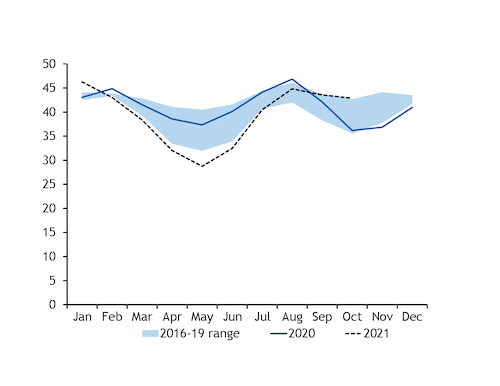

Nuclear availability is expected to climb by 4.9GW on the year this month, which should limit the market's overall reliance on fossil fuels. And strength in seaborne coal prices has outpaced the rise in oil-linked LNG prices, making the fuel less competitive with gas than in previous years. These two factors have probably freed utilities to continue to impose voluntary limits on their coal use.

Japanese outlook soft as Covid restrictions extended

High-CV thermal coal net-forward prices into Japan rose this week as all fob prices increased, but the demand outlook remains soft as an extension to coronavirus restrictions threatens to exacerbate the post-summer decline in seasonal power use.

Japan is extending a state of emergency in place in 19 prefectures as new Covid-19 infections remain high, driven by the more transmissible delta variant.

A panel of experts this week endorsed the government's proposal to extend an existing state of emergency in 19 prefectures covering most of the country's populated business and industrial areas, including Tokyo, Nagoya, Osaka and Fukuoka. The measures will be extended until 30 September from the previous end date of 12 September.

Power demand in Japan fell by 15pc from a week earlier to an average of 95GW on 3-9 September, according to power agency the Organisation for Cross-Regional Co-ordination of Transmission Operators. Tokyo, the biggest electricity consuming region, saw the biggest demand fall — of 22pc to 29GW — during the period.

As in South Korea, rising nuclear availability and increasingly competitive oil-linked LNG remain a threat to Japanese coal-fired generation this autumn. Power plant maintenance is also expected to rise slightly, with 8.6GW of coal-fired capacity scheduled to be offline this month, up from 7.1GW a year earlier. But overall availability should be higher on the year thanks to recent increases in installed capacity.