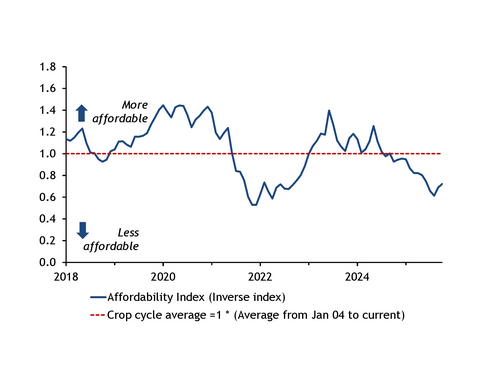

Global fertilizer affordability remains weak at levels similar to those of September 2022, but has recovered slightly from a more than three-year low in August because of a fall in fertilizer prices.

Nutrient affordability stood at 0.72 points in October, up from 0.69 in September and 0.61 in August, when it dropped to its lowest since April 2022, Argus data show.

Global fertilizer affordability had been on a downward trend since January.

An affordability index — comprising a fertilizer and crop index — above one indicates that fertilizers are more affordable compared with the base year set in 2004. An index below one indicates lower nutrient affordability.

The fertilizer index in October crept up to just below June's levels at 0.74 points, driven by falling urea, phosphates and potash prices.

But the crop index — which includes global prices for corn, wheat, rice and soybeans adjusted by output volumes — resumed its downward trend in October, having gained some ground in September, and crop prices are now as low as those of November 2019.

Urea price falls were the heaviest in recent months, with fob Middle East prices in October down by over $100/t from recent highs in August, when they averaged just over $500/t fob. Prices fell as buyers hesitated in the face of renewed Chinese exports, which outweighed strong import demand from India. Most market participants remained cautious into October, largely because of the lack of clarity on potential fresh exports from China. But prices received support from the end of October onwards, driven by a flurry of buying in Europe ahead of the implementation of the EU's Carbon Border Adjustment Mechanism on 1 January.

Phosphate prices began to decline earlier. Moroccan DAP export prices have now shed $93/t at the midpoint from a peak in early August averaging just under $800/t fob, their highest since October 2022. The seasonal decline in global demand going into the fourth quarter coupled with higher DAP inventories in key destination markets — notably India — and wide-ranging affordability concerns pressured prices. Brazilian buyers turned to more affordable NPs and superphosphates ahead of soybean applications, fostering a surplus of MAP that similarly weighed on prices.

Potash prices have experienced a milder decline, dropping by only $6/t since hitting a 28-month high in August at $314/t. MOP demand has slowed in most major importing markets since July, with ample inventories likely to be able to cover the majority of demand for the rest of 2025.