The Argus-calculated coker yield's premium to asphalt has held at record highs in recent weeks as asphalt supplies have grown ahead of the end of the paving season.

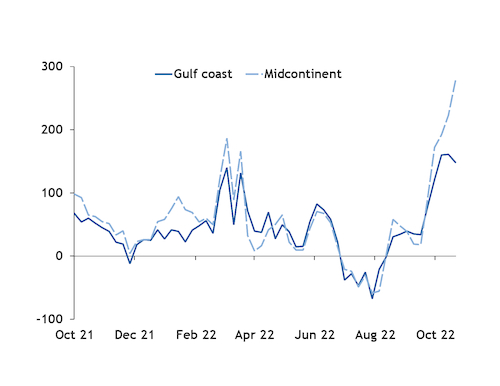

The midcontinent coker yield – a measure of profitability if asphalt is used as coker feedstock – declined by $21/st to $602/st on 28 October, but its premium to midcontinent waterborne asphalt grew to a record-high of $277/st. The Gulf coast coker yield followed a similar record-setting path, with its premium over asphalt falling marginally to $149/st last week.

US asphalt prices have become increasingly disconnected from lighter product prices in recent weeks as asphalt production and stocks increase, and demand declines as the paving season comes to a close.

Asphalt inventory levels inched down by 1.1pc to 22.8mn bl the week ending 21 October, but this was 10pc above the five-year average, according to US Energy Information Administration data. Meanwhile, motor fuel markets remain short, with inventories tracking below their five-year ranges.

Asphalt inventories have also been buoyed by discounted heavy crude. The differential between heavy Western Canadian Select (WCS) and WTI widened to a four-year high in October and averaged about $29/bl during the month. This compares to about $22/bl in September.

High-sulfur fuel oil prices have also tracked well-below asphalt, offering some producers a more-affordable blendstock or coker feed alternative.

Growing inventories have pressured asphalt prices across the US, further widening the coker yield's premium. The price of waterborne asphalt in the midcontinent lost 40pc of its value since 2 September, falling by $75/st last week to $300-$350/st fob. Waterborne US Gulf coast asphalt lost 25pc of its value over the same period and was assessed at $360-$400/st fob last week.

Weeks of delays and continued challenges along the Mississippi river have also pressured regional asphalt markets.

Refineries coming back from turnarounds have also contributed to softness in the asphalt market. Husky's 47,500 b/d refinery in Superior, Wisconsin, is expected to begin production as early as December.

Coastal markets remain flush with asphalt. The Gulf coast's export outlet to Latin America has contracted as refiners compete with growing exports from Colombia. And on the east coast, lower-cost Mediterranean asphalt continues to keep a lid on prices.