Seaborne thermal coal exports from Richards Bay to Europe rose nearly sixfold on the year in November, as supply from the country continued to help offset a halt in flows from Russia.

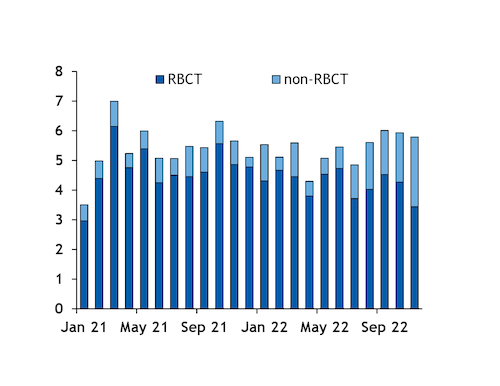

Overall seaborne thermal coal exports from Richards Bay remained relatively steady in November, but exports from the Richards Bay Coal Terminal (RBCT) slumped to a 22-month low as inventories at the facility remain stuck at around 2mn t.

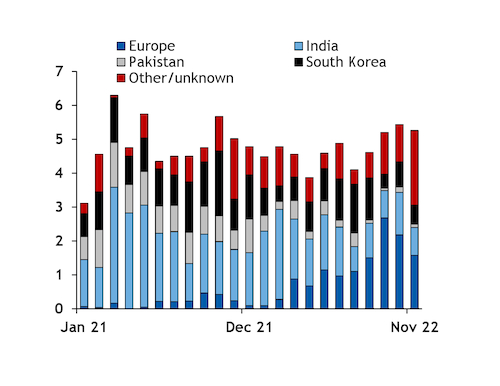

Richards Bay ports shipped at least 1.58mn t of thermal coal to Europe — including Belgium, France, Germany, Italy, the Netherlands and Poland but excluding Turkey — in November, up from just 236,000t in the same month a year earlier, ship-tracking data show.

Actual South African exports to Europe may be higher, as the final destinations of some vessels that departed Richards Bay in November are still unclear, while some South African coal is also likely to have been re-exported to Europe from Mozambique and shipped through other ports in the country such as Durban.

South Africa has stepped up as a key supplier to Europe since an EU ban on Russian product came into force on 10 August. From January to July, Richards Bay exports to Europe averaged 735,000 t/month, while in August to November deliveries have stepped up to 2.0mn t/month.

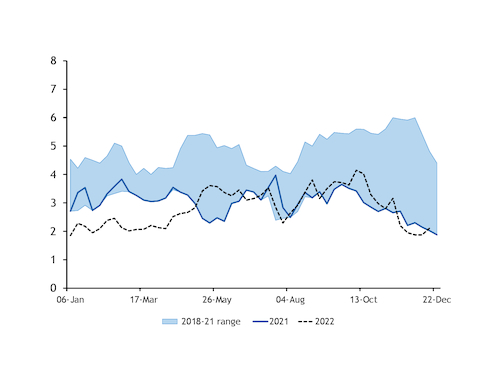

Overall thermal coal exports from Richards Bay reached 5.9mn t in November, up from 5.7mn t in the same month a year earlier. But these figures are likely to be inflated by shipments to China, which are thought to be coking coal rather than thermal, but which are difficult to separate.

The year-on-year increase was prompted mostly by much higher deliveries to Europe, as exports to other key destinations — including Pakistan and India — fell.

Deliveries to India, Pakistan slump

Richards Bay exports to India and Pakistan slumped in November.

Exports to India fell by 46pc on the year and by 34pc on the month to 820,000t. Indian receipts of South African coal have been hit by a sharp increase in cheaper Russian imports in recent months, which have partly displaced South African tonnage. This has been particularly for use in the cement and sponge iron industries.

South African flows to Pakistan collapsed by 82pc on the year to 99,000t in November. This coincided with total Pakistani imports falling to a six-year low over the month, with buyers having instead increased inflows of overland Afghan coal. Up-to-date trade flow information for this route is unavailable, but January-May imports totalled 1.5mn t, up from 366,000t in January-May 2021.

But Richards Bay exports to South Korea rose by 29pc on the year to 459,000t in November. The increase was prompted in part by South African coal being far more affordable than high-calorific value Australian product over the month. The fob Richards Bay NAR 6,000 kcal/kg assessment averaged a premium of $144.38/t to Australian product in November, up from an average premium of $25.88/t in the same month a year earlier.

RBCT exports fall to 22-month low

But while total Richards Bay volumes edged up last month, exports from RBCT in November fell sharply on the year, hit in part by a derailment on the North Corridor export line.

RBCT exports slumped by 29pc on the year and 19pc on the month to 3.44mn t in November.

A 97-wagon coal train derailed between Bloubank and Nhlazatshe stations on 8 November, leading to the closure of North Corridor lines 1 and 2, constricting supply to RBCT.

State-owned rail operator Transnet imposed a force majeure on deliveries on the line on 10-25 November. The derailment halted exports worth 5bn rand ($290mn), according to the Minerals Council of South Africa.

Rail shipments to RBCT averaged just 540,000 t/week in November, down from 1.15mn t/week in the same month a year earlier. This led to coal stocks at RBCT falling from 3.16mn t on 7 November to 1.87mn t on 28 November. Stocks have since recovered to 2.1mn t this week, but the limited inventory at the terminal is likely to continue to cap exports in the short term.

Some 48mn t was exported from RBCT between 1 January and 12 December, representing an annualised pace of 50mn t, well below the 25-year low of 58.7mn t exported in 2021.

Higher deliveries from other terminals in Richards Bay in November helped to partially mitigate the issues at RBCT. Exports from these facilities surged by 210pc on the year and by 42pc on the month to 2.35mn t.