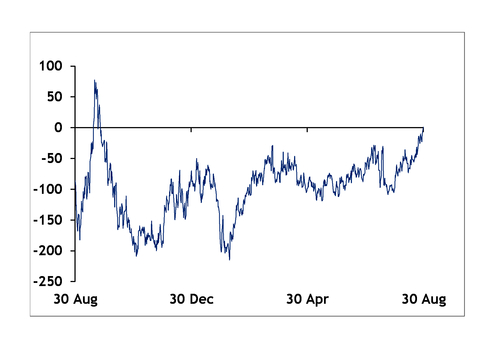

The northwest Europe physical propane-naphtha spread has been assessed in positive territory for the first time since December 2013. An increasingly bullish physical scene lifted large-cargo propane, cif Amsterdam-Rotterdam-Antwerp (ARA), to a slim 75¢/t premium to competing petrochemical feedstock naphtha in yesterday's session.

Outright European propane cargo prices were up by $12/t from the prior day, at $480/t, and naphtha cargoes were assessed up by $9.75/t to $479.25/t as the global LPG market continues to garner staunch support from limited US export capacity in the aftermath of Hurricane Harvey.

On the swaps market, the September propane-naphtha spread is indicated even further into positive territory at +$2/t in early trading. Petrochemical buyers will likely take advantage of this window of opportunity to lock-in September naphtha cargoes at a relative price to propane unseen in nearly four years.

Propane as a steam cracker feedstock produces more ethylene than naphtha but, crucially, yields less co-products. Some 2,993t of full range naphtha must be cracked to produce 1,000t of ethylene — the petrochemical industry's main building block for plastics and resins — alongside co-product yields of 462t of propylene, 164t of butadiene and 127t of butylene. By comparison, 2,285t of propane must be cracked to yield the same 1,000t of ethylene. This process produces co-product yields of 374t of propylene, 69t of butadiene and just 30t of butylene.

Accordingly, and all other things being equal, naphtha is most often the petrochemical feedstock of choice in northwest Europe. Propane enters the feedstock slate only when at a discount to the heavier feed.

The breach of parity across the physical and prompt paper markets is even more notable given current spot naphtha strength in northwest Europe. The heavier feedstock hit a near seven-month high versus North Sea Dated yesterday, extending its premium to the regional crude benchmark by $1.10/bl to $4.08/bl.

Naphtha demand from gasoline blenders has risen since Harvey hit late last week, as refinery disruptions in the US Gulf coast mean more European gasoline will be required to track east across the Atlantic. Light-virgin naphtha — a grade that typically flows into the blending pool — was trading at a $15-20/t premium to open-specification products this week, up from low double-digit premiums in the week to 25 August.

Propane surged to an 18-month high versus crude on 29 August, the cif ARA market's first opportunity to react to Harvey, and surpassed par again yesterday when it rose to 123.1pc of North Sea Dated — a 7.7pc gain in just two trading days.

Regional propane prices had surpassed multi-month highs earlier in August, a knock-on effect of low US stocks leading into the summer. This supported US Gulf coast propane prices and accordingly capped cross-Atlantic arbitrage opportunities.