Liquidity rose again at the Netherlands' TTF gas market in June from a year earlier, and also strengthened at Germany's NCG and Gaspool.

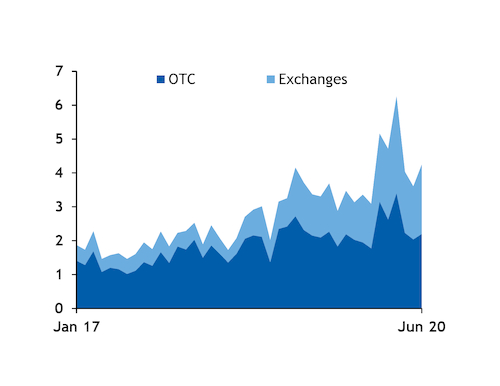

Aggregate traded volumes at the TTF climbed to 4.24TWh in June from 3.31TWh a year earlier and were the highest for any summer month since the hub was launched in 2003. The rise was largely driven by higher traded volumes on the exchanges, although over-the-counter (OTC) trading also climbed (see TTF liquidity graph).

The exchanges have gradually gained share over OTC products in the European gas market in recent years, particularly at the UK's NBP. OTC trades accounted for just 51.8pc of aggregate TTF traded volumes in June, down from 63.4pc a year earlier and the lowest share for any month. This was still well above the 33.5pc of OTC market share at the NBP.

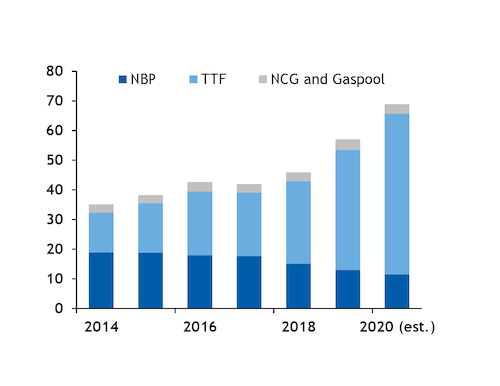

In contrast to the TTF, aggregate traded volumes at the NBP fell to 913TWh in June from 1.15PWh a year earlier, slipping on the year for the fourth consecutive month. The drop in OTC trade was most pronounced, with exchange-traded volumes regaining some market share, although also falling on an outright basis.

Liquidity at the NBP has slipped in recent years, accompanying the increase in trade at the TTF. But aggregate European market liquidity has continued to grow, outpacing the UK decline (see annual liquidity graph).

German liquidity reverses May fall

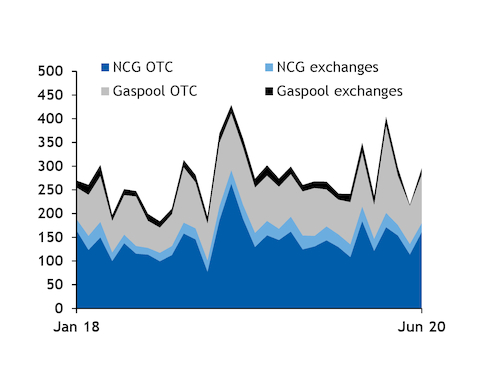

Liquidity at Germany's two hubs also climbed on the year, reversing a decline in May.

Traded volumes rose to 180TWh at NCG and 115TWh at Gaspool, from 168GWh and 105GWh, respectively, a year earlier. The vast majority of trades have been consistently made OTC in both markets, with only about 10-20pc of traded volumes accounted for on exchanges in most months (see German liquidity graph).

In contrast to the TTF, liquidity at the German hubs has stagnated in recent years.

NCG and Gaspool are scheduled to be integrated into a single German market on 1 October 2021, ahead of the 1 April 2022 deadline set by German law, which could have an effect on future German liquidity.

Uncertainties about the planned merger into the newly formed German VTP (Trading Hub Europe) may have weighed on liquidity in recent months. Some market participants have speculated that the merger of the two markets could spark a rise in liquidity, similar to the increase following the merger of France's two remaining market areas in late 2018 into the Peg. But a number of firms have expressed doubts that any gains would be significant, warning that a loss of liquidity could follow as trading opportunities between the two hubs disappear.

And doubts over plans to offset a 78pc drop in firm entry capacity into the German grid following the merger may persist, some market participants have said, even though regulator Bnetza has finalised plans to prevent offered capacity from falling. Bnetza finalised a regime that has allowed operators to offer the same amount of freely allocable capacity (FZK) for the period starting after the merger, using a capacity overbooking and buy-back system, as well as additional market-based measures.