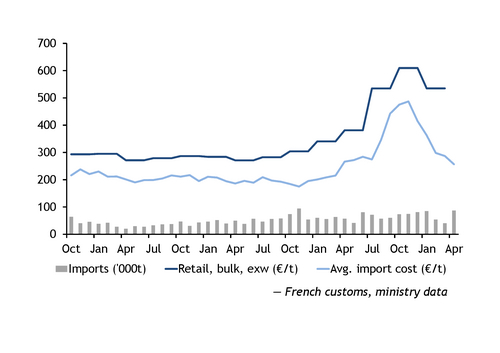

French premium wood pellet retail prices held well above recent-year averages in the first quarter, despite falling from the previous quarter's all-time high, in line with trends elsewhere in Europe.

The average price for bulk deliveries — of 5t at up to 50km, all taxes included — of DIN-Plus pellets was €534.76/t ($583.37) ex-works in the first quarter, €194.46/t higher than a year earlier, ecological transition ministry data show. Bagged pellet prices rose by €202.07/t over the same period to €540.37/t ex-works.

Retail prices remained firm in the country even though the average import cost — which is calculated using customs data and may include other grades of pellets — dropped significantly over the period (see chart). This could be as suppliers sought to offset at least some of the costs of more expensive pellets purchased in the second half of 2022.

The average retail price for the 2022-23 heating season for bagged and bulk pellets was €572.18/t and €588.64/t, respectively, well above the average price for imports at €279.04/t, although prices may have dropped for most of the second quarter of 2023, in line with the trend elsewhere in Europe. Wholesale local prices have been heard at around €325/t ex-works France so far in June.

On imports, French companies diversified their sourcing country portfolio to make up for sanctioned Russian supply in the 2022-23 winter. Overall imports rose by just 7,000t year on year to 408,000t during the period, with most of the increase seen in the fourth quarter, with imports broadly unchanged in January-March 2023.

France imported a combined 92,000t from seven new supplying countries — namely Canada, Vietnam, Malaysia, Brazil, Turkey, Norway and Slovakia — compared with the previous winter. This largely offset the year-on-year drop of 103,000t in imports of Russian wood pellets, which have been sanctioned by the EU and other western governments since 11 July 2022. Imports from Vietnam and Malaysia accounted for more than a third of the new supply, at 36,000t (see table).

| French wood pellet imports by key sources | t | ||

| Winter 22-23 | Winter 21-22 | ± yr/yr | |

| Belgium | 96,661 | 110,970 | -14,309 |

| US | 74,549 | 88,237 | -13,688 |

| Canada | 39,093 | 0 | 39,093 |

| Estonia | 28,046 | 10,182 | 17,864 |

| Vietnam | 24,869 | 0 | 24,869 |

| Germany | 24,457 | 31,293 | -6,836 |

| Spain | 22,178 | 20,165 | 2,013 |

| Portugal | 20,285 | 2,291 | 17,994 |

| Poland | 13,998 | 6,922 | 7,076 |

| Malaysia | 11,009 | 0 | 11,009 |

| Austria | 9,117 | 6,988 | 2,129 |

| Brazil | 5,981 | 0 | 5,981 |

| Lithuania | 5,583 | 8,108 | -2,525 |

| Turkey | 5,438 | 0 | 5,438 |

| France | 5,349 | 5,890 | -541 |

| Norway | 4,513 | 0 | 4,513 |

| Sweden | 3,009 | 21 | 2,988 |

| Netherlands | 2,953 | 2,562 | 391 |

| Latvia | 2,953 | 2,764 | 189 |

| China | 2,198 | 68 | 2,130 |

| Ukraine | 1,717 | 9 | 1,708 |

| Slovakia | 1,339 | 0 | 1,339 |

| Italy | 1,312 | 179 | 1,133 |

| Others | 1,812 | 104,837 | -103,025 |

| Total | 408,419 | 401,486 | 6,933 |

| — Customs data | |||