The EU cold-rolled coil market was assessing the effect of production disruption and import supply curbs today, in what is an increasingly tight segment of the flat product suite.

A fire broke out at Marcegaglia's Ravenna plant in Italy — one of the producer's three cold-rolled coil (CRC) mills — on 25-26 October, interrupting output. It is not clear which line was affected or how long it will be off line — the company refused to comment. But some sources suggest it could be a long stoppage. Marcegaglia's three CRC mills have a capacity of around 2.5mn t/yr and the compamy is now Italy's main supplier.

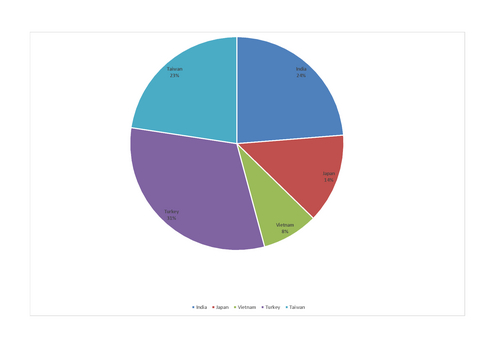

Italian buyers were already worried about overall supply before the fire, given the impending quota change and ongoing anti-dumping investigation on shipments from India, Japan, Vietnam, Taiwan and Turkey.

Several Spanish and Italian buyers have told Argus that they will have to reorientate supply chains away from imports back to domestic producers, assuming the latter will start producing more CRC for sale into the merchant market; in recent years EU producers have reduced output of some grades because of lower demand and high costs, compared with other regions.

Marcegaglia had already sold out its fourth-quarter capacity before the fire, with some buyers paying as high as €740-750/t base delivered for smaller tonnages because of supply concerns. This is even higher than buyers have been paying for hot-dip galvanised (HDG). This is not just a European phenomenon, as Chinese exporters have been offering CRC above HDG. At least one German buyer booked CRC from a major Chinese mill this week, while other Chinese producers' were offering around €610-620/t cfr, inclusive of dumping duties.

The five countries targeted in the dumping investigation represented 67pc of all EU CRC imports in 2024 and around 63pc of imports inn January-August, so overall import flows could be significantly reduced if dumping is proven.

At the same time, the impending safeguard change, which most now expect to be implemented in April, means the duty-free quota will drop to 1.73mn t/yr when implemented, a 53pc cut from 2024 import levels.

Tightness in the EU stands in sharp contrast to the UK market, which has become something of a dumping ground after Tata Steel stopped its Continuous Annealing Processing Line in March, meaning the safeguard was removed. The company still produces full hard for processing into HDG, but no material for the merchant market. South Korean CRC offers into the UK — around £500/t of late before the strengthening of the dollar against sterling — are below import and domestic offers for hot-rolled coil, which is rare.