The IEA has increased its global oil demand forecast by 110,000 b/d in 2024, citing an improved outlook in the US and higher bunker fuel use.

In its latest Oil Market Report (OMR), the Paris-based agency sees global oil demand rising by 1.34mn b/d to 103.18mn b/d this year — a significant slowdown on last year's growth of 2.28mn b/d.

The IEA's latest demand growth forecast for this year is the highest since it released its first projection for 2024 last July. At that time, it was guiding for growth of 1.15mn b/d for 2024. Still, the IEA's forecast remains substantially lower than that of Opec, which anticipates an increase of 2.25mn b/d to 104.4mn b/d.

The IEA gives two reasons for its upgrade — surging ethane demand for the US petrochemicals sector, and increased bunker fuel demand as ships that would have typically sailed through the Red Sea choose the safer-but-longer route around Africa to avoid the threat posed by Yemen's Houthi militants.

Some ships also appear to be 'fast steaming' to mitigate the impact of longer journeys, which is also adding to demand.

"With shipowners bypassing the Red Sea, longer routes around the Cape of Good Hope combined with faster speeds to sharply increase bunkering demand in [Singapore], and to a lesser extent in smaller southern African refuelling ports," the IEA said.

On US demand, the IEA said this suggests "the shift towards Chinese production in petrochemical markets could be losing momentum. The most cost-efficient petrochemical producers may now have the wherewithal to better compete with new Chinese plants." It sees Chinese consumption growth of 620,000 b/d in 2024, lower by 80,000 b/d than in the previous OMR.

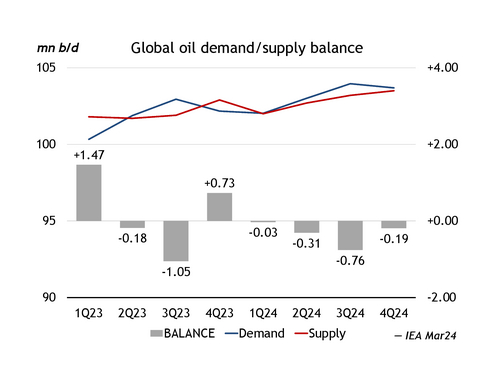

On global oil supply, the IEA sharply revised down its 2024 growth estimate by 920,000 b/d to 800,000 b/d, following the decision by several Opec+ members to extend their latest voluntary supply cuts by three months to the end of June.

The IEA's latest supply forecast assumes the Opec+ voluntary cuts remain in place until the end of 2024. This shifts its balance for this year from a surplus of around 800,000 b/d to a deficit of 280,000 b/d. Opec+ has yet to decide on its output policy for the second half of the year and may do so at a ministerial meeting scheduled for 1 June in Vienna.

Global observed oil stocks surged by 47.1mn bl in February, reversing a steep draw in January, the IEA said. This was due to a big increase in offshore stocks as seaborne exports "recorded an all-time high" and Red Sea shipping disruptions tied up significant amounts of oil on water, it said. While oil on water rose by 84.8mn bl in February according to preliminary data, on-land stocks fell for a seventh consecutive month, the IEA said.