Sulphur imports into Indonesia surged to 5.35mn t in 2025, up by 48pc from 3.62mn t a year earlier, according to the latest Global Trade Tracker (GTT) data. Indonesia is the world's third-largest sulphur importer after China and Morocco.

The sharp rise in demand was driven largely by two newly commissioned sulphur burners by battery materials producer QMB New Energy Materials, which together require around 553,000 t/yr of sulphur at full capacity. Higher sulphur burning activity, combined with difficulties in securing sulphuric acid import permits, pushed buyers with the flexibility to switch between the two raw materials toward more sulphur purchases despite steadily rising prices throughout the year.

Argus assessed cfr Indonesia granular sulphur at $547/t on a midpoint basis on 18 December 2025, up by $360/t or 193pc from the start of the year. A perfect storm of geopolitical uncertainty linked to sanctions and tariffs disrupting trade flows, alongside lower sulphur output from key supply regions, lent further support to prices across 2025.

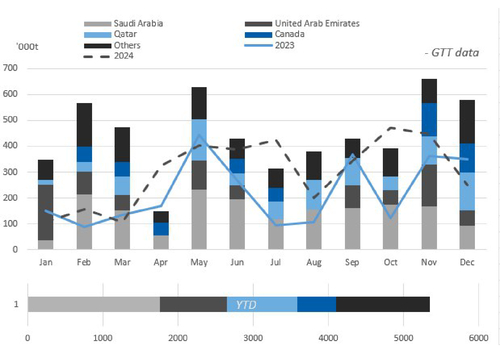

Sulphur deliveries increased from most major origins in 2025. Imports from Saudi Arabia and Qatar climbed to 1.76mn t and 930,500t respectively, up from 1mn t and 418,000t in 2024. Canadian shipments also rose by 36pc on the year to 514,500t, because higher prices widened arbitrage opportunities and a Middle East supply deficit boosted the competitiveness of Canadian sulphur.

Sulphuric acid imports fall

Indonesia's sulphuric acid imports fell by 3pc on the year to 1.09mn t in 2025. Ongoing challenges in obtaining import licences kept many buyers out of the market and encouraged some usual sulphuric acid buyers, like QMB New Energy Materials, to lean more on sulphur instead, given that sulphur imports do not require licences.

Sulphuric acid imports from South Korea and Japan fell sharply by 40pc and 65pc respectively to 172,000t and 105,900t, GTT data show, because persistently low treatment and refining charges (TC/RCs) for copper concentrates squeezed margins and curbed smelter operating rates.

But imports from China more than doubled to 670,300t because revenue from by-products including sulphuric acid helped cushion falling copper margins and kept Chinese smelters running at high utilisation rates.