Freight rates for Asia-Pacific dry bulk Panamaxes could continue to see support if bunker prices keep rising with crude futures.

Bunker prices could move higher, as January Nymex WTI rose by $1.89/bl to $77.28/bl and February Ice Brent rose by $2.02/bl to $82.70/bl with their 14 December settlements, as the IEA raised its outlook for global oil demand and TC Energy's 622,000 b/d Keystone crude pipeline from Canada to the US remained shut.

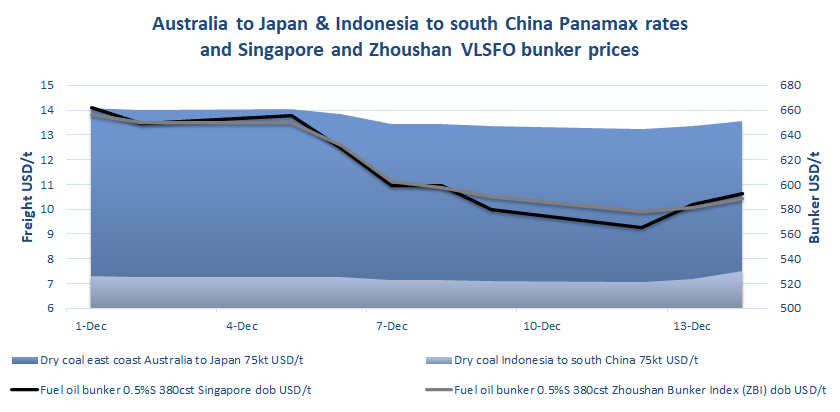

The price of very-low sulphur fuel oil (VLSFO) with 0.5pc sulphur at Singapore and east China's Zhoushan increased to $593/t and $589/t on 14 December, higher by $28/t and $11/t respectively from $565/t and $578/t on 12 December.

Panamax dry bulk freight rates on the east Australia-Japan and Indonesia-south China routes subsequently rose to $13.55/t and $7.50/t, up by 30¢/t and 45¢/t over the same period.

But gains on freight rates, especially from Australia, could be capped, as buyers of Australian coking coal are waiting on the market sidelines, with some expecting a fall in prices. Seaborne trade activity in China is similarly subdued as buyers hesitate purchasing high-priced cargoes. The market has been relatively quiet after last week's trade, a Chinese trader said, pointing out that buying interest has waned, although several US offers were available.

"Supply is stable but demand is not improving, so people are concerned if prices will sustain," an Indian trader said, adding that there were several cargoes of premium mid-volatile coking coal available for December and January. A northeast Asian consumer agreed, indicating no spot demand in the short term.