Russian state-controlled Gazprom's natural gas sales to Europe, excluding the Baltic states, and Turkey could increase in 2017 from last year's record high.

Deliveries have already reached a new record this month, chairman Viktor Zubkov said. The firm sold 14.1bn m³ to the region on 1-23 January, up by 2.7bn m³ compared with a year earlier. European demand rose for a second consecutive year in 2016, after muted consumption in 2011-14, Zubkov said.

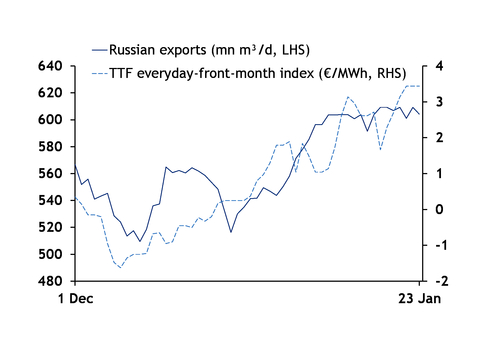

Russian exports to Europe have increased, particularly this winter. Hub prices above oil-indexed import costs have encouraged strong nominations by companies with flexible crude-linked contracts. And Gazprom raised sales through its European trading subsidiaries last year.

"Our gas was, remains and will be the most competitive in Europe", deputy chief executive Alexander Medvedev said. This will continue even with US LNG exports, which will head to higher-priced markets, he said.

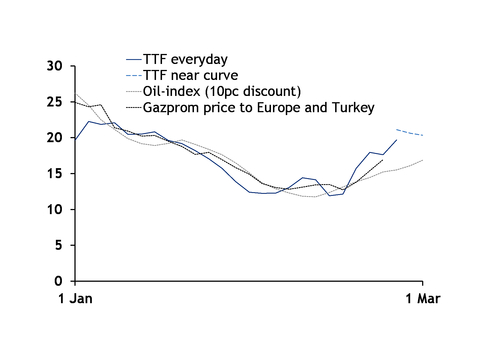

US LNG deliveries to Europe depend on the global price configuration, Medvedev said. European demand for Russian gas climbed in 2016 because hub prices were higher than oil-indexed import costs, and following cold weather, he said.

Power sector gas demand has also risen. UK NBP hub prompt prices have held at levels that have encouraged gas burn ahead of coal for power generation for most of the past two years. And Dutch TTF and German prompt and near-curve prices slipped in the second half of 2016, displacing coal from the mix.

The continental fuel-switching price — at which a 55pc-efficient gas-fired plant is competitive with a 38pc-efficient coal-fired unit — was above the cost of oil-indexed gas for much of the fourth quarter. This offered an incentive for strong power sector gas burn, supported by brisk imports from Russia.

Russian exports have accelerated this month, as hub prices remain above oil-indexed values. And there has been an incentive for high nominations by firms with hub-linked contracts, which account for almost a fifth of Gazprom's deliveries to Europe.

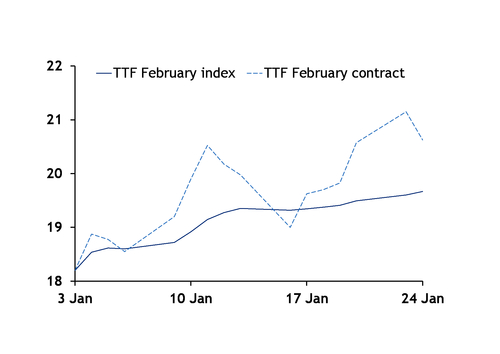

TTF prompt prices have climbed well above the front-month index, which settled at €17.46/MWh for January. Russian deliveries increased in the past when European prompt markets rose above the front-month index's settlement.

There could be some incentive for quick imports from Russia next month. The TTF February contract finished yesterday significantly higher than expected oil-indexed prices.

| Sales dynamics in Gazprom's key markets, 1-23 Jan | ±% * |

| Italy | 45.2 |

| France | 63.0 |

| Austria | 122.4 |

| Hungary | 11.1 |

| Czech Republic | 17.7 |

| Greece | 8.5 |

| Denmark | 78.1 |

| * year on year | |