Описание

Что такое волатильность и риски на рынках энергоносителей? Для ответа на этот, казалось бы, простой вопрос необходимы аналитические данные и знание конъюнктуры рынка. Если вы владеете данной информацией, вы можете более быстро и эффективно принимать решения в сфере торговли, хеджирования и управления рисками.

Argus Possibility Curves — это сервис прогнозирования, основанный на вероятности. Ежедневно Argus публикует прогноз цен на все основные сорта нефти и ключевые нефтепродукты, а также вероятность того, что цена сложится на том или ином уровне. Кривые вероятности, создаваемые на основе новейших методов обработки данных и машинного обучения в сочетании с уникальной собственной базой ценовой информации Argus, позволяют точно оценить степень волатильности и взвесить риски, связанные с динамикой цен на нефть и нефтепродукты.

Применение Argus Possibility Curves

Кривые Argus Possibility Curves разработаны с использованием передовых технологий и диагностики моделей, основанных на многолетнем опыте анализа рынка.

Argus Possibility Curves можно использовать для разработки инструментов торговли и управления рисками, например, систем показателей торговли, основанных на данных о последних изменениях на рынке, при помощи которых можно:

- измерять волатильность цен — на быстро развивающихся рынках могут открываться превосходные возможности для торговли;

- измерять баланс рисков (повышательный и понижательный риск) — серьезные рыночные изменения, происходящие нечасто, могут повлиять на прибыль и убытки;

- поскольку прогнозные кривые вероятности Argus Possibility Curves охватывают период до трех месяцев, на их основе можно разрабатывать системы оценки сортов нефти, спредов для контрактов с разными сроками исполнения и спредов для различных сортов.

Ключевые особенности

Альтернативные сделки

Argus предоставляет информацию об альтернативных сделках на рынке физических товаров, а также о традиционных финансовых и макроэкономических факторах

Освещение рынка нефти и нефтепродуктов

прогноз цен на основные международные сорта нефти и ключевые нефтепродукты

Инструменты для анализа

мы используем более 200 макроэкономических и финансовых инструментов, специально отобранных для анализа энергетических и товарно-сырьевых рынков.

Машинное обучение

Применяемая система машинного обучения включает как линейные, так и нелинейные связи, взаимозависимости между рыночными факторами, а также обладает возможностью обработки небольших массивов данных

Данные об альтернативных сделках на рынке физических товаров

Argus является ведущим ценовым агентством на международных рынках энергетики и сырьевых товаров. Наш опыт позволяет анализировать получаемые данные исходя из реальной конъюнктуры рынка.

Данные и определение ключевых факторов

Argus использует собственную информацию о сделках и ценах, дополненную фундаментальными, финансовыми и макроэкономическими данными.

Преимущества

Кривые вероятности – это инновационный метод прогнозирования цен на сырьевые товары, позволяющий получить динамичную и детальную картину рынка, которой невозможно добиться традиционными методами.

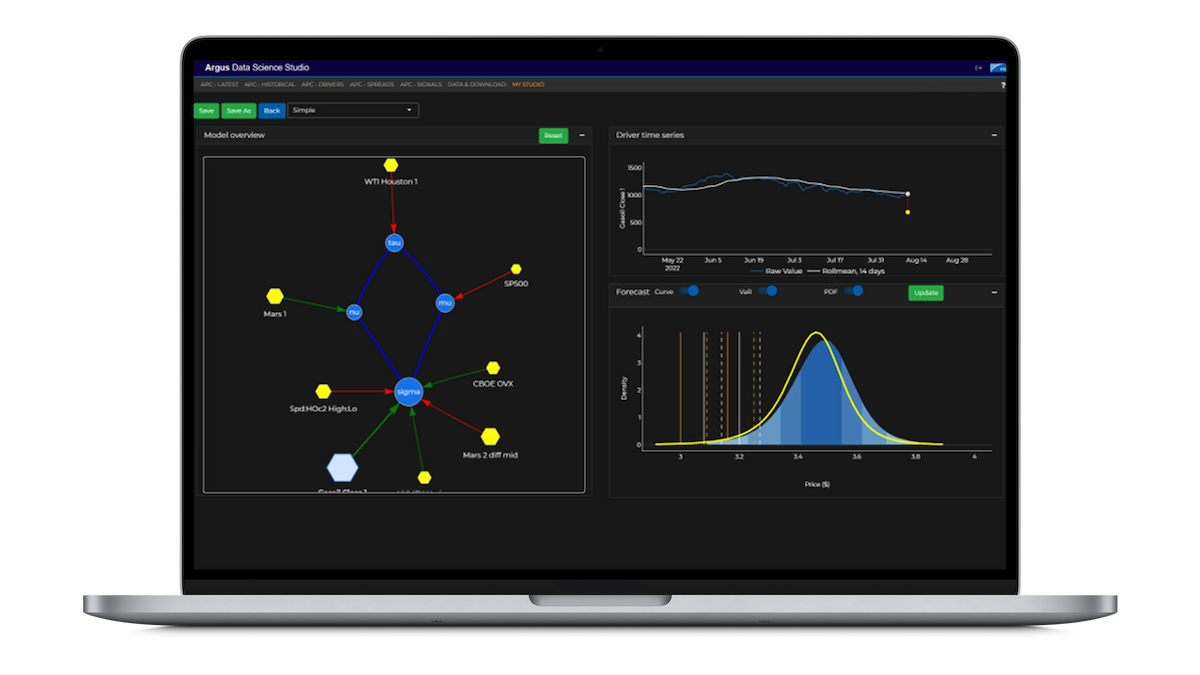

Создание кривых вероятности в Argus Data Science Studio

Argus Data Science Studio — это эффективный инструмент моделирования, помогающий принимать решения в области аналитики, торговли, хеджирования и управления рисками. Он позволяет визуализировать данные Argus Possibility Curves и настраивать параметры прогнозов, изменяя факторы влияния и их взаимосвязи на основе знаний клиента о конкретном рынке.

Узнать больше

Запросить примеры отчетов

Напишите нам на markets@argusmedia.com или заполните форму, и мы

подберем для вас решение, которое будет соответствовать вашим потребностям.