Spanish LNG reloads slumped in March, despite continued small-scale shipments to Italy, as a shrinking basis between the PVB and other European hubs limited opportunities for regional arbitrage.

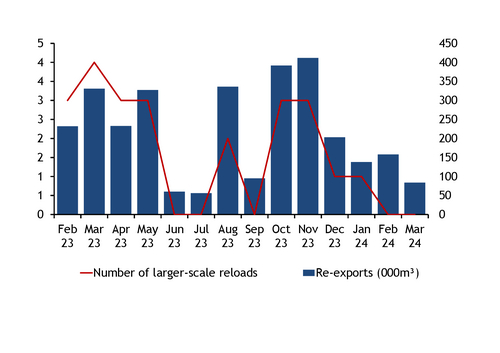

Spanish reloads plummeted in March to just 84,000m³ of LNG, the lowest since 56,000m³ of LNG in October (see data and download).

Spanish re-exports have been muted since the start of the year, as a narrowing price differential between Spain's PVB and northern European hubs may be too small to cover the cost of reloads in Spain. Day-ahead prices on Spain's Mibgas exchange were on average at parity with the TTF in March, in from discounts of €0.42/MWh in February and €0.65/MWh in January.

The Edison-chartered 30,000m³ Ravenna Knutsen delivered two cargoes from the Enagas-operated Barcelona and Sagunto terminals to Italy's mid-scale Panigaglia LNG import terminal and small-scale Ravenna terminal.

And delivery of small-size cargoes to those Italian terminals from Spain could continue this summer, as the closure of the LNG Toscana (OLT) terminal until October for maintenance will leave Italy in need of alternative pipeline gas or LNG until works end.

Enagas and Edison in 2020 signed an agreement to boost small-scale LNG deliveries in the Mediterranean from Enagas facilities to Edison's customers and the Ravenna terminal, in which both companies hold stakes. And the Edison-chartered Ravenna Knutsen is one of four active vessels allowed to unload at Panigaglia.

A vessel also delivered 3,100 m³ of LNG reloaded in Spain to small-scale LNG firm Avenir's Higas terminal in the Italian port of Oristano last month.

In any case, prevailing LNG prices make large-scale re-exports from Spanish terminals appear unlikely in the coming months. Argus-assessed monthly and quarterly PVB prices for delivery in April-September have moved close to other European hubs, capping opportunities for regional arbitrage outside of Italy.

The PVB May contract closed €0-0.25/MWh above the TTF, ZTP, Peg and NBP on Monday. But the PVB May price held an average premium of €1.85/MWh to the PSV on 1-8 April.

Enagas seeks alternatives for El Musel

Enagas last week announced it will study adapting the El Musel LNG terminal to store and manage other gas molecules such as green hydrogen.

El Musel was reactivated in mid-2023 as a re-export and storage facility. But the terminal has yet to reload a cargo and has instead steadily boiled off LNG received there by operator Endesa.

El Musel uses sendout to keep storage facilities at maximum capacity and allow for reloads, but a lack of economic incentive prevented reloads last year, Endesa told Argus.