High prices for North Sea sour crudes are prompting European refiners to switch to sweeter grades, in particular more affordable US WTI crude.

The inclusion of WTI into the North Sea Dated benchmark from June has led to higher volumes of the grade flowing to Europe. Loadings of the grade from the US bound for Europe rose to a record high of more than 2mn b/d in July, up from 1.6mn b/d in June, tracking data show, and higher than the average of around 1.18mn b/d last year. The rising intake of WTI in recent months has been driven mainly by increased shipments to Rotterdam relative to previous months as well as higher deliveries to France and Spain.

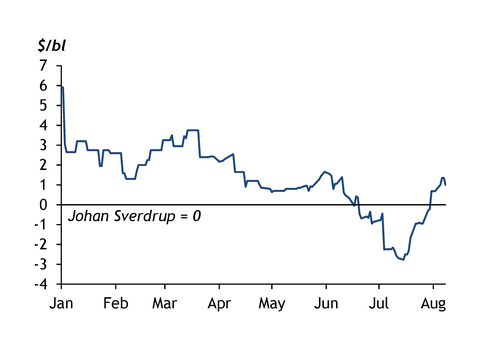

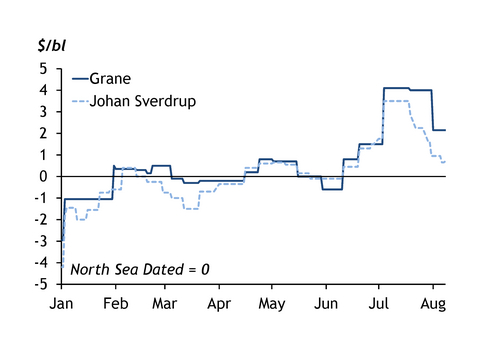

Prompt WTI supplies have been looking a more economic option than local medium sour grades Johan Sverdrup and Grane from Norway, particularly as some WTI cargoes have been trading while already en route to Europe. Johan Sverdrup and Grane both surged to their highest premiums in a year to benchmark North Sea Dated at $3.50/bl and $4.10/bl, respectively,in July, driven by a tightening in the supply of sour crude globally following Opec+ production cuts, increases by state-controlled Saudi Aramco to its official formula prices for supplies to European customers, and a halt to around 350,000 b/d of Iraqi Kirkuk exports since late March (see graph). This put the two regional sour crudes on a fob basis nearly $2/bl above both WTI on a delivered-to-Rotterdam basisand North Sea light sweet crudes, such as Ekofisk, on a fob basis,prompting some European refiners to switch to the sweeter grades (see graph).

TotalEnergies bought two cargoes of light sour Forties and a cargo of light sweet Ekofisk in July through the North Sea afternoon trading window, although it has some equity in each of the grades. It also bought eight cargoes of WTI. The firm has already purchased six WTI cargoes in the afternoon trading window during the sessions from 1-10 August.

Demand for Johan Sverdrup by contrast has been weak. A number of August-loading cargoes of Johan Sverdrup were still unsold over the 1-10 August period, when the trading cycle would normally have moved on to September. And the September-loading programme is almost entirely available, according to market participants. Weak demand may be encouraging some deliveries of Johan Sverdrup into storage instead, according to some traders. Tracking and loading programmes point to a difference between actual exports emerging from the Johan Sverdrup loading port at Mongstad and the loading schedule.

Sour scenario

Increases by Saudi Aramco to its official formula prices would normally help stimulate demand for local sour crude alternatives, such as Johan Sverdrup, but this has not been the case so far this month. Aramco increased its official formula prices for its September term crudes for its northwest European buyers by $1-3/bl from August, and by $0.10-1.55/bl for its customers in the Mediterranean region.

The switch to sweeter grades has weighed on regional sour crude values for August. Johan Sverdrup has fallen by almost $2.80/bl since mid-July to just a 71¢/bl premium to North Sea Dated as of 10 August. Prices for Grane have eased as well, falling to $2.15/bl above the benchmark during the same period.

European refiners will still need some heavier crude to blend with WTI or similar-quality local grades, some traders noted. Relatively high prices for local medium sour crude are prompting buyers to look for supplies elsewhere. European buying interest has firmed for Iraqi sour and Angolan medium and heavy sweet crudes, according to market participants. Some traders expect that arrivals from these countries will increase in the coming weeks.