The London Metal Exchange's (LME) steel scrap cfr Taiwan has hit a record-high volume in February, since its launch on 19 July 2021.

The contract ended the month with 309 lots, or 3,090t, being traded on the last day of February, bringing net trade to 833 lots during the month. This surpassed the previous record high of 666 lots in November 2022.

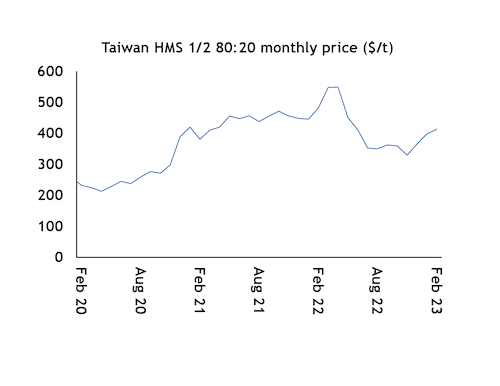

Factoring in the monthly average February scrap price for the Asia's scrap benchmark index at $413.70/t, this implies that approximately $3.5mn worth of trades were cleared in February.

"In a price-sensitive and volatile market, risk management becomes increasingly important,"LME's vice-president Edric Koh said. "Steel participants are showing an interest in managing their price exposure by hedging with the LME ferrous contracts."

Volatility in the broader scrap market has persisted and even increased, given a multitude of bullish and bearish factors like the Covid-19 pandemic, closed borders, geopolitical tensions, economic rate hikes and natural disasters like the earthquake in Turkey on February 6.

The Argus cfr Taiwan containerised HMS 1/2 80:20 index kicked off March on a firm footing. The index rose by $8/t from the previous day to $418/t on 1 March as high import demand for scrap in Turkey bolstered sentiment, which rippled into Asia. This prompted suppliers to keep a watchful eye on arbitrage opportunities as demand for ferrous scrap in South Asia also rose.

In the broader international market, the Turkish bulk HMS 1/2 80:20 price remained at an elevated level of $456.80/t on 1 March, marking a $54.30/t surge since the start of this year.

There remain uncertainties and scepticism about the rebar volume needed for rebuilding works in Turkey, but speculation and initial government estimates have triggered a rapid strengthening in global ferrous scrap markets.

"It's great to see improved liquidity in the LME Taiwan scrap contract, which leads us to believe that this will be a great hedging tool to help us manage price volatility risk as well as bringing us one step closer to our ESG [environmental, social and governance] goal," a trader with a prominent trading company said.