Bangladesh's currency crisis has caused huge problems for the country's economy, complicating the import of basic foodstuffs and other essential goods as the local currency, the taka, has plunged against the US dollar. Against this backdrop, the LPG sector has not been a priority for the government, and supply shortages have emerged as importers have been unable to secure letters of credit from banks. Jakaria Jalal, head of strategy and planning with Bashundhara Group, Bangladesh's biggest LPG operator by market share, spoke to Argus' Rituparna Ghosh about the impact of the situation on LPG growth prospects and investment. Edited highlights follow:

What is your assessment of the current crisis in Bangladesh's LPG sector?

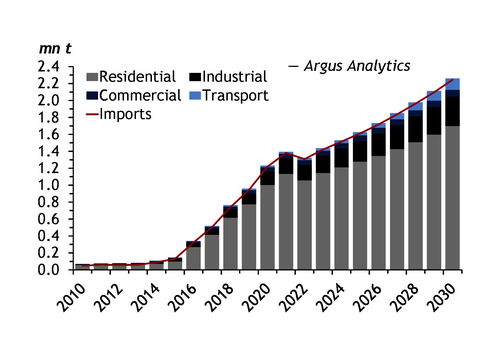

The LPG market is in real trouble, which is an outcome of a financial crisis that has made the industry vulnerable. Operators are finding it very difficult to survive as they are struggling to raise letters of credit [LCs] on time over the past five to seven months. The challenge actually began in last June-July [2022], when the dollar exchange rate started going up from 86 taka a dollar, and is now at 110 taka. Raising an LC takes no less than three to five weeks. There is no shortage of money, but a shortage of foreign reserves, which is the main concern as banks cannot buy dollars with the given exchange rate. Over the past two to three years, we have seen 10-15pc growth in the LPG market, but due to this [crisis] we are not seeing any growth this year, but rather we would see 5-6pc "degrowth" in LPG demand by the end of the year.

Is the current market situation sustainable?

That is a very difficult question to answer. The $3.5bn invested in this marketis in danger if you cannot bring product on time and cannot serve the market. This is going to have a lasting impact on the growth of this industry as we lose market confidence. Almost all southeast Asian markets are facing challenges because of dollar inflation. People have already started replacing LPG with biomass in Bangladesh. LPG is not a priority sector for the government as Bangladesh is also dependent on wheat, rice and necessary baby food item imports. There were previously 22 companies importing LPG, but right now there are only 15 firms importing the fuel — five or six companies have stopped importing the product and are sourcing it from other firms instead.

Isn't it unfortunate to be facing this crisis at a time when the benchmark Saudi contract price (CP) is at its lowest for several years?

It is very unfortunate as we could have sold the product at Tk900-1,000/t, but today LPG prices are around Tk1,300-1,400/t because of the scarcity of product. So the international CP price declines are not yielding any benefit to the customer.

What is the outlook for planned investment in LPG infrastructure?

Most of the projects have now been stopped as the market is very volatile — we don't have clarity on what the situation might be in the next month. Most of the LPG projects were long term, and would only materialise in the next 5-10 years.

Does Bashundhara Group have any infrastructure projects lined up in its capital spending plans?

We had a massive [capital spending] plan. We were the first Bangladeshi company to have brought two [very large gas carrier] VLGC vessels to Bangladesh. Logistically we have invested a few billion dollars in this business, but all of a sudden we had to scrap all our future project plans. We are unable to charter any VLGC vessels currently because we cannot secure the LC of $3mn. We also had a plan to work on a land storage facility in Matarbari with a South Korean company, which has stalled as the basic requirements are not manageable right now. Bangladesh will require an import terminal that can accommodate VLGCs, as bringing in small vessels is actually not profitable.

How do you see the prospects for LPG use in autogas in Bangladesh?

We have seen huge growth in the autogas sector because of natural gas scarcity in Bangladesh. Three or four years ago, autogas demand stood at around 3,000 t/month, but is now at 12,000 t/month, totalling about 150,000 t/yr. So it went up quite exponentially. This will be gone soon if there aren't any new vehicles in the market, but similarly the automobile sector is also facing import challenges. So I don't see any major growth for the autogas sector without new vehicles. From here on, the autogas industry will only grow organically.

How do you see industrial demand for LPG?

LPG is mostly used in [steam] boilers, which previously used to run on compressed natural gas [CNG]. Prospects for LPG in the industrial sector are high, but the challenge is that CNG prices are subsidised, while LPG prices are variable, taxable and much higher.

What is your outlook for the LPG market for the rest of this year?

We don't expect any growth this year as we are struggling. Looking into the future, with an optimistic view I would say the market would go up to 3mn t [annually] by 2025 and 2026 if the price disparity with CNG can be eradicated. If we can look into this market with adequate supply and can bring LPG at a cheaper price, I think the market can go up to 3mn t/yr in next three or four years.