The government is to impose 16pc VAT on LPG as part of the IMF's recommended measures to reduce Kenya's debt burden under a $2.3bn Covid-19 recovery loan

The rapid expansion of Kenya's LPG market over the past five years, thanks largely to a supportive government, is under threat after the treasury revealed it would add 16pc valued-added tax (VAT) on LPG from 1 July.

Kenya's lower house of parliament passed a bill last year that added LPG to the list of products that are subject to VAT, having previously been given a reprieve to allow demand to grow. The move came after the IMF in 2020 pushed Nairobi to hike all fuel taxes and cut spending as part of a $2.3bn Covid-19 recovery loan. The local industry and key stakeholders managed to lobby the government to defer introducing tax on LPG for a year, but the advocacy push has failed to secure a further extension.

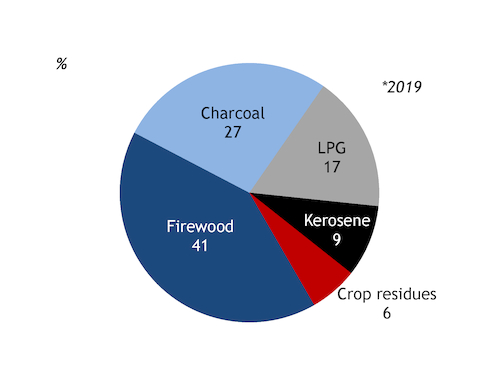

The move appears to contradict Nairobi's strong support for LPG as a replacement cooking fuel for harmful and environmentally damaging fuels such as firewood, charcoal and kerosine. The government first exempted LPG from VAT in 2016, at the same time it introduced a subsidy programme for LPG cooking equipment and raised VAT on kerosine to 16pc. The country's energy ministry co-hosted a 2019 forum on clean cooking, in which the health ministry participated. And the government in 2019 brought forward a target to deliver nationwide access to clean cooking fuels to 2028 from 2030.

But Nairobi has apparently acquiesced to the IMF's requests to secure the much-needed loan. "The Covid-19 shock exacerbated Kenya's pre-existing fiscal vulnerabilities. Kenya's debt is sustainable, but it is at high risk of debt distress," the IMF says. "To address debt-related risks, the authorities have taken action to hold the fiscal deficit and debt ratios to 8.7pc and 70.4pc of GDP, respectively, this fiscal year. This includes restoring tax revenues that had been falling even before the Covid-19 pandemic, to levels achieved in recent years," the IMF's deputy managing director, Antoinette Sayeh, says. "This will free up resources for private investment, setting a strong footing for durable growth coming out of this global shock and catalysing support from other development partners," an IMF official says.

The government has accepted the IMF's terms to secure the three-year financial package. "It is not that somebody in government wants this [tax] per se… there is goodwill from the government, but Kenya needs money from the IMF," Petroleum Institute of East Africa analyst Vivienne Ayuma says. "Kenya needs to improve its tax base… the debt burden is quite high. The country is in a tight spot."

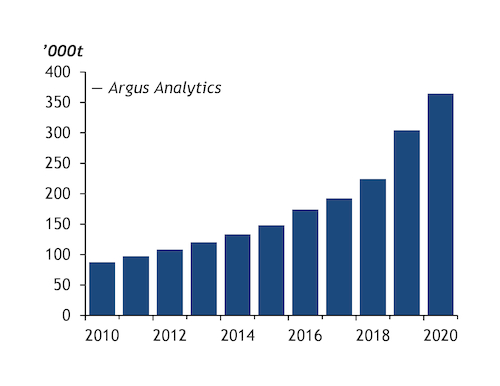

Kenya's LPG demand grew by over a third to more than 300,000t in 2019, Argus calculates. This was forecast to increase by a further 16pc to more than 350,000t in 2020, partly slowed by the Covid-19 pandemic. LPG is widely available in urban areas of the country, but only 52pc of these households use the fuel, 2019 census data show. The other 48pc find LPG too expensive and any increase in price will definitely impact demand, Ayuma says. "In a depressed economy where purchasing power has decreased, people have lost jobs, business is suppressed, we could see many users going back to unclean fuels," she says. "It feels like adding VAT at this stage would be counterproductive."

Lost in the shuffle

Fuel stacking, where consumers alternate between a range of different fuels depending on price and availability, is a common practice in Kenya. "The price increase will reshuffle the fuel stack. Those using multiple sources of fuel will increase their consumption of non-LPG fuels, likely to be dirtier fuels. Others will decide not to refill existing containers or to postpone refilling, while escaping to alternative solutions," Nairobi-based consultancy Dalberg's managing director, Jasper Grosskurth, says. "The illegal LPG refill market might grow owing to the increased benefit of evading formal and taxable channels."

| Kenya household cooking fuel demand 2019 | '000t | ||

| Urban | Rural | Total | |

| Firewood | 1,294 | 8,296 | 9,590 |

| Charcoal | 732 | 1,271 | 1,969 |

| LPG | 151 | 50 | 201 |

| Kerosene | 205 | 38 | 243 |

| Crop Residues | 39 | 333 | 372 |

| — Energy ministry | |||