A tax on MTBE or its reclassification may force refiners to avoid it as a blendstock and make exports uneconomical

China's demand for isobutane has increased significantly in the past few years but could face headwinds in 2024 from a potential consumption tax on MTBE, a gasoline component that is mostly made from the isomer. Normal butane consumption should on the other hand continue to grow strongly, with 1.6mn t/yr of butane-fed maleic anhydride (MA) production capacity due to open this year.

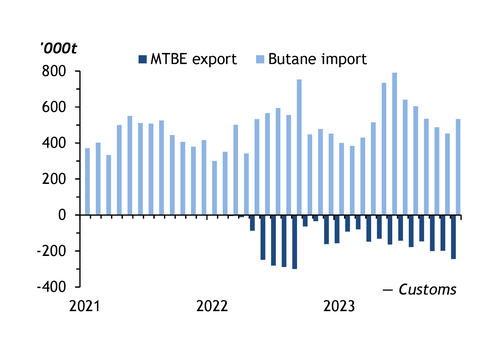

China's butane imports increased by 12pc on the year to 6.5mn t in 2023, customs data show, with this growth mainly driven by demand from flexible ethylene crackers for normal butane and MTBE producers for isobutane. Residential demand for butane decreased last year, market participants say. Several mixed-feed crackers started up last year, including Sanjiang Petrochemical's 1mn t/yr unit in Zhejiang, east China. MTBE exports also grew to a record high of 1.89mn t, most of which was produced from isobutane, adding about 1.2mn t of demand.

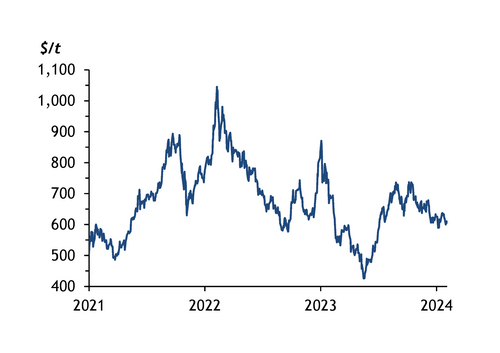

But market participants are increasingly concerned about the possibility of an MTBE consumption tax, as it is the last component not taxed in China's gasoline blending market. All other gasoline components have been hit by a tax of 1.52 yuan/litre, or Yn2,100/t ($292/t), over the past few years, including iso-octane in June 2023. This has reduced the market share held by private-sector gasoline blenders and raised the share held by state-owned refiners.

MTBE has so far escaped the tax because it is classified as a chemical. This has allowed domestic gasoline blenders to use it as a cheaper blendstock and producers to export it without it contributing to their oil products export quota. Another possible problem is if it were to be defined as an oil product, as it would fall under the export quota allocated to the major refiners by the commerce ministry.

The country's MTBE production stood at about 15mn-16mn t in 2023, according to a refiner in north China that exports significant volumes of MTBE. The authorities may find it hard to impose the tax on MTBE because of the number and diversity of the companies involved, it says. But given the trend is to rationalise the gasoline blending market, it might only be a matter of time before it too is taxed, the refiner adds. And once it is, the refiner says it will stop exporting MTBE as it would make more sense to export gasoline under the quota system.

The likelihood is that MTBE will be taxed from this year as China's gasoline demand is expected to decline and state-owned refiners are facing pressure to raise profits, according to a state-owned refiner in east China.

New normal

Normal butane demand is expected to grow substantially this year. The aforementioned 1.6mn t/yr of new MA capacity will add about 1.6mn t/yr of normal butane demand, Argus data show. This includes Hengli Petrochemical's 420,000 t/yr Liaoning unit, Wanhua Chemical's 200,000 t/yr Shandong unit, Sinopec Qingdao refinery's 200,000 t/yr Shandong unit, and Zhongjing Petrochemical's 400,000 t/yr Fujian facility. MA can be used to produce 1,4-butanediol, an important feedstock for biodegradable plastic polybutylene adipate co-terephthalate. This has attracted a lot of investment since China established a policy to phase out single-use plastics.

The number of new MA plants expected to come on line this year could lead to overcapacity, a new MA producer in east China says. Normal butane prices in China were Yn4,200t in late January but rose above Yn5,100/t recently in Shandong because of growing demand and falling supply from the Hengli and Sinopec Qingdao refineries — both of which have new MA plants coming on stream later this year.

Out of China's 6.5mn t of butane imports in 2023, 80pc came from the Middle East with 30-40pc isobutane and 60-70pc normal butane content. Middle Eastern supply is growing while China's uncertain demand given the possible MTBE tax means importers may be wary of purchasing butane cargoes with high isobutane content.