A recently reinstated biodiesel tax credit (BTC) and exemptions for small refineries on biofuel mandates will likely limit gains in biomass-based diesel D4 RIN prices in 2020.

Those prices next year should still find support from a historical market-based correlation between the heating oil-soybean oil (HOBO) spread and D4 RIN prices.

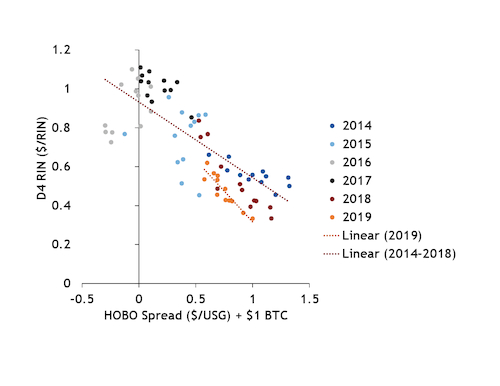

Poor biodiesel production economics, as measured by the HOBO spread, will drive the need for stronger D4 RIN credits to incentivize blending more expensive biomass-based biodiesel into conventional diesel in 2020. The historical correlation between current year D4 RIN prices and the HOBO spread suggests that D4 RIN prices will have room to rise by around 2¢/RIN for every 1¢/USG decrease in the HOBO spread in 2020.

The HOBO spread fell by over two-fold to -51¢/USG between June and December, and will continue to decline moving into 2020. Gains in soybean oil prices have outstripped gains in ULSD prices amid record low plantings after spring flooding in the Midwest the announcement of an interim US-China trade deal.

Following the recent interim trade agreement between China and the US, the Chinese government announced that it would increase agricultural product imports from the US. This first-phase agreement, if followed through, will likely lead to a rise in US soybean demand next year.

But in the long term, the five-year reinstatement of the BTC on 20 December will incentivize biodiesel blending, boost D4 RIN generation, and cap D4 RIN gains. Small refinery exemptions (SREs) will also continue to pressure D4 RIN prices.

The US biodiesel industry had waited almost two years for Congress to renew the BTC, which was the longest period the tax credit had remained lapsed since its inception. Several producers stopped purchasing feedstocks and shut down plants, particularly because it overlapped with the Environmental Protection Agency's (EPA) high volume of SREs.

Large producers announced closures or cuts affecting more than 220mn USG of supply since July, citing uncertainty over the tax credit and the EPA's approval of 31 SREs for the 2018 compliance year as the primary reasons.

The slowdown in the biodiesel industry resulted in a drop in biodiesel RIN production between August-November. But once plants ramp up production in 2020 because of the return of the BTC, and as the EPA fails to account for waived required volumes under its 2020 and 2021 renewable fuel standard, D4 RIN gains will hit their limit.

The EPA's approval of 31 SREs for the 2018 compliance year equates to a loss of around 7pc of Renewable Fuel Standard required volume. This is in addition to the 35 exemptions for the 2017 compliance year that waived around 9pc of the required volumes.

The agency left the 2021 biomass-based diesel volumes at 2020 levels, or 2.43bn USG, which is only 15.5pc higher than the 2019 biomass-based diesel volume at 2.1bn USG.

By Jacqueline Reigle