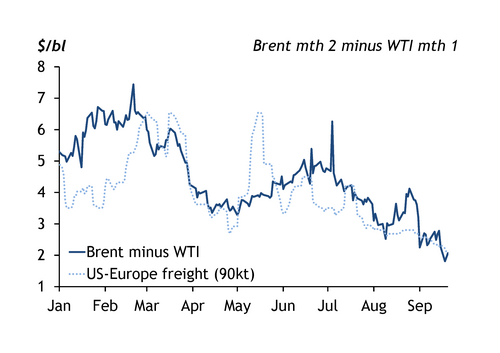

US and North Sea crude benchmark prices have closely aligned this month with the difference equivalent to the cost of freight from the Gulf coast to Europe.

Shipping a 700,000 bl cargo of light sweet WTI to refineries in Europe has cost $2.33/bl on average this month, or just a penny away from the average premium that the Ice second-month Brent futures contract has held to Nymex front-month WTI futures over the same period (see graph). The price spread is the narrowest between the two markets since the North Sea crude complex expanded to include WTI earlier this year. This difference appears to be increasingly set just by the cost of transatlantic freight, specifically the market for 90,000t Aframax class tankers.

WTI-Brent price spreads used to be more closely correlated with the smaller 70,000t Aframax freight rates. This was largely because the standard US export cargo was around 550,000 bl before upgrades to port infrastructure on the Gulf coast in 2019-20 enabled shippers to load bigger vessels. Larger cargo sizes of 700,000 bl now are standard for shipments of US crude to Europe — similar in size to typical North Sea crude cargoes that are included in the North Sea Dated pricing mechanism.

An apparent correlation remains between the 70,000t Aframax rate and the spread between prompt Nymex and Ice front-month Brent, which is still used by market observers to track general arbitrage conditions. November Brent futures have held a $3.23/bl premium to October WTI futures since 1 September, within a quarter of the 70,000t freight cost.

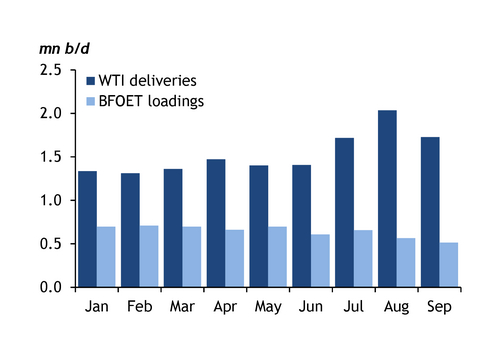

North Sea Dated was expanded in May this year to include WTI deliveries alongside local North Sea grades Brent, Forties, Oseberg, Ekofisk and Troll — collectively known as BFOET. The addition of the US light sweet crude has put downward pressure on the benchmark, as deliveries of WTI to Europe are consistently more than double the combined loadings of the other North Sea Dated component crude streams.

Freightal attraction

Roughly 1.73mn b/d of WTI has already departed the US Gulf coast for September arrival in Europe, according to preliminary tracking data by analytics firm Vortexa. This compares with less than 515,000 b/d of BFOET crude scheduled to load this month. WTI deliveries averaged 1.72mn b/d in the three months following WTI's inclusion in the Brent benchmark, up by nearly 22pc compared with the preceding three months, Vortexa data show.

WTI has directly set North Sea Dated on eight of the 15 trade sessions in September. This has had the effect of lowering the North Sea benchmark's value by an average of 7¢/bl this month compared with what it would have been without the inclusion of the US crude. The grade's dominance in North Sea crude pricing eased in August as Asia-Pacific demand for US crude lifted WTI values, but it had set the North Sea Dated benchmark most days in the first two months after WTI was admitted into the basket of benchmark crudes.

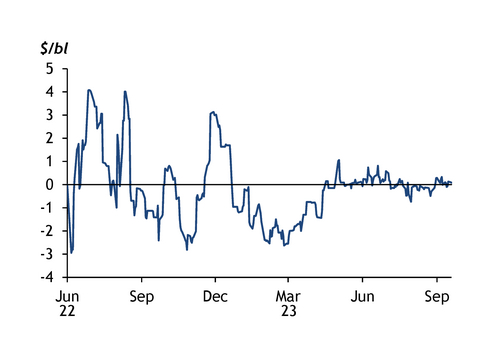

Plentiful supplies of WTI in the European market still will affect North Sea pricing whether the US crude directly sets North Sea Dated or not. Other North Sea crudes have to fall in value in order to remain competitive to regional refiners. Forties — the most liquid of the BFOET grades — has declined in value relative to the freight-adjusted price of WTI since the US crude's inclusion in the North Sea Dated benchmark. Forties has averaged a premium of just 1¢/bl to freight-adjusted WTI since the beginning of June, compared with an average premium of 78¢/bl over the same period in 2022.