Описание

Мы проводим исследования рынков для клиентов, используя весь объем имеющихся у нас данных.

Наша команда консультантов, большинство из которых имеют многолетний опыт работы в энергетических и товарно-сырьевых отраслях, располагает обширными данными о фундаментальных показателях рынка и ценообразовании. Всё это позволяет нам предоставлять клиентам полную и точную информацию для принятия стратегических решений.

Мы можем взять на себя широкий спектр задач – от технико-экономического обоснования до планирования стратегии по снижению выбросов углерода и всего, что с этим связано.

Почему Argus

Основные возможности

Технико-экономические обоснования

Анализ предлагаемого проекта для определения его преимуществ и экономической целесообразности.

Оценка проекта

Оценить, превышает ли финансовая выгода риски для бизнеса.

Экспертиза

Сбор и анализ информации для поддержки принятия решений.

Стратегическое планирование

Наша база точных аналитических данных, собранная независимыми экспертами, поможет вам в разработке коммерческой стратегии.

Анализ законодательства и регулирования

Мы отслеживаем и интерпретируем последствия текущих и будущих изменений законодательства и нормативно-правового регулирования.

Разработка стратегии выхода на рынок

Анализ потенциального объема рынка, сценариев ценовых прогнозов, изменений законодательства и конкурентной среды.

Примеры исследований

Наши индивидуальные специализированные исследования используются клиентами, работающими в различных отраслях, в том числе государственными органами, национальными нефтяными и энергетическими компаниями, транснациональными корпорациями, финансовым сектором, торговыми компаниями на рынке энергоносителей, независимыми компаниями в секторе добычи, переработки и транспортировки энергоносителей, а также клиентами в секторах консалтинга и энергосбытовыми компаниями. Ниже представлена подборка тематических исследований с кратким описанием результатов каждого проекта.

Наши специалисты являются признанными экспертами в отрасли.

Специалисты Argus — это эксперты, находящиеся в тесном контакте с участниками рынка и работающие совместно с клиентами. Мы ставим своей целью удовлетворять ваши потребности и стремимся всегда быть открытыми для клиентов, оперативно реагировать на запросы и постоянно контактировать с участниками рынка.

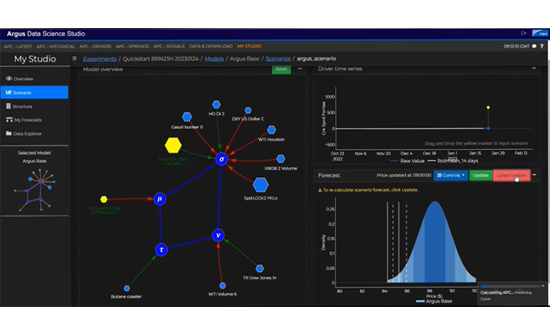

Аналитика и прогнозирование

С помощью информации о фундаментальных показателях рынка, аналитических инструментов и визуализации данных, ценовых прогнозов и стратегических отчетов мы осуществляем прогнозирование дальнейшего развития событий, чтобы помочь вам реализовать свои возможности.

Подробнее

Запросить примеры отчетов

Напишите нам на markets@argusmedia.com или заполните форму, и мы

подберем для вас решение, которое будет соответствовать вашим потребностям.