The sudden return of Venezuelan petroleum coke exports in the second-quarter of 2022 came at an opportune time, as record high coal prices left a lot of room for additional coke supply. But potential further increases in Venezuelan coke availability, as well as an uncertain coke demand outlook, could challenge US and other high-sulphur coke sellers in 2023.

Venezuelan coke had been largely unavailable in recent years following US sanctions and deterioration of the country's export infrastructure. But upgrades to facilities at the port of Jose this year have resulted in a surge of exports, with much of it landing in China. China received 1.81mn t of Venezuelan coke in 2022, up by more than tenfold from 151,500t in 2021, according to customs data compiled by Global Trade Tracker (GTT). And the pace of these imports has been accelerating recently, with a record 404,200t delivered to China in November.

India has also been buying this coke, but in much smaller volumes, receiving only 333,600t in January-October, the latest data available. If China's appetite declines, as seems likely considering its total import volumes this year have been record-breaking, Venezuelan sellers may need to increase the discounts offered to Indian buyers against prevailing US coke prices, which have ranged between $5-20/t.

Turkey has become the second-largest market behind China for Venezuelan coke. Turkey received 479,500t of Venezuelan coke imports in the first 10 months of 2022, or 17.4pc of all global import volumes from Venezuela reported in GTT data. Turkish cement plants took more coke overall this year amid record high coal prices and uncertainty surrounding Russian coal supplies. Turkey's coke imports increased by more than half in January-October, reaching 2.75mn t. The country's cement sector had moved away from coke in 2021 for similar reasons as India, when coke discounts to coal evaporated.

But although Turkish buyers are now looking to coke as the least expensive fuel, opportunities for sellers to replace Chinese market share here may be slim, on turmoil in the Turkish economy and a sharp depreciation of its currency against the US dollar. And cement plant utilisation rates in the country are likely to soften on unfavourable market conditions, rising raw material and energy costs, and lower demand for cement from the construction sector.

Other coke exporters boost supplies

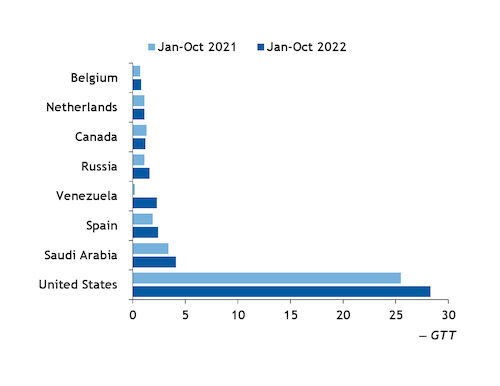

The US — the largest green coke exporter — increased its share of the global seaborne market by 2.6 percentage points on the year to 71.1pc, exporting 28.28mn t in the first 10 months, even as competition from Venezuela and other producers increased.

In addition to Venezuela, which exported 2.32mn t in January-October against 184,000t a year before, according to GTT data from importing countries, Russia and Saudi Arabia also substantially increased shipments in 2022. Russian coke shipments — mainly to China — rose by 48.2pc on the year to 1.65mn t in January-October, while Saudi Arabia exported 4.11mn t, up by 21pc over the same period. Spain also increased exports to 2.44mn t in the first 10 months, up by 26.9pc on the year.

Considering that Venezuela's improved export operations only began in the second quarter of 2022 and exports have surged in recent weeks, the Latin American country's total seaborne volume is likely to continue to climb in 2023. There are also potential signs of the US softening sanctions on the country, although this is not yet determined.

A continued rise in exports from Russia will depend on how much pressure sanctions against the country's oil industry ultimately inflict on its refining industry, as well as the prospects for demand for its fuels in Asia-Pacific.