WTI Houston's locational premium to west Texas appears poised to widen from last year given continued export demand and a likely incremental increase in deliveries to Houston with Corpus Christi pipelines filling as Permian crude production rises. But with pipeline capacity to spare, the much wider spreads of past years seem unlikely.

The US Gulf coast has seen booming exports to Europe this year to replace Russian output. US Gulf crude exports to Europe averaged 1.8mn b/d this year. The US has exported 2.3mn b/d of crude to Europe to date for December, which would be up from an already record high of 2.2mn b/d in October.

Some of the growing export demand can be attributed to normal end-of-year fluctuations as firms seek to unload unused inventories for tax purposes, but exports are still historically high.

WTI Midland prices rose through most of 2023 compared to WTI prices at the Magellan East Houston (MEH) terminal on increased demand for Permian-quality WTI through the export hub of Corpus Christi, Texas, where several export terminals can partially load VLCCs.

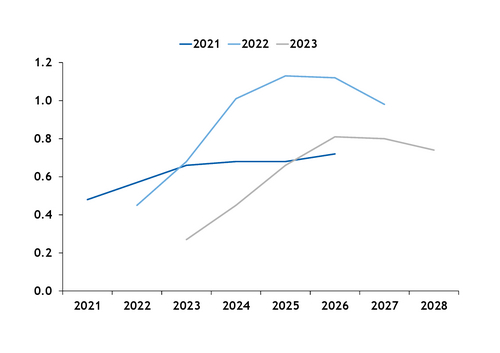

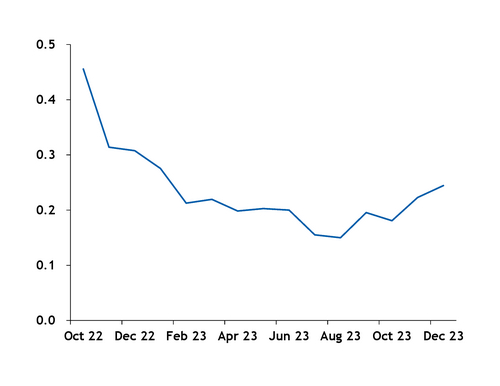

For 2023 delivery, WTI at MEH averaged 21¢/bl over WTI in Midland. This was tighter than the 36¢/bl premium for 2022 deliveries and the 48¢/bl premium for 2021.

But the monthly WTI Houston premium to WTI Midland has risen since hitting a low in the September trade month of just 15¢/bl — the tightest since Argus launched the WTI Houston assessment in 2015. For the current February trade month that started this week, WTI Houston is averaging 56¢/bl over WTI Midland so far.

WTI Houston's premium to Midland widened to an average of 36¢/bl for January deliveries. WTI Houston ended the January trade month at nearly $1/bl over WTI Midland, the highest in three years, with WTI Houston trading at 10-month high premiums to the domestic sweet benchmark contract during the same week.

The 2024 delivery average WTI Houston premium to WTI Midland is about 60¢/bl, based on the recent January trade month average and Thursday's Argus forward curves spreads.

At this time last year, the average WTI Houston premium to WTI Midland for future 2023 deliveries was 30¢/bl taking into account Argus forward curves data, which was 9¢/bl wider than the realized prompt-month spread.

This year, deliveries for WTI Houston averaged a 35¢/bl premium to WTI Midland, 14¢/bl higher than the average prompt-month spread. The WTI Houston price premium to WTI Midland for 2025 deliveries is 90¢/bl, according to Argus forward curves data.

Permian crude production has been rising monthly since September and is projected to reach a record high of 5.99mn b/d in January, according to the US Energy Information Administration (EIA) Drilling Productivity Report. The EIA forecast in November that Permian production would grow to 6.2mn-6.6mn b/d by December 2024, depending on price. Those production estimates are well below the combined outbound pipeline and Permian basin refinery capacity of over 8mn b/d.

As the pipelines to Corpus Christi fill, incremental shipments shift eastward toward Houston.

US Gulf coast pipelines already reported record-high flows this year. In the third quarter, Energy Transfer saw record exports from its Houston and nearby Nederland, Texas, terminals, and Enterprise Products moved record volumes to its marine terminals as well.

On top of growing pipeline flows, Enterprise Products planned to revert its 210,000 b/d Seminole pipeline to Enterprise's ECHO Terminal from crude to natural gas liquids service by the end of 2023, removing some crude capacity.

While the Houston premium is growing with incremental volumes moving to Houston amid high export demand, it is unlikely to widen to prior levels when Permian producers faced large bottlenecks.

The WTI MEH-Midland premium reached historic levels when there was less pipeline connectivity from the Permian basin to the and US Gulf coast. The Houston-Midland premium averaged nearly $11/bl for 2018 deliveries but tightened as large pipeline projects came online, prompting a pipeline capacity overhang even as volumes recovered from Covid-19-related lows.