The South Korean coal market rebounded sharply this week on the back of a stronger demand outlook for the first quarter and supply disruption in Indonesia.

Argus assessed NAR 5,800 kcal/kg cfr South Korea at $173.11/t today, up by $17.08/t on the week.

Indonesia, the second-largest coal supplier to South Korea, suspended all thermal coal exports for January, prompted by domestic fuel shortages. A number of Indonesian coal producers declared force majeure to their customers as a result, while it remains unclear whether the ban will be lifted at the end of the month.

The South Korean government announced on 3 January that the short-term impact of the Indonesian coal export ban will be limited at least for January, considering utilities' current level of coal stocks and that there is no disruption in deliveries from other countries. The government also said more than half of the scheduled Indonesian cargoes for January delivery have been either loaded or shipped already, while delays in the rest of the cargoes will affect only two of the state-owned Kepco utilities, according to a source familiar with the matter.

Indonesian coal accounted for 20pc of South Korea's coal import mix in 2021, while Australian coal accounted for nearly half of the mix.

Despite the expected limited short-term impact of the ban, the market is anticipating stronger demand in the first quarter in case of an extension, as South Korean domestic gas prices have soared above the fuel-switching threshold. Kogas' power sector tariff this month reached the highest of any month since at least January 2015. The tariff reflected rallies in global spot LNG prices during the fourth quarter of last year as the company increased spot purchases.

The implied tax-inclusive generation cost for a high-efficiency gas-fired unit running on Kogas' supply in January is now around $48.93/MWh more expensive than for an average-efficiency coal-fired unit in South Korea, compared with a $12.97/MWh premium during the same month last year.

Forward coal prices suggest the coal-to-gas fuel-switching band will continue to fall through the first quarter, meaning price-induced fuel switching will be limited unless Kogas' tariffs fall more rapidly. Meanwhile, Seoul's earlier decision to freeze electricity prices until April this year to prevent inflation is further pressuring generators' margins, strengthening the demand outlook for the solid fuel for the January-March period despite ongoing seasonal coal-fired plant restrictions.

The South Korean government is reportedly considering easing winter restrictions on the coal sulphur content in case the export ban gets extended, as Indonesian coal has a relatively lower sulphur content and has helped generators to cap sulphur emissions at 0.4pc.

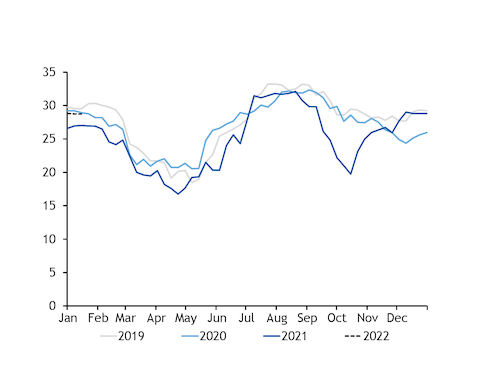

Kepco's coal availability is scheduled to average 27.8GW this month, according to Argus analysis based on the latest maintenance schedule published by the Korea Power Exchange. By comparison, Kepco's coal availability averaged 26.9GW in January 2021, with output over the month totalling 21.2GW.

Kepco's higher coal availability is scheduled alongside an expected 3GW of year-on-year growth in South Korea's nuclear output this month, with average power demand projected to remain flat at 70GW, KPX forecasts.

Cold weather boosts Japanese coal demand

Cold weather in Japan strengthened the coal demand outlook in the country this week, while the Indonesian export ban has further tightened the supply-demand balance.

Temperatures in Tokyo were around 2.06°C below the historic average today and are forecast to remain below the seasonal norm for most days during the next fortnight, Speedwell weather data show.

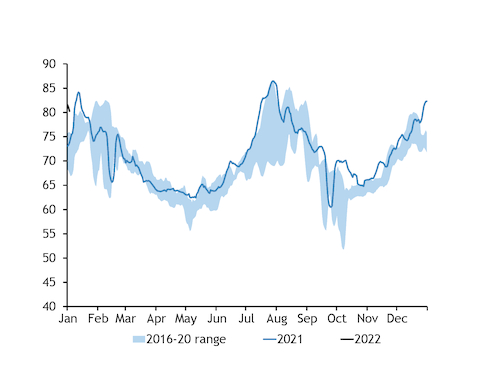

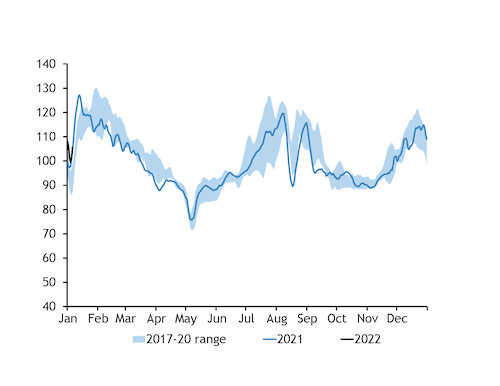

Colder weather lifted the Japan Power Exchange's (Jepx) system-wide day-ahead base-load power prices by 7.7pc on the week to an average of ¥19.11/kWh ($163.88/MWh) during 1-7 January, while overall power demand during the week to 6 January dropped by 5pc to 106GW.

Firmer power prices have improved theoretical margins for thermal generators, with the day-ahead clean-dark spread for a 44pc-efficient coal-fired unit averaging ¥11,032/kWh between 31 December and 6 January, compared with ¥9,270/MWh average on 17-23 December. The equivalent clean spark spread for a 58pc-efficient gas-fired unit running on oil-linked LNG supplies averaged ¥10,654/MWh during the same period.

The CDS premium against CSS seems to have boosted demand for coal burn in Japan, with the country's net coal-fired capacity expected to increase by 3.9GW during 3-9 January, while gas and oil-fired capacity is expected to display a net decrease of 290MW and 950MW on the week, respectively.

Japan's Joban Joint Power also plans to resume the 250MW coal-fired unit 7 on 11 January after an unexpected outage on 30 December.

Meanwhile, Japan's embassy in Jakarta is waiting for the Indonesian government's response following its request to resume high-calorific value coal exports to Japan. The embassy reportedly requested the government to allow shipment of five loaded coal vessels to Japan on 5 January.