Constraints on government budgets for road projects are helping to keep a lid on bitumen margins in Europe, exacerbated by strong crude and fuel oil prices, plentiful supply in the Mediterranean and a closed arbitrage to key export outlets.

Work on road and highway projects in Europe is being restricted this year by persistently high rates of inflation and budget deficits, both knock-on effects of the pandemic and the war in Ukraine. Demand in France and Germany has declined sharply this year, while consumption in the UK, Romania and Italy has failed to rebound from last year's steep fall.

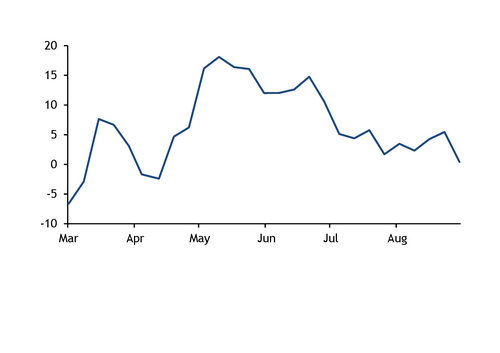

European bitumen demand tends to take a dip in the peak summer holiday season from late July through August before recovering in September. But this year's summer lull was especially pronounced and the autumn rebound has been slow to materialise so far.

Despite this, truck suppliers in key northwest European markets such as Germany, France, the Benelux countries and the UK are seeking hefty price hikes for September supplies versus August, with many contracts at least in part formula-linked with prior month moves in high-sulphur fuel oil (HSFO) values. Argus assessments for fob Rotterdam HSFO barges averaged $537.50/t last month, up by $73.50/t compared with July. Recouping all of those HSFO gains is likely to prove difficult for bitumen suppliers to achieve. Since last week, sellers have been discussing September price hikes of at least €40-50/t ($43-54/t) in Germany and France and upwards of £50/t ($63/t) in the UK.

Desperately seeking buyers

Pressure on margins is even more acute in the bitumen cargo market, as abundant supply from the Mediterranean struggles to find export outlets. Spanish export availability has risen markedly since late July, coinciding with a steep post-elections drop in domestic demand. In Greece, Motor Oil Hellas has ramped up production over the past two months after a turnaround at its 180,000 b/d Corinth refinery and Hellenic Petroleum's export cargo tenders have become more frequent. In Turkey, Tupras' bitumen production rose by 7pc on the year to surpass 1mn t in January-June.

But with the arbitrage to the US firmly shut for months and lacklustre demand from both the Asia-Pacific and west African export markets, Mediterranean bitumen cargoes are commanding unseasonably weak differentials to regional HSFO prices, exacerbated by strong support to fuel oil values from Saudi Arabia and Russia's decision to extend their voluntary crude supply cuts to the end of this year.

Greek, Turkish and Italian bitumen cargoes are only commanding single-digit premiums to fob Mediterranean HSFO cargoes at the moment, while Spanish fob cargo premiums are little higher at around $10/t. The latter is up from $7-8/t a year ago when high outright prices in the wake of the Ukraine war eroded demand in Europe and north Africa, but it is substantially lower than around $30/t in September 2021 and $60/t in the same month of 2020.

European sanctions on Russian oil imports have hit bitumen production and supply in northern Europe this year, including Germany. At the start of the year, market participants were anticipating strong demand from northern Europe for surplus Mediterranean bitumen, as happened in 2022. But a sharp run-up in fob Mediterranean HSFO cargo prices relative to fob Rotterdam HSFO barges this summer, coupled with hefty gains in bitumen tanker freight rates, has made it hard to justify northbound flows over and above term supplies.

The overall picture for Europe's bitumen market could change in the coming weeks when Canadian producer Irving Oil starts a major planned turnaround at its 320,000 b/d refinery at Saint John in New Brunswick. An end to west Africa's rainy season, likely in October, will also boost demand for Mediterranean bitumen. But the key factor will be the scale of road project activity across northwest and central Europe in the autumn months.