UK-Australian mining firm BHP plans to beneficiate its iron ore to improve its grade, as it expects wider grade price differentials to dominate in the future as steelmakers across Asia focus on cutting carbon emissions and reducing pollution.

The firm is studying options to build beneficiation plants at its 60mn t/yr Jimblebar mine in Western Australia (WA) to improve the quality of the product. It has sought expressions of interest for the project, with construction and commissioning works planned for two years from April-June 2024.

Jimblebar Blend Fines, which are 60.5pc Fe, have traded at a discount of around $20/dry metric tonne (dmt) to a basket of 62pc Fe indexes, including Argus, for most of this year. BHP hopes to reduce or eliminate the discount by upgrading the ore.

The Jimblebar ore lends itself to beneficiation, BHP chief executive Mike Henry said. Higher quality ores will be in increasingly high demand as China and south Asian nations seek to use them to cut emissions and improve value in use, he added.

BHP will focus on quality improvements and reliable operational performance, rather than on increasing exports out of WA much beyond 290mn t/yr on a 100pc basis, despite being granted access to up to 330mn t/yr of export capacity at the multi-user Port Hedland facility.

"We will creep beyond 290mn t/yr," Henry said. To do that BHP needs to debottleneck the Pilbara rail system, but to go to 330mn t/yr would require more work including a new car dumper at Port Hedland and changes to stockpile yard, he added.

BHP produced iron ore at a cash cost of $16.15/t fob Port Hedland, excluding third-party royalties, in July-December, up from $14.38/t a year earlier. The firm expects to come in at the lower end of its cost guidance of $17.50-18.50/t in the 2021-22 financial year. Inflation is pushing up costs across the iron ore industry and this higher marginal cost of supply will determine prices in the longer term, according to BHP.

The WA iron ore division reported earnings before interest and tax of $10.17bn for July-December, up from $9.31bn a year earlier, because higher received prices offset a small decline in volumes.

BHP's Samarco joint venture with Brazilian iron ore producer Vale restarted in December 2020, but BHP did not record any revenue against it despite producing 2.06mn t on an equity basis in July-December.

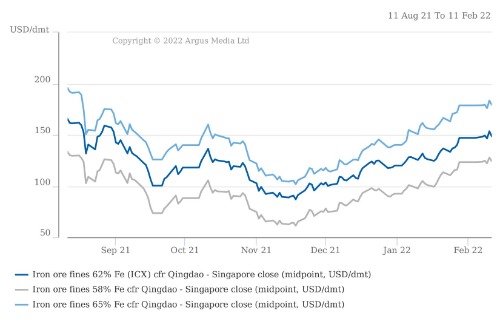

The Argus ICX iron ore was last assessed at $148.65/dmt cfr Qingdao on a 62pc Fe basis on 14 February, up from $90.05/dmt on 16 November but down from a high of $235.55/dmt on 12 May. Argus assessed 58pc Fe at $124.10/dmt cfr Qingdao on 14 February, up from $63.80/dmt on 16 November but down from a high of $207.10/dmt on 12 May.