Fresh floods in the Hunter Valley region of New South Wales (NSW) and along the Blue Mountains rail line have disrupted deliveries of coal to the key port of Newcastle.

The Australian Bureau of Meteorology has issued major flood warnings for the Hunter Valley centres of Bulga and Singleton, as both witness higher water levels than those during the floods in March. It also issued a flood warning for Maitland, as waters move downstream towards the sea overnight and into 8 July.

Singleton, which has received evacuation notices, lies on a major junction of the Hunter Valley rail network. Maitland is an even bigger rail junction located just before the rail lines enter Newcastle. The initial concern is that flooding will block rail access to the port for several days. But cleanup operations in these areas, all key residential centres, will likely add to already high levels of workforce absenteeism.

A landslip at Blackheath has closed the Blue Mountains train line, which connects the western coalfields of NSW to Sydney and the ports of Newcastle and Port Kembla. The closure of the line, which was shut for around a month from mid-March due to a similar incident, mostly affects coal deliveries from Thai-owned Centennial's Springvale, Airly and Clarence mines.

The floods in NSW follow significant flooding in March that left most Hunter Valley coal mines saturated, with water storage facilities full. Rain during February-March impacted coal shipments for several weeks, as illustrated by a 21pc drop in Yancoal's produced coal sales in January-March. [Newcastle coal shipments only recovered in May-June] (https://direct.argusmedia.com/newsandanalysis/article/2347258).

Mines outside the Hunter Valley that deliver coal to Newcastle, including Yancoal's 20mn t/yr Moolarben mine, Glencore's 10mn t/yr Ulan mine and Whitehaven's operations in the Gunnedah basin, have received less rain and are not as saturated as those in the middle of the valley.

Hunter Valley mines include BHP's 20mn t/yr Mount Arthur mine, the 12.5mn t/yr Hunter Valley Operations joint venture between Yancoal and Glencore, Yancoal's 18mn t/yr Mount Thorley Warkworth complex, Glencore's 7.5mn t/yr Mount Owen and the 10mn t/yr United Wambo joint venture between Glencore and Peabody.

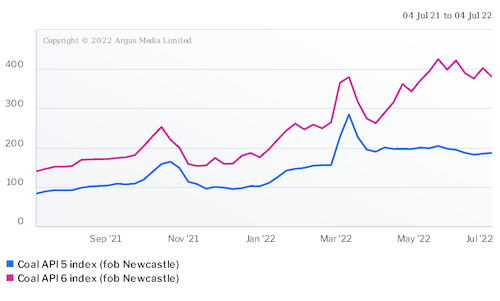

Argus last assessed high-grade 6,000 kcal/kg NAR thermal coal at $383.82/t fob Newcastle on 1 July, down from a peak of $425.90/t on 20 May but up from $128.77/t a year earlier. It assessed lower grade 5,500 kcal/kg NAR coal at $188.73/t fob Newcastle on 1 July, down from $206.80/t on 20 May and from a peak of $287.15/t on 11 March.

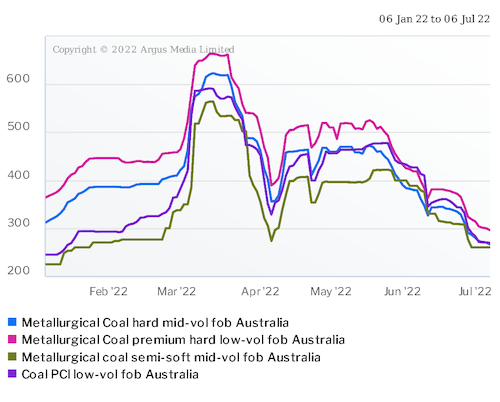

Argus last assessed the semi-soft mid-volatile metallurgical coal price at $260/t fob Australia on 1 July, down from $400/t on 31 May, but up from $126.90/t on 19 July last year.