Sluggish exports could start to pressure Ukrainian corn prices, as a slower export pace since December could result in larger-than-expected available volumes for exports in the coming months.

In Ukraine's spot market, corn prices so far have continued to draw support from limited supply on the local market, as farmers and trading firms attempt to out-wait each other. For producers, this has meant waiting for a surge in demand — and higher bids — from trading companies looking to cover their short positions in the fob or destination markets. But farmers' need to finance inputs means they cannot hold on to crops indefinitely.

And cpt buyers are in no rush to build up stocks, given uncertainties surrounding global supply and demand, geopolitics and developments in military activity in the Black Sea region.

The long-running stand-off between farmers and cpt buyers has narrowed market participants' focus on spot-loading volumes, with even large trading firms capping the volumes of their positions, market participants said. Forward liquidity is also capped by fresh memories of the logistics issues of 2022, with market participants looking to avoid being unable to ship paid-for volumes or being stuck with large, immovable stocks.

Lower output dampens selling pace

A decline in Ukraine's 2024-25 corn production, compared with the previous season, was one of the reasons that farmers held back on selling corn and waited for higher prices, market participants said.

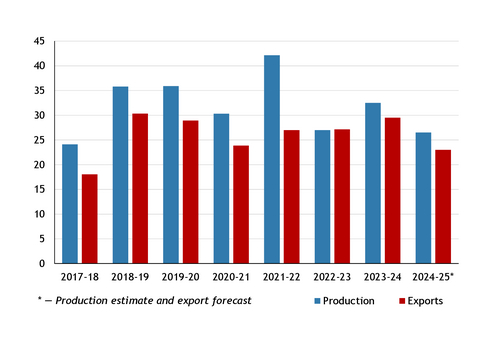

Ukraine's corn production could fall to 26.5mn t in 2024-25 from 32.5mn t in the 2023-24 marketing season, according to the US Department of Agriculture's (USDA's) latest forecast, while Argus estimates the country's 2024-25 corn output at 23.9mn t. Dry, hot weather in the summer as the crop developed was the chief driver of the year-on-year output drop, with pre-harvest estimates from some local analysts pegging production volumes even lower — at about 21mn-22mn t.

Slower exports since December

Sluggish farmer sales, storms in the Black Sea and new export regulations were the main reasons for December's decline in Ukraine's corn export pace, market participants said. But shipments failed to pick up in the first half of January, with only about 1.7mn t having been declared for exports in the first 22 days of this month.

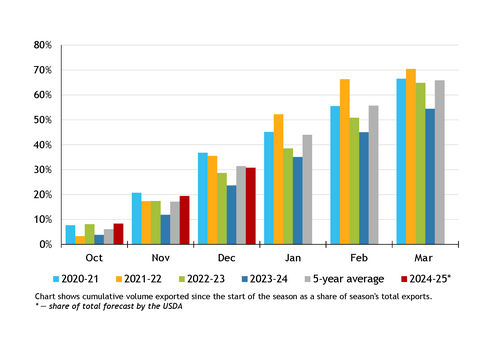

But Ukraine's corn export pace at the start of the season did not stray far from previous averages. The country shipped about 4.7mn t of corn in October-November, or about 19pc of the 23mn t of total 2024-25 exports forecast by the USDA. This compares with the 2020-21 marketing year, when Ukraine exported about 5mn t of corn in the first two months, or about 21pc of the total 2020-21 corn exports of 23.9mn t.

The steady pace of corn exports at the start of the season was driven by sustained sales by larger corn producers, which have a stronger need to fulfill their earlier-planned inflows of funds, according to market participants.

Instead, the slowdown came in December, when Ukraine shipped 2.6mn t of corn, compared with 3.4mn t in December 2023, 3.8mn t in 2020 and 3.9mn t as the five-year average for December corn exports.

This brought Ukraine's cumulative corn exports for October-December to 30.8pc of the total 23mn t projected for 2024-25. This is below the five-year average of 31.4pc for the same period and well below the 36.8pc reached in the first three months of the 2020-21 marketing year.