Sellers of Norway's largest crude grade, Johan Sverdrup, are increasingly looking elsewhere for buyers as Chinese interest has waned.

China accounted for just 16pc of Johan Sverdrup exports in July, compared with 63pc in the first quarter of this year. The country had been the main destination for Johan Sverdrup exports since the field started up in October 2019. The first cargo of the crude headed to Ningbo in China and the country has consistently been the largest single buyer of the grade.

China's declining appetite for Johan Sverdrup is part of a wider slump in interest from the country's independent refiners, which are the main Chinese buyers of the grade. Government measures introduced earlier this summer to crack down on the trading of crude import rights have contributed to a drop in independent refinery throughputs. China's crude throughputs sank to a five-month low of 13.96mn b/d in July because of limited import quotas for independent refiners and lower demand because of travel restrictions resulting from Covid-19 lockdowns and bad weather. The delivered-China price of Johan Sverdrup has come under pressure, averaging a premium of just 68¢/bl to front-month Ice Brent in the month of delivery so far in August, compared with an average premium of $1.75/bl in June.

The backwardated market structure has been an additional hindrance to Chinese buying of North Sea crude. Prompt Atlantic basin prices have been trading at strong premiums to contracts delivering further out in recent months, weighing on the economics of long-haul shipments to China. Benchmark North Sea Dated — the price of North Sea crude loading in the coming month — has traded at more than $2/bl above the Ice Brent December contract this month, compared with an equivalent premium of just 65¢/bl in the second quarter.

A wide premium for Ice Brent relative to Dubai swaps has also left Atlantic basin prices looking uneconomic relative to Mideast Gulf alternatives. But a narrowing of this premium to below $3/bl for the first time since May could now potentially make North Sea crudes more affordable for Asia-Pacific buyers.

Non-Chinese Asian refiners have been stepping up their purchases of Johan Sverdrup — attracted by the lower prices resulting from the absence of Chinese buying. The largest single destination for Johan Sverdrup last month was South Korea. It took nearly 130,000 b/d, or 44pc, of Johan Sverdrup exports. The country has already taken more than 70,000 b/d of Johan Sverdrup so far this year, compared with 25,000 b/d in the whole of last year. And India has emerged as a key buyer of Johan Sverdrup this year, taking more than 30,000 b/d, having previously taken only a single 1mn bl cargo.

Challenging tradition

Buyers in the Mediterranean have been increasing their buying in the absence of Chinese interest. Greece this year joined Turkey as a key buyer of Johan Sverdrup, taking more than 15,000 b/d, up from 3,000 b/d last year. Turkey has taken 3mn bl in the past month alone.

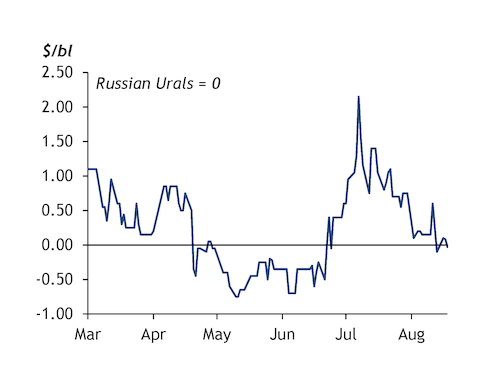

A lower price for Johan Sverdrup has enabled it to compete with Urals in the Russian crude's traditional markets. The fob Mongstad price of Johan Sverdrup this week dropped below the delivered-Rotterdam price of Urals. It has averaged a 15¢/bl premium to the Urals price so far this month, compared with a $1/bl premium in July (see graph). Poland took no Johan Sverdrup until March, but has since imported 2.6mn bl. And the 600,000 bl Kmarin Rigour tanker is en route to deliver Germany's first-ever seaborne cargo of the Norwegian grade. But buying elsewhere in northwest Europe is little changed, with key North Sea customers in the UK and Netherlands still accounting for only 7pc of the crude's exports this year.

| North Sea output | '000 b/d | ||||

| Jul | Jun | May | Jan-Jul | Jan-Jul 20 | |

| Total UK | 953 | 880 | 786 | 895 | 1,055 |

| Brent Blend | 58 | 60 | 39 | 62 | 68 |

| Forties Blend | 252 | 20 | 135 | 209 | 335 |

| Flotta Blend | 77 | 60 | 58 | 54 | 50 |

| Other offshore | 517 | 690 | 505 | 514 | 539 |

| Onshore | 14 | 14 | 14 | 14 | 15 |

| Liverpool Bay | 6 | 6 | 6 | 6 | 8 |

| UK Statfjord | 1 | 2 | 1 | 1 | 2 |

| UK Ekofisk | 27 | 28 | 27 | 33 | 38 |

| Total Norway | 1,763 | 1,680 | 1,675 | 1,750 | 1,729 |

| Statfjord | 51 | 103 | 51 | 66 | 61 |

| Gullfaks | 179 | 211 | 179 | 187 | 172 |

| Oseberg | 97 | 100 | 77 | 96 | 101 |

| Ekofisk | 205 | 212 | 205 | 219 | 221 |

| Troll | 155 | 160 | 116 | 136 | 151 |

| Grane | 232 | 180 | 194 | 204 | 215 |

| Johan Sverdrup | 471 | 520 | 535 | 512 | 401 |

| Other offshore | 373 | 194 | 317 | 331 | 407 |

| Denmark | 67 | 66 | 69 | 65 | 74 |

| Netherlands | 21 | 21 | 21 | 21 | 18 |

| North Sea total | 2,804 | 2,647 | 2,550 | 2,731 | 2,876 |

| *revised | |||||